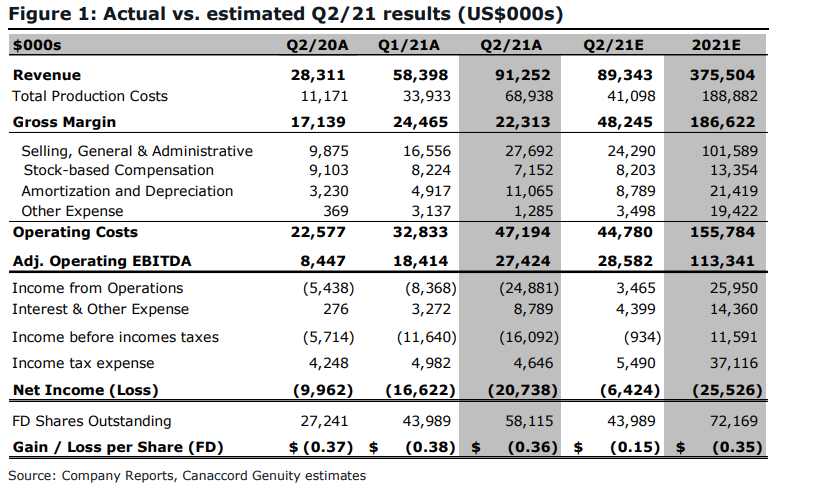

On August 16, Ayr Wellness (CSE: AYR.a) reported their second quarter financial results. The company reported revenues of $91.3 million, up 222% year over year, and 56% sequentially. Gross profit came in at $22.38 million, up over 100% year over year, but down almost 9% sequentially, primarily due to accounting shenanigans. The company also reported an adjusted EBITDA figure of $27.4 million for the second quarter, up 50% sequentially and 225% year over year. Finally, the firm announced third quarter revenue guidance of $100 million and increased their full year 2022 guidance to $800 million in revenue and $300 million in adjusted EBITDA.

Analysts seemed to have slightly revised down their price targets on Ayr Wellness after the results, bringing the 12-month consensus price target to $70 from $76 last month. The company only has 6 analysts who cover the stock, with 2 having strong buys and the other 4 have buy ratings. The street high sits at $84 while the lowest comes in at $35.

Canaccord Genuity was one of the firms to keep their price target and rating unchanged. They reiterated their C$70 price target and buy rating on Ayr Wellness, saying that the companies successful roll-ups is helping grow their top-line.

Ayr Wellness slightly beat Canaccord’s top-line estimate but higher production costs due to the accounting around acquiring inventory caused gross margin, costs, and net income to come in lower than Canaccord’s estimates. Part of the large sequential revenue increase came from the second quarter being the first full quarter of Liberty Health Sciences, recreational sales in Arizona, and “a sizable step-up in retail sales in Pennsylvania.” Gross margins came in at 58.2%, up 400bps sequentially and higher than Canaccord’s 54% estimate.

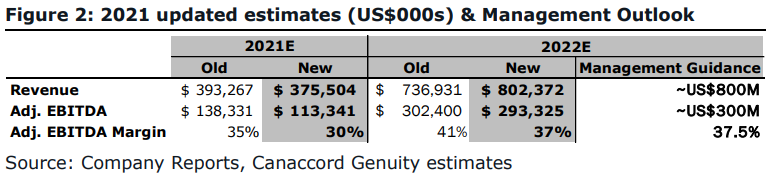

Canaccord says that the updated 2022 guidance is strong but the slightly adjusted EBITDA margin has to do with costs. The company now expects the adjusted EBITDA margin to be 37.5% rather than 41.4%. Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.