Bed Bath & Beyond (OTC: BBBYQ) is officially ceasing trade on public markets. The halt follows the company filing for bankruptcy on April 23 via a Chapter 11 filing in New Jersey.

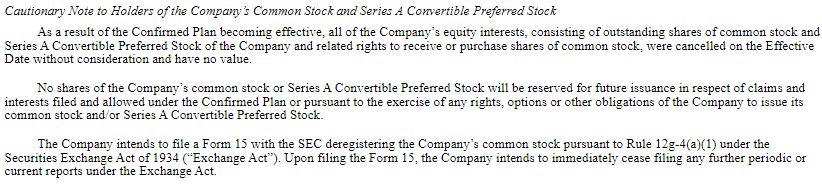

The company, who officially made the filing as “20230930-DK-Butterfly-1, Inc.”, late on Friday made a filing with the Securities and Exchange Commission indicating that as a result of confirmed bankruptcy plan made with the U.S. Bankruptcy Court for the District of New Jersey becoming effective, all of the company’s equity interests have been cancelled. Such equity interests include outstanding shares of common stock and Series A convertible preferred stock of the company.

Furthermore, no shares of the company will be reserved for future issuance in respect of claims and interests filed under the bankruptcy plan.

A Form 15 has also been submitted to the SEC for the deregistration of its shares on the public markets, immediately ceasing the listing and ending the obligations of the company to file anything with the regulator.

In short, as of September 29, 2023, all shares of the corporation have been cancelled, amounting to shareholders receiving $0.00 for their ownership in the company, despite the company closing the last session at $0.079 per share.

Information for this briefing was found via Edgar and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.