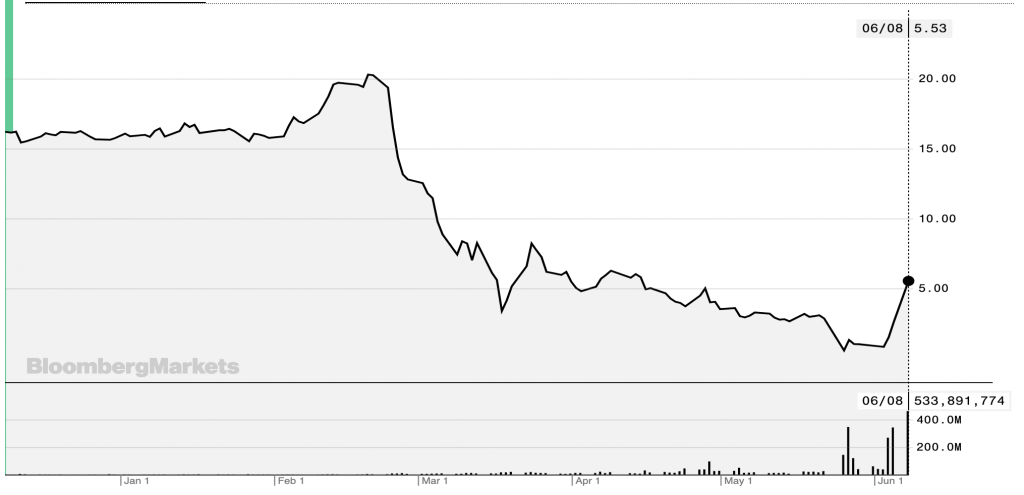

For those of us still puzzled about last week’s trading fiasco regarding the infamous car rental company Hertz Global (NYSE: HTZ) – hold on tight! We had thought that Friday’s bizarre rush to purchase the bankrupt stock was just retail investors reacting to the full moon and would soon subside, but apparently that prediction was wrong.

On Friday, Hertz stock closed at $2.57, which amounts to an approximate 215% increase since June 1. But now it appears that the madness has caused a cascade of even more buying, with the stock soaring as high as $6.25 on Monday – which translates to a market cap of nearly $900 million for the bankrupt company.

Since Hertz filed for bankruptcy after it was unable to meet its extensive debt obligations amid the coronavirus pandemic, nearly 80,000 new investors on Robin Hood have have joined the stock buying frenzy. However, it is worth noting a very important fundamental, which appears to be surprisingly overlooked: when a company goes bankrupt, all of their debt must be paid in full before shareholders get any equity returns – given that Hertz has $19 billion worth of debt and lease obligations as of May, it will take a miracle for the financial situation to turn around.

Albeit Hertz’s stock is without a doubt worthless, but Robin Hood retail investors continue to pour in their hard-earned government stimulus checks. Maybe there is something that seasoned billionaire investor Carl Icahn must have overlooked. But anyways, stay tuned: surely there will be more head-scratching developments to follow.

Information for this briefing was found via Bloomberg and Markets Insider. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.