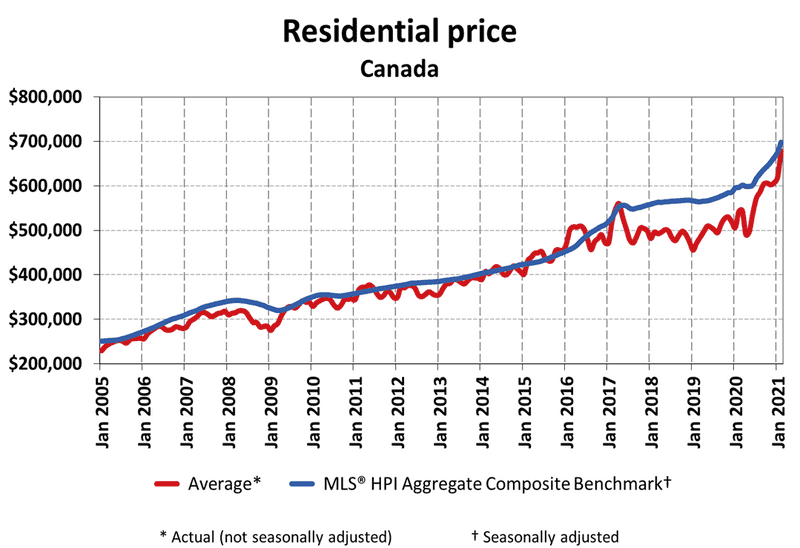

The Bank of Canada remains optimistic with regards to the ongoing economic recovery, with plans to curtail several emergency programs introduced at the height of the Covid-19 crisis as early as next month. Simultaneously, however, the central bank is also sounding the alarm over Canada’s housing market, which has been running hot as “fear of missing out” (FOMO) have prompted even more potential homebuyers to flood the market amid record-low mortgage rates.

Speaking at a CFA Society conference on Tuesday, BoC deputy governor Toni Gravelle highlighted the central bank’s rising concerns over housing prices, particularly the “fear of missing out,” which has further propelled gains in the surging market. Responding to audience questions, Gravelle revealed that the Bank of Canada is in the midst of analyzing just how much excess exuberance is behind the recent surges in home prices.

“One of the concerns we’re having is there’s starting to be ‘fear of missing out’, FOMO, and that might driving some of the expectations,” he explained. Back in February, BoC governor Tiff Macklem cautioned that the housing market may be entering bubble territory, especially since prices continue to sharply escalate amid ongoing demand. According to the Canadian Real Estate Association, home sales set a new all-time record in February, as prices soared by 25% from year-ago levels.

Information for this briefing was found via the BoC and CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.