Bed Bath & Beyond (NASDAQ: BBBY) failed to make bond interest payments a week after its bank lenders issued a default notice due to an overdraft on its credit lines.

A spokesperson for the retailer told The Wall Street Journal acknowledged Wednesday that the company failed to pay more than $28 million on three tranches of notes totaling nearly $1.2 billion due on February 1.

The coupon payment failure comes nearly a month after the company hinted at bankruptcy and warned it was running low on funds.

The company has been preparing for a chapter 11 procedure for weeks, including attempting to acquire a loan to fund its bankruptcy and lined up a buyer for its stronger business, the Buybuy Baby chain.

Bed Bath & Beyond stated last week that JPMorgan Chase & Co. found the company was in default after it failed to repay amounts borrowed on its revolving credit lines. According to a recent securities filing, the company has $550 million in loans outstanding from banks led by JPMorgan Chase & Co., and an additional $375 million under a facility supplied by Sixth Street Partners.

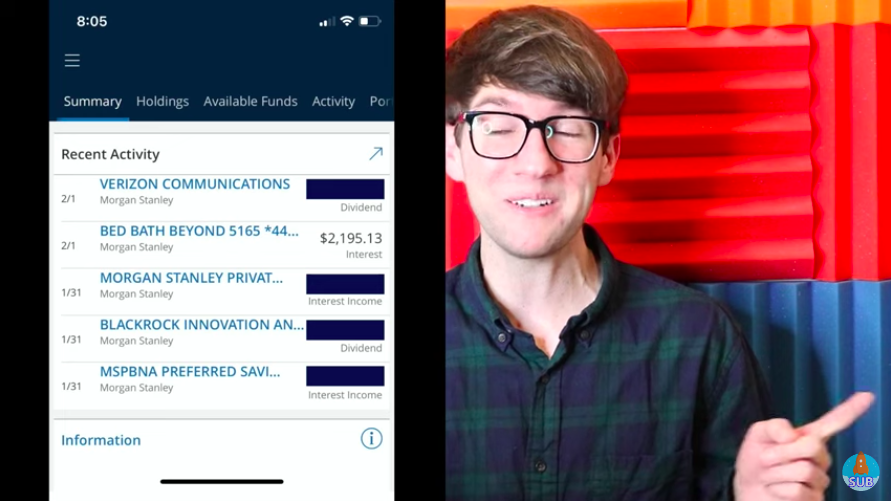

Youtuber: Bed Bath & Beyond paid

However, a YouTuber by the name “Ben – Mr. Business” recently claimed that his friends “who [have accounts] in Morgan Stanley received their interest payment for their Bed Bath & Beyond bonds,” for their 2024, 2034, and 2044 bonds.

“It’s looking like Bed Bath & Beyond will begin paying all of the interest to all the different brokerages through their paying agent Bank of New York,” the online user said. “So it’ll maybe take a couple of days later depending on what brokerage you have.”

When the Youtuber was asked for proof of the claim of coupon payment, he showed a screenshot of what seems to be his friend’s portfolio manager app showing that they received interest payment from Bed Bath & Beyond for the 2044 bonds.

“So this is 100% irrefutable evidence that Bed Bath & Beyond has begun paying out the interest for their bonds,” he added.

The Youtuber also tried to fact-check The Wall Street Journal’s article that said it has a $28 million outstanding interest payment that it failed to make, saying that the retailer only has “approximately $24.8 million debt services” due last Wednesday. He also pointed out that while the article said Bed Bath & Beyond has around $1.2 billion outstanding debt, the retailer’s recent press release only put this at “approximately $1 billion of debt.”

30-day grace period

The retailer earlier entered into a 30-day grace period to make good on bond coupon payments, but doing so did not erase the default caused by its failure to repay bank loans. To resolve a default, borrowers would often have to make up missed payments on all of their debt.

“We continue to work with our advisors and implement actions to manage our business as efficiently as possible. Multiple paths are being explored and we are determining our next steps carefully, and in a timely manner,” the spokeswoman said.

In addition, the corporation has begun closing 87 additional flagship locations and its Harmon drugstore network. The closures are in addition to the 150 planned for last year while simultaneously conducting layoffs in an effort to stay afloat.

The retailer announced a $393 million loss for the quarter ending November 26 as sales fell 33%. Earlier, however, Bed Bath & Beyond initially said they would not be able to file their financial statements for said quarter and asked for a five-day extension to file.

“Based on business performance for the third quarter of fiscal 2022, the Company has determined the need for additional time to complete its quarter-end close procedures, including the evaluation of its results in conjunction with quarterly long-lived asset impairment testing,” the company said in a statement.

The year 2022 had been a challenging one for the retailer, marked by a seemingly short-run short squeeze that ended with a 20-year old being US$110 million richer and Canadian investor Ryan Cohen cashing out his investment. The latter sent the firm’s rising share price back down by 44% after hours, back at where it started before the squeeze.

To address its ballooning debt, the company tapped law firm Kirkland & Ellis, the world’s largest law firm by revenue, which has gained popularity for its dominance in restructuring and bankruptcy situations.

Come September, the firm saw its CFO Gustavo Arnal jump off the 18th floor of a Manhattan office building. Upon his passing, Laura Crossen, then Senior VP of Finance and Chief Accounting Officer, took over.

While no one will ever know with certainty the reason for Arnal’s action, it may suggest a federal lawsuit filed in late August against him and Ryan Cohen, GameStop Corp.’s (NYSE: GME) chairman and a prominent investor in BBBY, could have some degree of credibility.

$BBBY Going to be listening to this song on repeat on the way to work tomorrow!!!! It’s so good! pic.twitter.com/q3HKCMWRkN

— PorscheOnly (@porscheonly1) January 29, 2023

Bed Bath & Beyond last traded at $3.27 on the Nasdaq.

Information for this briefing was found via The Wall Street Journal and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.