There’s been another major silver transaction in the mining sector.

Silvercrest Metals (TSX: SIL) is set to be acquired by Coeur Mining (NYSE: CDE) for a $1.7 billion price tag, to create what they call a leading global silver company. The deal follows another major transaction last month, which saw First Majestic Silver (TSX: AG) agree to acquire Gatos Silver (TSX: GATO) for $970 million.

Lets dive in.

The High Level

Coeur Mining has agreed to acquire SilverCrest in an all-stock transaction, valued at $1.7 billion. SilverCrest shareholders are set to receive 1.6022 shares of Coeur for every share they hold, which translates to consideration of $11.34 at the time of announcement.

The figure represents an 18% premium to the 20 day moving average of SilverCrest, which is in line with recent premiums offered to other silver takeouts.

The transaction will bring together Coeur’s Rochester Mine in Nevada, and its Palmarejo mine in Mexico, with SilverCrest’s Las Chispas mine. On a combined basis, the company is expected to produce 21 million silver ounces in 2025, along with 432,000 gold ounces, for total silver equivalent production of about 55 million ounces.

The Financials

From a financial perspective, the deal makes sense for Coeur shareholders.

SilverCrest, despite being in production for a short period of time, is entirely debt free, and is churning out free cash flow. In 2023 the company produced free cash flow of $121 million, while producing 10.4 million ounces of silver equivalent at an all in sustaining cost of $12.58 per ounce.

More recently, last quarter saw free cash flow of $24 million, while its all in sustaining costs came in at $16.88 per ounce. Treasury assets meanwhile total somewhere in the neighbourhood of $122 million, which is made up of $98 million in cash and $24 million in bullion.

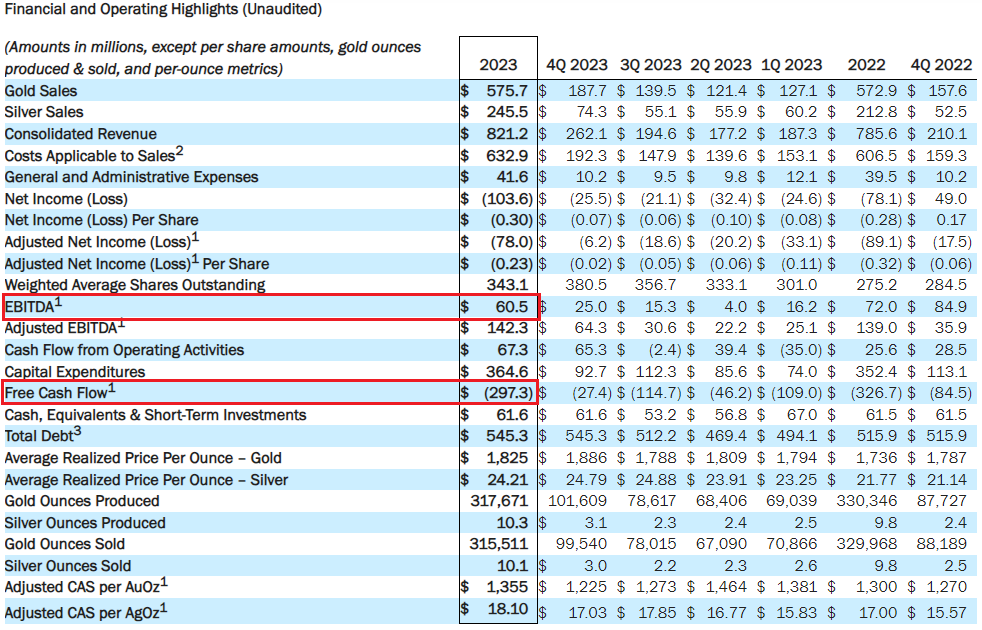

On a combined basis, Coeur is expected to churn out $350 million in free cash flow in 2025, along with EBITDA of $700 million – but in saying that, Coeur’s free cash flow in 2023 came in at negative $297 million, while EBITDA was just $60 million.

And year to date in 2024, free cash flow has been negative $94 million, while EBITDA is just $77 million, which doesn’t exactly inspire confidence that that guidance can be hit, even with the addition of SilverCrest.

SilverCrest’s treasury position and free cash flow profile meanwhile will result in an immediate reduction to Coeur’s leverage ratio, which is expected to drop by 40%.

Las Chispas

So lets take a peek at the SilverCrest asset.

SilverCrest is a single asset producer, with all production coming from their Las Chispas mine which entered production in November 2022. For 2024, the mine expects to churn out somewhere between 10.0 million and 10.3 million silver equivalent ounces, at an all-in sustaining cost between $14.90 and $15.75 per ounce.

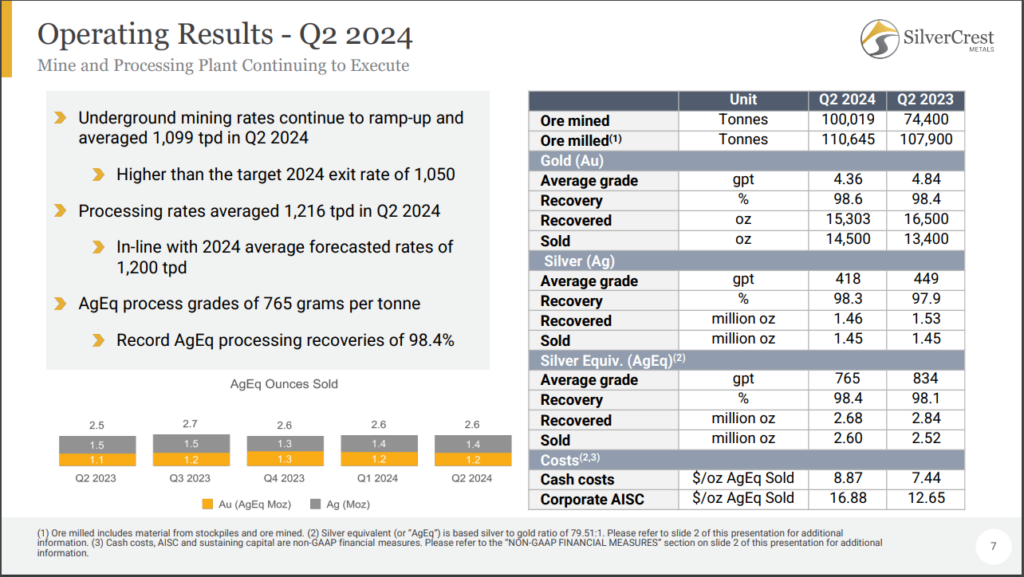

The operation currently mines roughly 1,100 tonnes per day of material, while the processing plant on site is averaging 1,200 tonnes per day, with average grades of 765 g/t silver equivalent and a recovery rate in the ballpark of 98.4%.

While this is well and good, when it was put into production it had an estimated mine life of roughly 8 years, meaning we’re about 25% of the way through that already. The mine life is based on proven and probable reserves of about 3.4 million tonnes, and as of August 2023 had a net present value of $550 million based on $1800 gold and $23 silver.

To add to that short mine life, the 2023 technical report actually reduced tonnage in the projects mineral resource estimate, with veins being narrower than previously believed, and stockwork being less continuous. It should also be noted that head grade is expected to decline for the next several years, until it gets a slight bump in 2028 and 2029 based on current projections.

On the flip side of things, free cash flow was projected to average $84 million a year from the mine, at much lower metals prices. And to be fair to SilverCrest, they’ve committed up to $14 million for exploration in 2024 alone in an attempt to add ounces to its reserves.

The Market Reaction

So, the big question. How does the market like it?

As of the time of recording, SilverCrest has jumped by $1.03, or 11%, to sit at $10.32. Which is short of the stated consideration price of $11.34 a share, but considering Coeur shares fell by 8% on the announcement to $6.50 a share, it’s only a few pennies short of the $10.41 in value shareholders of SilverCrest are getting based on the stated exchange ratio.

Shareholder response has been mostly positive as well, which is kind of a rarity these days.

Mark IKN indicated that he felt that the price was way too cheap, but a win is a win.

I will, of course, complain $CDE is getting this way too cheap. But it is what it is and a win is a win.

— Mark (@Mark_IKN) October 4, 2024

The Silver Baron and Mailey seem to agree with Mark’s sentiment.

Based on the five year performance of SILV, it does feel a bit like a low ball offer..

— Mailey (@MaileyCapital) October 4, 2024

While Yux, like us, is a bit of a skeptic on the free cash flow claims for the combined company.

M&A $CDE to buy $SILV in all share deal.

— 𝙔∪𝕏² (@_Yux__) October 4, 2024

1.6022 share ratio, which was ~20% premium before open.

The combined company to produce 21moz and become a top 5 silver producer (though 'only' 40% revenue from silver).

The FCF claims look great. On paper at least… Let's see it proven. https://t.co/a4aeQ4T4Xa

And newsletter writer Fred Hickey is just bummed he needs to find an alternative he likes as much as he liked SilverCrest.

Another one of my precious metals mining stocks getting taken over. Coeur buying SilverCrest. Obviously not surprised, as I've been saying SILV was an attractive takeover candidate – including in my latest HTS letter published earlier this week. Problem is finding appealing…

— fred hickey (@htsfhickey) October 4, 2024

In Closing

So was this a good deal for SilverCrest shareholders? Like anything, that depends when you got in. If you were invested this time last year, you more than doubled your money. If you invested two years ago, well, then the return might not be as great.

But what I do know, is that this is good for the junior mining sector in general.

Last month, we saw Gatos Silver acquired. This month, it was SilverCrest. While I don’t know who’s next, what I do know is that this signals theres starting to be a bit of life in the market, and that the majors are looking to expand their stake in silver.

And eventually that will start to trickle down.

As someone that is well positioned among a number of silver names, that excites me.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.