Owning a car has become so expensive that auto loan delinquency rates are seeing levels higher than in the Great Recession.

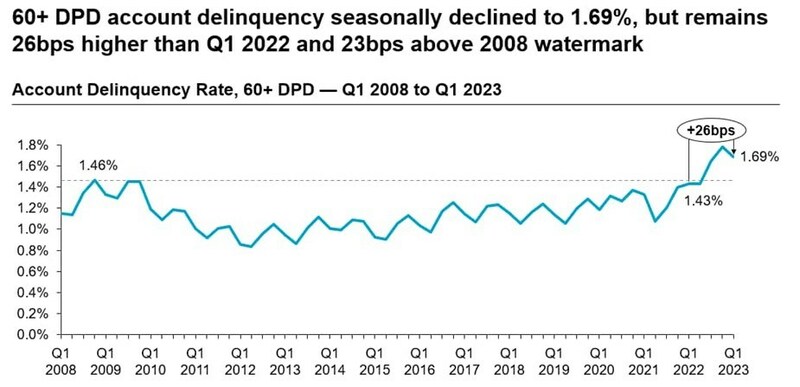

Data from TransUnion and S&P Global Mobility’s AutoCreditInsight found that account-level delinquency rates of auto loans 60+ days past due have risen 26 basis points from the first quarter of 2021’s 1.43% to 1.69% in the first quarter of 2023.

Recent data from Cox Automotive reveals that the average American now needs to allocate a staggering 42 weeks of income to settle the cost of a new car, a significant increase from the pre-pandemic figure of around 33 weeks. The used-car market has also borne the brunt of this trend, with average listing prices surging upwards by more than 30% compared to pre-pandemic levels.

Compounding the situation, soaring interest rates have exacerbated the financial burden for potential buyers. New car loans, on average, now demand a monthly payment upwards of $750, along with a steep interest rate of 9.5%. The scenario is grimmer for used cars, where the average interest rate surpasses 13.7%. Loan terms, spanning almost six years, have contributed to the prolonged financial commitment.

Severe delinquency rates for auto loans, usually tethered to unemployment fluctuations, have surged to levels not seen since 2006. This phenomenon challenges the conventional economic correlation between a strong job market and a low delinquency rate.

And it has been so terrible that Cox seems to have stopped publishing delinquency rates after May’s 5.3% month-on-month and 21.2% year-over-year increase report.

Holy fucking shit……

— Darth Powell 🦈🇺🇲🇺🇦🇵🇱🇫🇮 (@GRomePow) August 22, 2023

Cox Automotive has stopped reporting its weekly auto loan delinquency rates after these HORRENDOUS May numbers.

h/t @shefska pic.twitter.com/Mu1V1NHAct

S&P Global’s recent analysis paints a concerning picture, with loan performance paralleling or even surpassing the dire levels witnessed during the 2008 financial crisis.

Looking ahead, the impending expiration of a student loan payment holiday threatens to further tighten the financial squeeze on borrowers.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.