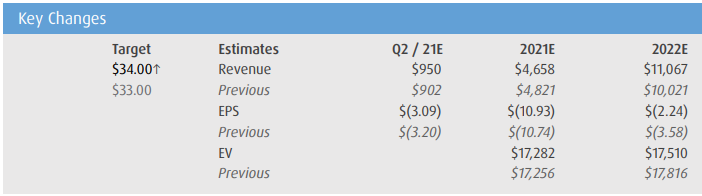

Yesterday, BMO Capital Markets raised their 12-month price target on Air Canada (TSX: AC) to C$34 from C$33 and reiterated their outperform rating on the stock off the back of further easing of travel restrictions worldwide.

Air Canada currently has 17 analysts covering the stock with an average 12-month price target of C$28.63, or a 22% upside. The street high sits at C$35 which comes from Raymond James and the lowest sits at C$12. Out of the 17 analysts, five have strong buy ratings, eight have buy ratings and four have hold ratings.

BMO believes that the travel recovery is now underway but will “undoubtedly face speed bumps,” and that it will have an effect on Air Canada’s share price along the way. They believe that Air Canada is the most efficient and customer-focused airline post-pandemic, and recommend investors to add to their position on a pullback.

They are modeling Canada’s resumption of airline travel after the U.S. They say that the U.S airlines saw significant pent-up demand following their 18-month travel and border restrictions. BMO believes that Canada will start to see the demand re-accelerate this fall and into 2022. Air Canada announced that it is seeing bookings improve for travel within North America and the Atlantic markets for this quarter.

Below you can see the changes BMO made to their second quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.