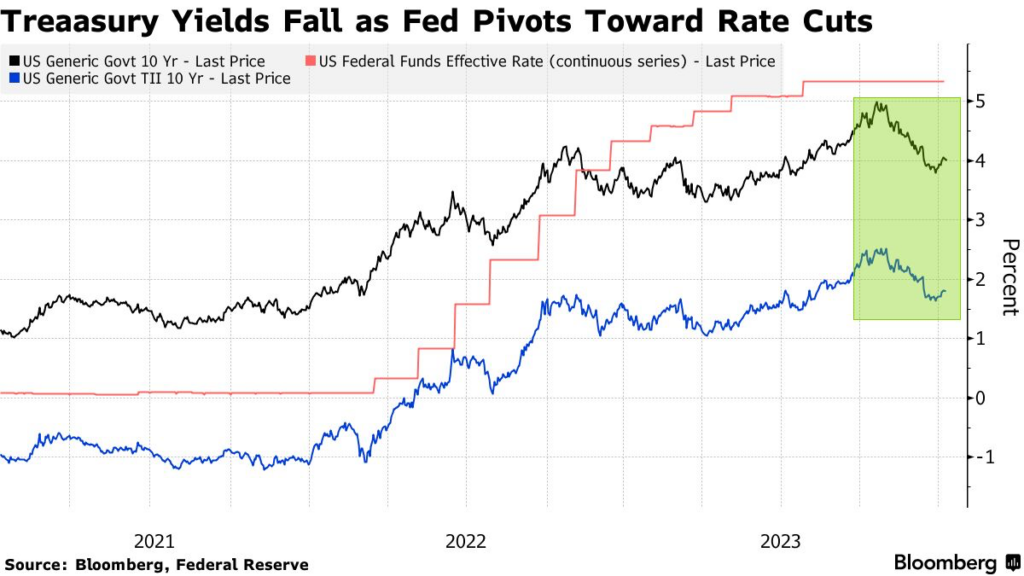

Financial markets are reportedly pricing in a scenario where the Federal Reserve might implement rate cuts at every meeting from March 2024 to December 2024. This aggressive stance suggests a belief that interest rates will follow a consistent downward trajectory throughout the year.

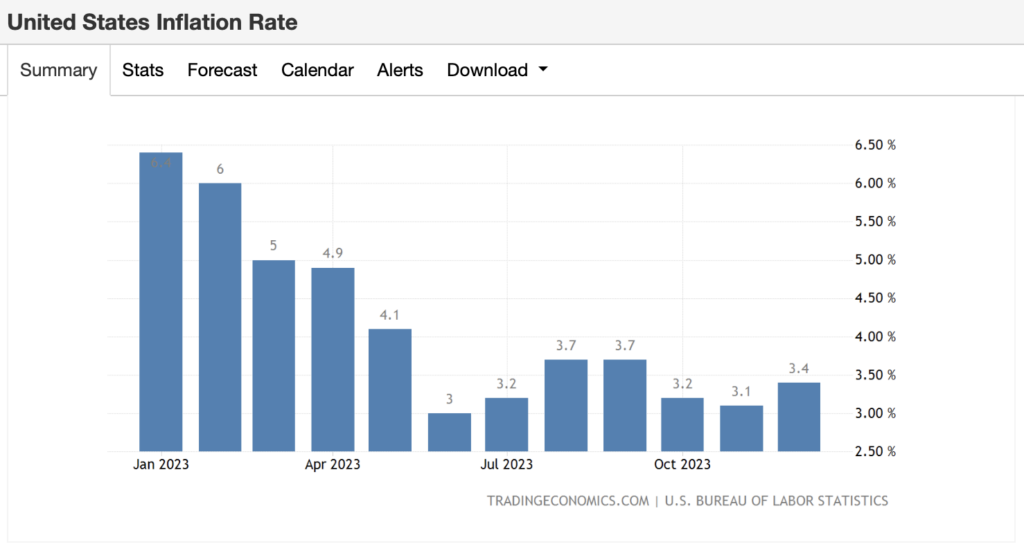

Despite a robust jobs report and a 3.4% increase in inflation, investors seem more dovish, reflecting a ~41% chance of another rate cut in December, bringing the total cuts to seven in 2024.

“Fed pivot” is now being considered an understatement as markets anticipate a significant shift in the central bank’s approach.

You can't make this up:

— The Kobeissi Letter (@KobeissiLetter) January 11, 2024

Markets are now pricing-in a rate cut at EVERY Fed meeting this year beginning in March 2024 until December 2024.

Effectively, markets are saying that interest rates will move in a straight-line lower.

Even with a hot jobs report and inflation rising to… pic.twitter.com/89G92Fj7UO

Consumer prices surged 3.4% in December compared to a year ago, surpassing expectations and posing a challenge for the Federal Reserve’s inflation-fighting efforts. The rise, driven by increased housing and energy costs, stands well above the Fed’s target rate of 2%.

Interest rate cuts, if implemented, could alleviate borrowing costs for credit cards and mortgages. However, they also carry the risk of fueling consumer demand and exacerbating inflationary pressures.

While some food prices continue to outpace overall inflation, core inflation, excluding volatile food and energy prices, showed a slight cooling at 3.9% in December compared to the previous month.

The latest economic data comes in the wake of a stronger-than-expected jobs report for December, challenging concerns of an imminent recession. Analysts now express optimism about the potential for a “soft landing,” where the economy continues to grow while inflation returns to normal levels.

Federal Reserve Chair Jerome Powell, in a recent press conference, emphasized the uncertainty of the path ahead. He acknowledged the easing of inflation from its highs but cautioned that ongoing progress is not assured.

Market observers, initially expecting rate cuts as early as March, may face disappointment, according to Ellen Zentner, Chief U.S. Economist at Morgan Stanley. Strong job gains provide the Fed with room to maintain higher rates without immediate recession concerns.

JPMorgan Asset Management suggests that the market’s pricing of approximately 1.5% in rate cuts may be a reasonable central case, with potential for more significant cuts in adverse economic scenarios.

The divergence between the Fed’s quarterly dot plot, predicting 75 basis points of cuts by year-end, and the market’s more aggressive stance highlights the uncertainty and volatility in current economic forecasts.

As the Fed contemplates its next moves, potential rate cuts could impact the yield curve, with some experts anticipating a steepening trend. However, the central bank faces the delicate task of balancing economic stimulation against the risk of a resurgence in inflation.

Information for this briefing was found via Bloomberg, ABC, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.