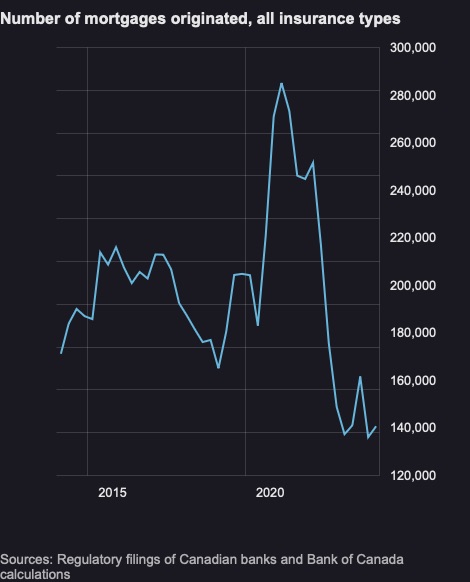

The Bank of Canada has issued a correction after discovering a significant error in its mortgage origination data for the first quarter of 2024. The initial figures, which were missing data from March, have now been updated to reflect a more accurate picture of the housing market.

The previous chart revealed that fewer than 100,000 mortgages were issued in the first three months of 2024, marking the lowest level since records began.

In a public statement, the central bank acknowledged the mistake and published the corrected data on its website. “We’ve identified an error in our charts. The figures on mortgage originations for the first quarter were missing data from March. The corrected data have now been published. We apologize for the error,” the Bank of Canada posted.

We've identified an error in our charts. The figures on mortgage originations for the first quarter were missing data from March. The corrected data have now been published.

— Bank of Canada (@bankofcanada) June 18, 2024

The updated charts can be found here: https://t.co/UfeEEopFmp

We apologize for the error. https://t.co/kQjDdHl3Jx

The corrected chart still shows a significant dip in mortgage originations, aligning with the ongoing trends of reduced borrowing and high-interest rates. The data now shows that mortgages issued in the first quarter of the year are above 100,000, and even jumped from 136,340 in Q4 2023 to 140,896 in Q1 2024. However, the level is still reflecting a sharp decline from previous years, driven largely by the Bank of Canada’s aggressive rate hikes aimed at controlling inflation.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.