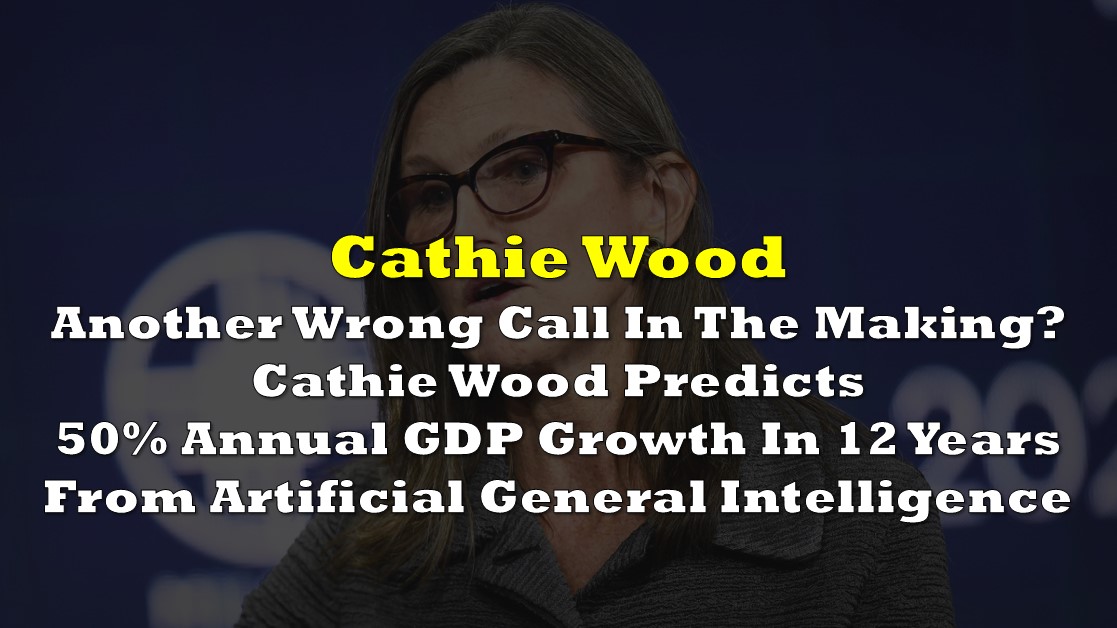

When ARK Invest CEO Cathie Wood believes in something, better be sure she will hype it up–even if it risks another wrong call. The tech bull said the country’s gross domestic product could grow up to 50% annually in just 12 years, thanks to artificial general intelligence (AGI).

Replying to a tweet by ARK Invest’s own Director for Research Brett Winton, Wood said that her investment firm “must share more of [its] research about AGI,” purportedly to shed light on how the field could “accelerate growth in GDP.” Winton’s tweet itself described the potential through the supposed decline in the estimated time to achieve AGI.

.@ARKInvest must share more of our research about #artificialgeneralintelligence (AGI) and how it is likely to transform the way the world works. Within 6-12 years, breakthroughs in AGI could a accelerate growth in GDP from 3-5% per year to 30-50% per year. New DNA will win! https://t.co/RxVp8K4IK4

— Cathie Wood (@CathieDWood) May 22, 2022

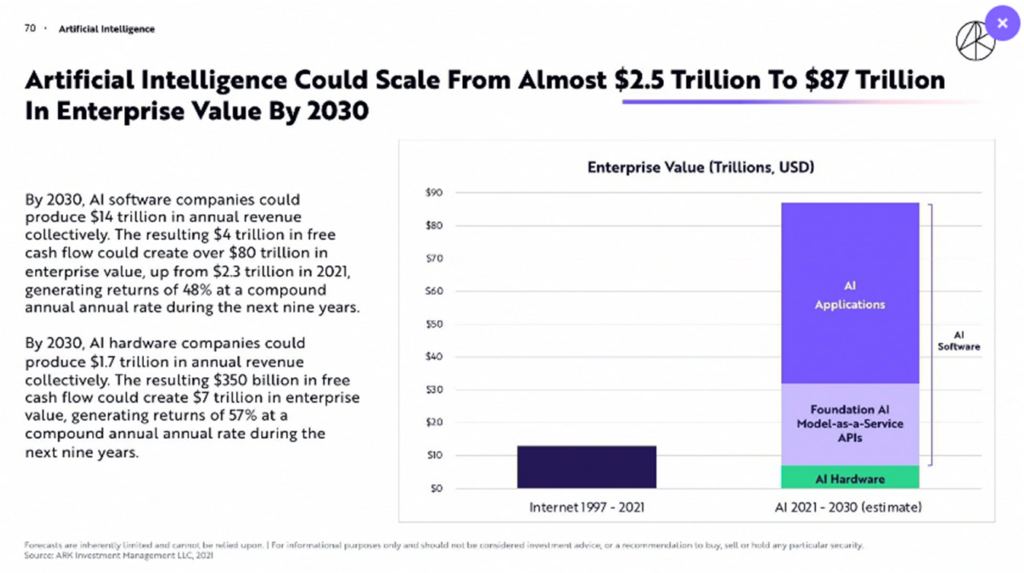

The investment firm’s Big Ideas 2022 report released earlier this year was more bullish on the field, saying the industry could grow as big as US$87 trillion dollars by 2030.

But Twitter users following the thread are calling the bluff, with some paralleling the prediction to Wood’s wrong call on the oil price outlook.

Is this the same analysis that predicted this statement? https://t.co/Dh5u6Hc2EY

— MarketAlly LLC (@MarketAlly) May 22, 2022

Hey Hype Machine…meet Reality… https://t.co/kpouwQTTsk

— Process (@nuck_luck40) May 22, 2022

Please do share more of your research on #artificialgeneralintelligence or any topic that shows GDP growth of 30-50% per year (any country/any planet works). https://t.co/j2asqQI6fR

— MSM (@socialmedia5130) May 22, 2022

How will #artificialgeneralintelligence fundamentally double ALL productivity every 2 yrs?

— Mike Regan (@MikeReganInvest) May 22, 2022

NOMINAL GDP could grow 30-50% / yr in a hyperinflation like Weimar Germany or Zimbabwe – how did those work out?

Is AI’s big idea to print worthless money & grow 79.6 billion % m/m? https://t.co/Hob4Sn9hBP pic.twitter.com/GpYlUZQLnB

Wood’s ARK Innovation ETF (NYSE: ARKK), deemed the “worst-performing fund” in Q1 2022 by analytics firm Morningstar, has also been tagged in the discussion.

$ARKK is counting on #artificialgeneralintelligence (AGI) in order to be able to pick stocks better.#goals https://t.co/mUX15KInQS

— Exile of the Mainstream (@exileofthemain) May 22, 2022

This is a more "macro-economically meaningful" chart https://t.co/CNlr82yrFF

— Josh Young 🦬🛢️ (@Josh_Young_1) May 22, 2022

This is not Wood’s first bullish call this year. Also from the investment firm’s Big Ideas 2022 report, the fund manager’s bullish target for the price of bitcoin is over US$1 million per coin in 2030, which calls the computation into question.

The discussion on AGI comes on the heels of Google’s DeepMind Research Director Dr. Nando de Freitas’s tweet that human-level artificial intelligence is close to being achieved.

“My opinion: It’s all about scale now! The game is over!” said Dr. de Freitas.

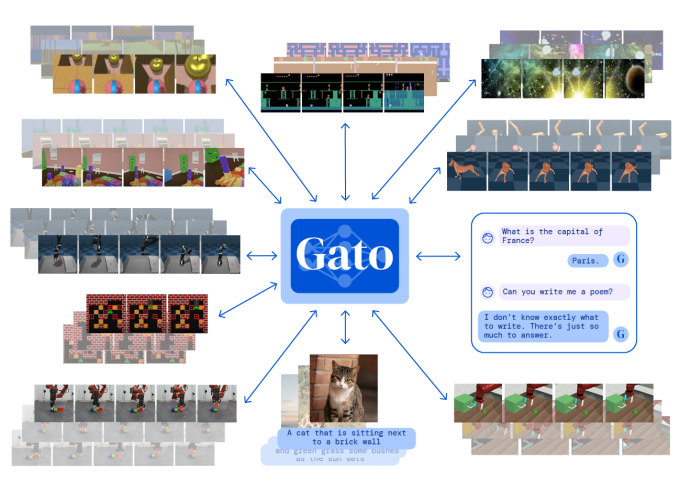

DeepMind is working on its AI system called Gato, trained to complete 604 tasks, including engaging in a dialogue and playing Atari games.

Someone’s opinion article. My opinion: It’s all about scale now! The Game is Over! It’s about making these models bigger, safer, compute efficient, faster at sampling, smarter memory, more modalities, INNOVATIVE DATA, on/offline, … 1/N https://t.co/UJxSLZGc71

— Nando de Freitas 🏳️🌈 (@NandoDF) May 14, 2022

But when asked how far along would the AI be from passing a real Turing test–the prime determinant if a computer can demonstrate human intelligence–Dr. de Freitas believed it is “far still.”

Far still. I’m amazed at what 🦩 can do, eg talk about a hockey puck accurately even though it is hardly visible, or @OpenAI’s DALLE2 with its compositional image generation. We used to invent algorithms and write 100’s of papers to solve these tasks! Different, but intelligent.

— Nando de Freitas 🏳️🌈 (@NandoDF) May 17, 2022

Information for this briefing was found via Twitter, TechCrunch and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

I’ve been saying it for years: the problem with AI is that it’s too specific.