FULL DISCLOSURE: This is sponsored content for ATHA Energy.

ATHA Energy (TSXV: SASK) has begun drill testing the Angilak project in Nunavut under a phase one program. The program follows ATHA acquiring the project earlier this year with the completion of its merger with Latitude Uranium, whom last year intersected 7.54% U3O8 over 1.6 metres at the project.

The exploration program will see the company conduct 10,000 metres of drill testing, with the company aiming to expand known high grade uranium mineralization at the Lac 50 deposit. The program, which began this morning, will see two X10 diamond drills utilized, which are capable of drilling to depths of 2,000 metres.

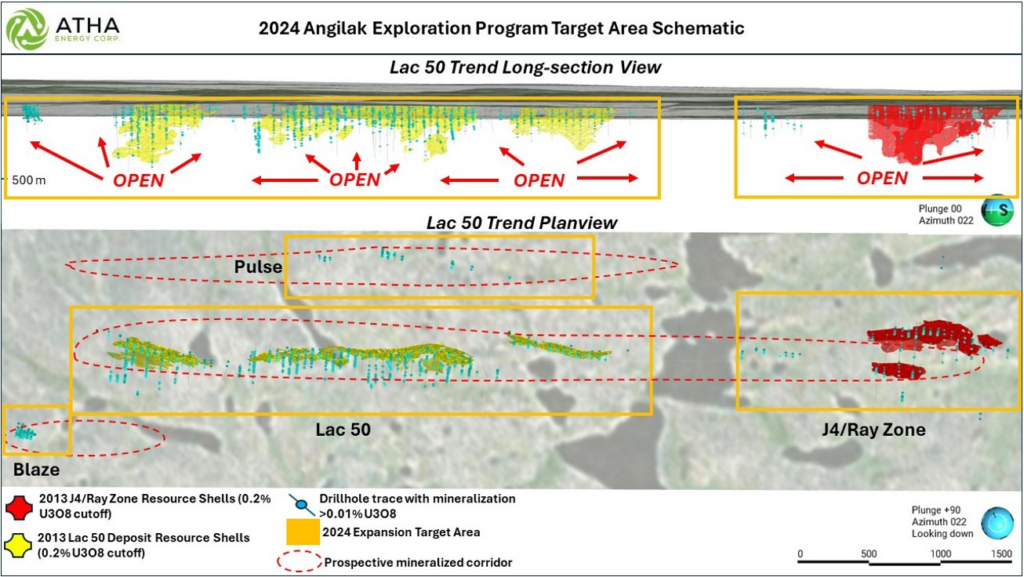

Four zones are set to be tested under the program, including the Lac 50 Deposit, where expansion along strike and at depth is being targeted, as well as the testing of the extension of stacked lenses of mineralization adjacent to the main zones of mineralization where the historical resource exists. The project presently has a historical resource of 43.3 million pounds of U3O8 at a grade of 0.69%.

Other zones to be drilled tested include Blaze, where grades beyond 4.0% U3O8 have previously been hit, J4/Ray, where grades beyond 10.0% U3O8 have been hit, and Pulse, where prior drilling has intersected grades higher than 2.0% U3O8. All of the mineralized zones are said to remain open, with the objective of the entire program being the evaluation of the prospective envelope hosting high-grade uranium mineralization near to the Lac 50 deposit.

READ: ATHA Energy Options Out 70% Of Vista Project For $10.7 Million In Total Consideration

Phase two of the exploration program will see ATHA conduct airborne geophysics and ground geochemistry sampling and mapping. This phase of the program is expected to begin in August, with the intent of identifying and derisking a pipeline of high-priority targets for future exploration.

“On top of being one of the largest, high-grade deposits outside the Athabasca Basin, our team believes the unexplored potential of the Angilak Project – and the region at large – make it one of the most attractive uranium exploration opportunities in the entire uranium sector. Our objective at ATHA is to explore at scale within globally leading uranium jurisdictions, with a focus on projects with future production potential. This comes with the backdrop of the best fundamental demand driven uranium market in decades,” commented Troy Boisjoli, CEO of ATHA Energy.

ATHA Energy last traded at $0.79 on the TSX Venture.

FULL DISCLOSURE: ATHA Energy is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of ATHA Energy. The author has been compensated to cover ATHA Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.