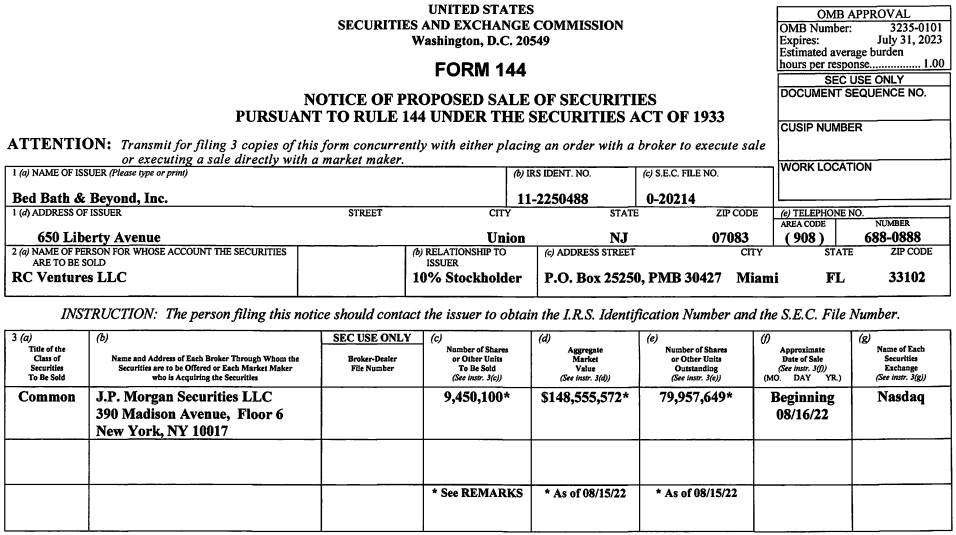

The drama continues for Bed Bath & Beyond (NASDAQ: BBBY) this evening as investors learn of a filing made by Ryan Cohen of RC Ventures LLC. The filing, a Form 144, was made public this afternoon and quickly caught the ire of Twitter and WallStreetBets users alike. The timing of the filing happened to coincide with that of the share price of the equity tumbling hard, fast.

Bed Bath & Beyond: RC Ventures LLC Files to Sell 9,450,100 Shares

— Thomas Thornton (@TommyThornton) August 17, 2022

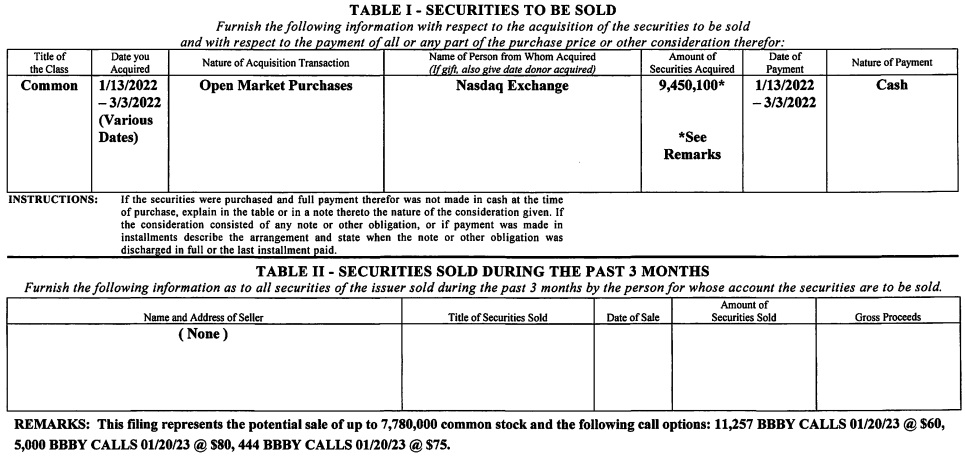

The filing in question, a Form 144, amounts to a proposed sale of securities, under Rule 144 of the Securities Act of 1933 in the US. The form itself was a required filing by RC Ventures if it wishes to sell stock in the company, following the fund becoming classified as an insider of Bed Bath & Beyond, due to acquiring over a 10% stake in the firm.

As per a separate filing, a Schedule 13D, the fund apparently held an 11.8% interest in the company as of August 16, which is based on the company having just under 80.0 million shares outstanding. RC Ventures indicated that it had 9,450,100 shares in total, worth approximately $148.6 million as of August 15.

It should be noted here that RC Ventures may not have yet sold the 9.45 million shares it has control over, like has been misrepresented on certain social media channels. Rather, it represents the potential sale of those securities. The potential sales were set to begin August 16, 2022.

What’s more, as per the remarks included within the filing, it technically represents the potential sale of 7.78 million common shares of Bed bath & Beyond, as well as 11,257 call options that expire January 20, 2023 with a strike price of $60, 5,000 call options that expire January 20, 2023 with a strike price of $80, and 444 call options with an expiry of January 20, 2023 with a strike price of $75.

The shares, or any fraction of them, may now be sold within the next 90 days in connection with this Form 144 filing. After 90 days has elapsed, a separate form would be required to be filed if he wishes to sell beyond that time frame.

Elsewhere in the market, Jim Cramer has seemingly taken a victory lap on the equity only closing 11.8% higher today, with the name sinking in after hours trading. Cramer was notably a strong critic of the company in recent days, encouraging the firm to raise desperately needed capital in the wake of the meme stocks movement getting behind the name once more.

Bed Bath, now what? How are the fundies, Ape-a-roonie-mcfaddies?

— Jim Cramer (@jimcramer) August 17, 2022

Bed Bath, apers, is a failing store with bad merchandise that needs capital and unless you provide it to them with your continual buying, you might be holding a real bad hand. But who cares!!

— Jim Cramer (@jimcramer) August 17, 2022

almost ready: RC Cola here we come! oops RC Ventures!!! pic.twitter.com/wfT3pbAeMi

— Jim Cramer (@jimcramer) August 17, 2022

Main Street Bets One–Wall Street Bets Zero… but that's okay, there's always tomorrow with Bed Bath; checking to see if i got a 20% off coupon in the mail today. But why should this be any different from any other day!!! Hoohah!

— Jim Cramer (@jimcramer) August 17, 2022

Did my buddy pal friend Ryan Cohen beat the company to the selling punch? Probably… $BBBY

— Jim Cramer (@jimcramer) August 17, 2022

I will say this about Primatologist-in-chief Ryan Cohen: he has ridden a wave of Jane Goodall's finest all the way to the bank and is a lot smarter than Bed Bath which should have bailed before him.. Ryan, please come on Mad Money tomorrow and tell us how you did it!!

— Jim Cramer (@jimcramer) August 17, 2022

Some would say Cramer has a slight obsession.

Bed Bath & Beyond last traded at $23.08 on the Nasdaq.

Information for this briefing was found via Edgar, Twitter and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.