Alphabet (NASDAQ: GOOGL) announced that it will be reporting its quarterly financial results on October 26th, with its earnings call happening at 4:30 after the market closes. For the consensus estimates, 32 analysts expect Alphabet’s revenue to be $63.32 billion for the third quarter. Gross margins are expected to be 56.79% this quarter and net income is estimated to be $15.94 billion.

Alphabet currently has 49 analysts covering the stock with an average 12-month price target of $3,168, or a 15% upside. Out of the 49 analysts, 17 have strong buy ratings, 30 have buys, 1 has a hold rating and 1 analyst has a sell. The street high price target sits at $4,288.52 from Elazar Advisors, while the lowest comes in at $1,850.

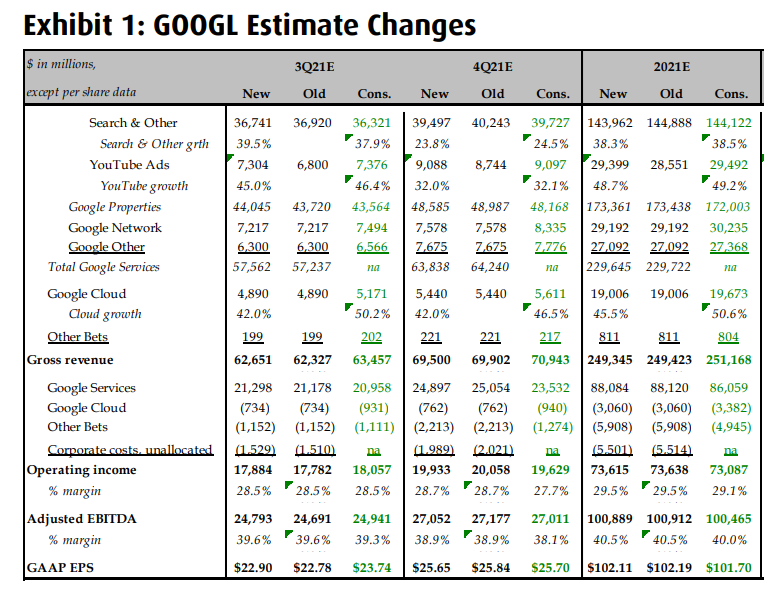

In BMO Capital Market’s note, they reiterate their $3,000 12-month price target and outperform rating and slightly increased third-quarter estimates but lowered the overall full-year 2021 and 2022 estimates. They believe that Alphabet investors have set high expectations for the company this quarter but believe the overall risk/reward is still tilted favourably.

They are raising near-term revenue estimates, primarily because they believe YouTube will outperform this quarter, but lower their estimates for the Search & Other segment going into the fourth quarter to reflect a more normal eCommerce buying pattern and Alphabet’s move away from last-click attribution.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.