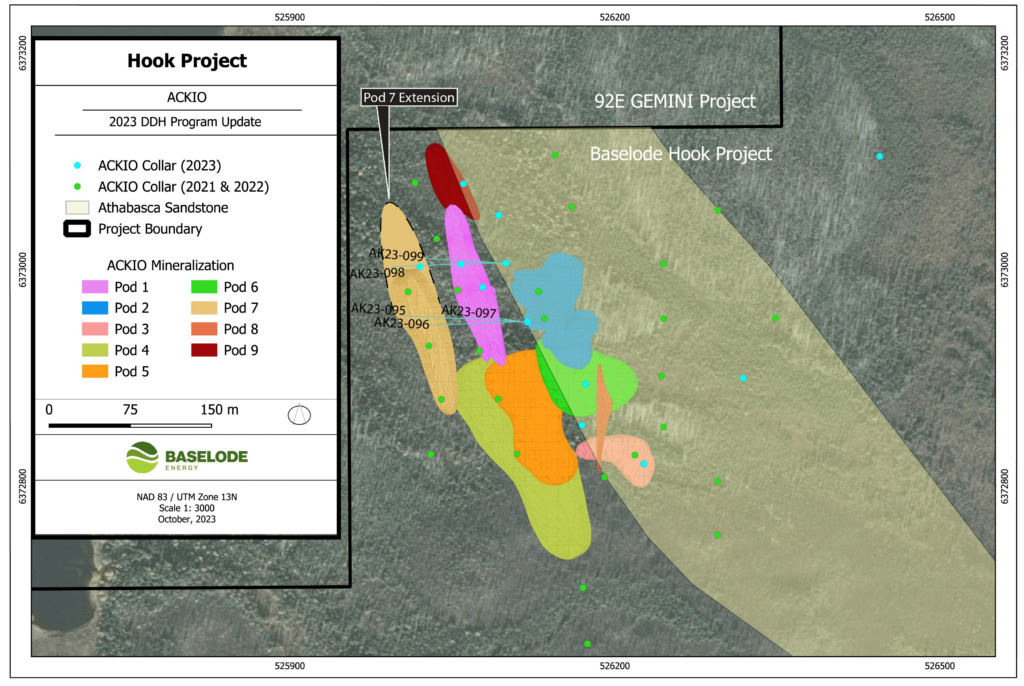

Baseload Energy (TSXV: FIND) is reporting success in its most recent exploration program, which saw a total of 36 holes drilled at its ACKIO uranium prospect at its Hook project in the Athabasca Basin.

The company this morning released results from five drill holes, while assays remain outstanding from a further fifteen holes conducted. Three of the five holes are said to have intersected uranium mineralization within 50 metres of surface, and contain over 30 metres of mineralization.

Highlights from the results include:

- AK23-95: 0.41% U3O8 over 34.85 metres from 46.65 metres depth, including 1.11$ U3O8 over 7.4 metres

- AK23-96: 0.36% U3O8 over 20.0 metres from 54.0 metres depth

- AK23-98: 0.18% U3O8 over 13.0 metres from 432.0 metres depth

- AK-23-99: 0.27% U3O8 over 16.0 metres from 71.0 metres depth

“ACKIO continues to impress us with near-surface, high-grade uranium mineralization in Pod 1, and with growth potential in Pod 7 starting to be realized. Drill holes AK23-095, AK23-096, and AK23-098 intersected mineralization starting within 50 m of surface, and had greater than 30 m of composite mineralization. This demonstrates the potential of ACKIO as it hosts shallow, high-grade uranium and is endowed with multiple thick sequences of mineralization,” commented CEO James Sykes on the results.

The program as a whole saw 7,512 metres drilled across 36 holes, of which 30 were focused on the ACKIO prospect. The target is found 30 km to the southeast of established infrastructure, and 70 km northeast of Cameco’s Key Lake mill.

Baselode Energy last traded at $0.34 on the TSX Venture.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.