Bed Bath & Beyond Inc. (NASDAQ: BBBY) is apparently tapping law firm Kirkland & Ellis to help address the ballooning debt, according to a person familiar with the situation.

The retailer is on the spotlight after a seemingly short-run short squeeze this week, ending with a 20-year old being US$110 million richer and Canadian investor Ryan Cohen cashing in his investment. The latter sent the firm’s rising share price back down by 44% after hours, back at where it started before the squeeze.

During the squeeze, a lot of pundits–including controversial TV host Jim Cramer–had been highlighting the company’s glaringly high debt and lack of liquidity.

"What's going on with $BBBY? Obviously the company should be selling stock, I think they're completely paralyzed," says @jimcramer. "I'm gonna give them free legal advice, given the fact that I actually know the law here: they can sell!" pic.twitter.com/j75SdgiYLS

— Squawk Box (@SquawkCNBC) August 17, 2022

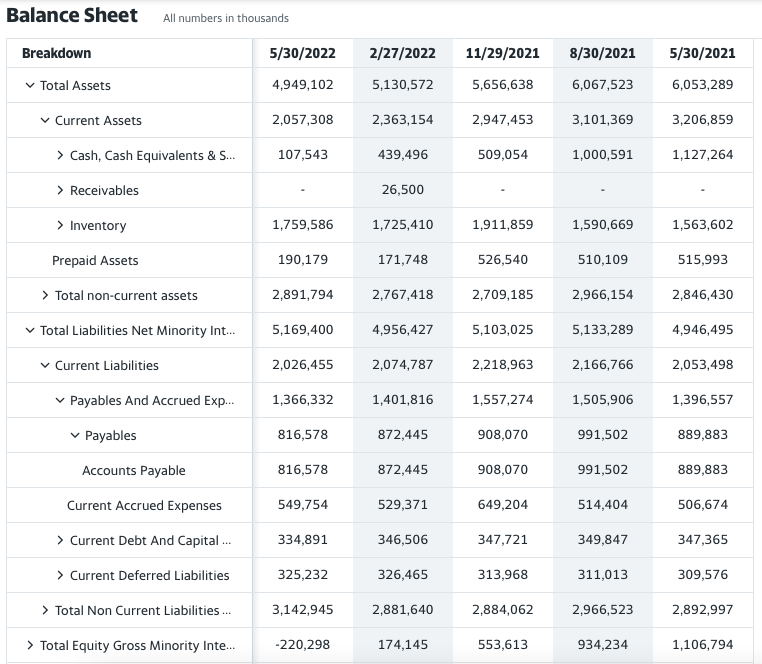

As of the latest financial reports, Bed Bath & Beyond has been posting declining revenues, widening losses, and redder cash outflows. In the latest quarter, the firm actually reported an over-leveraged balance sheet, including a US$107.5 million cash balance against US$816.6 million in current payables.

Kirkland & Ellis– the world’s largest law firm by revenue–has gained popularity for its dominance in restructuring and bankruptcy situations. It was named top restructuring law firm in the world for five years in a row by the Global Restructuring Review. The law office’s clientele included Chapter 11 debtors like driller Seadrill Limited, mall operator Washington Prime Group Inc., and department store chain Belk.

“While we get a lot of press for leading many of the largest and most complicated in-court restructurings (e.g., JCPenney, iHeart, Caesar’s, Toys R Us, Intelsat, Seadrill, United Airlines, TXU/Energy Future Holdings etc.), what many people do not realize is that for every one of those there are many more where we quietly and discretely help the company steer clear of trouble out of court (e.g., Macy’s, Petsmart, Envision, etc.),” said the law firm’s Restructuring Practice Group partner Josh Sussberg in an interview.

The firm was tapped by Bed Bath & Beyond to ruminate on ideas how to address the firm’s financials either through raising funds or refinancing debts, according to the said person intimate with the situation.

On Thursday, the retailer’s filing said it has been “working expeditiously over the past several weeks with external financial advisers and lenders on strengthening our balance sheet.”

Bed Bath & Beyond last traded at US$18.55 on the Nasdaq.

Information for this briefing was found via Bloomberg and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.