The recent failures of three US banks, Signature Bank, Silicon Valley Bank, and more recently, First Republic Bank may have been a factor in an uptick in cryptocurrency ownership.

A new study shows that ownership of digital assets has increased by four percentage points since April 2022, with 22% of US adults now owning some form of cryptocurrency.

The Morning Consult Cryptocurrency Insights Hub found that amid industry instability following the implosions in the crypto space beginning in 2022, turmoil in the traditional banking industry may have spurred interest and support for decentralized finance.

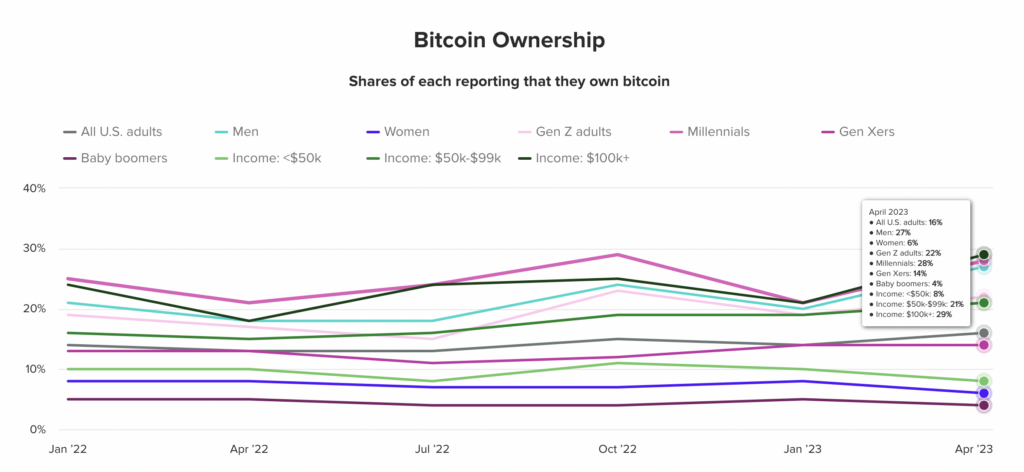

#Crypto ownership among U.S. investors rose to 22% in April, according to @MorningConsult. Not surprisingly, #Bitcoin was the most widely held digital asset, with 16% of respondents saying they owned some of it. https://t.co/5MZS6ElJN9 pic.twitter.com/AHP4uzOxJc

— U.S. Global Investors (@USFunds) May 1, 2023

Bitcoin still held the biggest piece of the pie with 16% of the respondents saying they own the coin, with Ethereum trailing at 12%. The study also found that a vast majority of bitcoin holders in the US are male millennials at 27% and 28% of US adults respectively.

Recent volatility in cryptocurrency prices may be pushing trading activity. Almost half, or 46% of bitcoin investors sought to cash in on the mid-March price jump, ethereum sales more than doubled at 33% last month compared to 16% the year before, while binance coin sales more than tripled from 10% to 34%.

The combined market value of four banks (SVB, Signature, Credit Suisse and First Republic) have plunged $50 billion year-to-date, while the market value of gold miners is up $41 billion and Bitcoin is up $255 billion. Read more: https://t.co/WpRy3n235l pic.twitter.com/jQFwopxnf1

— U.S. Global Investors (@USFunds) May 1, 2023

Notably, the desire for more regulation has dramatically increased, jumping 10 percentage points to 29% in April 2023 compared to the year before, indicating that many investors are still wary of the risks involved in this emerging industry.

But it doesn’t look like the lack of regulation will stop the uptick in ownership, at least for now. According to the study, 26% of American adults are looking to buy crypto in the next month.

Information for this story was found via Morning Consult, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.