Acreage Holdings (CSE: ACRG.u) reported earnings for Q4 2018 yesterday after the bell, indicating a total net loss of $217mm for the quarter and $219mm for the full fiscal year. Although the news release and an accompanying investor presentation were released to the public, as of the time of writing full financial documents have yet to be pushed to Sedar or the companys website.

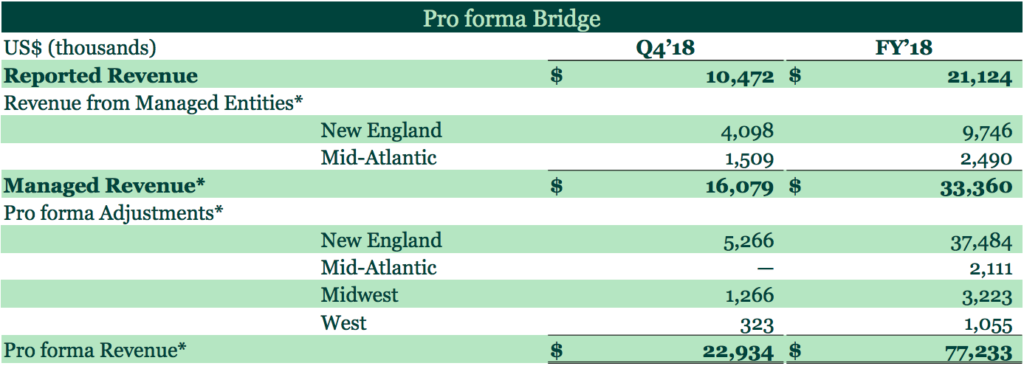

Aside from the significant quarterly loss, which was stated to be the result of a change in fair market value of derivative liabilities, most notable was revenues for the quarter of $10.4mm, and a total for the year of $21.2mm.

However, the company was certain to make light of its pro forma quarterly and annual revenue figures, which came in at a stated $22.9mm and $77.2mm respectively. These pro forma figures were defined in the fine print as being “managed results of operations, adjusted to reflect the full fiscal year regardless of when an acquisition or management contract commenced.” The company went further to break down its results as being split between managed companies – firms for which consolidation is not yet allowable due to a lack of control – as well as pro forma figures for acquisitions that occurred throughout the quarter or the year.

Speaking in terms of pro forma, non-IFRS standards the company reported a loss of $10.8mm for the quarter. This was after deducting $55.7mm in compensation expense, in addition to $142.1mm in fair market value adjustments. For the year, the company reported a loss of $30.3mm under the same standards.

Notably, the company also reported goodwill and intangible asset valuations of $186mm on total assets of $571mm, which equates to roughly 32.5% of all assets.

More to come upon the filing of financial documents..

Information for this briefing was found via Acreage Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.