US President Joe Biden’s administration intends to sell more crude oil, with 26 million barrels set to be delivered to the market from April 1 to June 30 from the Strategic Petroleum Reserve (SPR), completing budget orders enacted years ago that it had hoped to halt as oil prices have steadied.

Unlike Biden’s announcement of the largest-ever drawdown of the SPR–180 million barrels or 1 million barrels per day for six months–in response to Russia’s war in Ukraine, the latest release of 26 million barrels is in response to a requirement included in two laws passed by Congress during former President Barack Obama’s administration: the Bipartisan Budget Act of 2015 and the Fixing America’s Surface Transportation (FAST) Act.

In a nutshell, the law passed in 2015 pre-planned releases from the SPR and use the revenue to modernize the reserves with upgrades.

I understand that some do not follow always follow legislation. .But in 2015 the Obama administration set out a release schedule of the SPR to pay for the much need upgrades, along with some other government-funded programs. https://t.co/MkDNcftQYQ

— Tracy (𝒞𝒽𝒾 ) (@chigrl) February 13, 2023

This 26M barrel release has… https://t.co/kZoQX9ynR6

The statement also comes ahead of an anticipated increase in gas prices as the United States approaches the summer driving season.

The state of the reserves

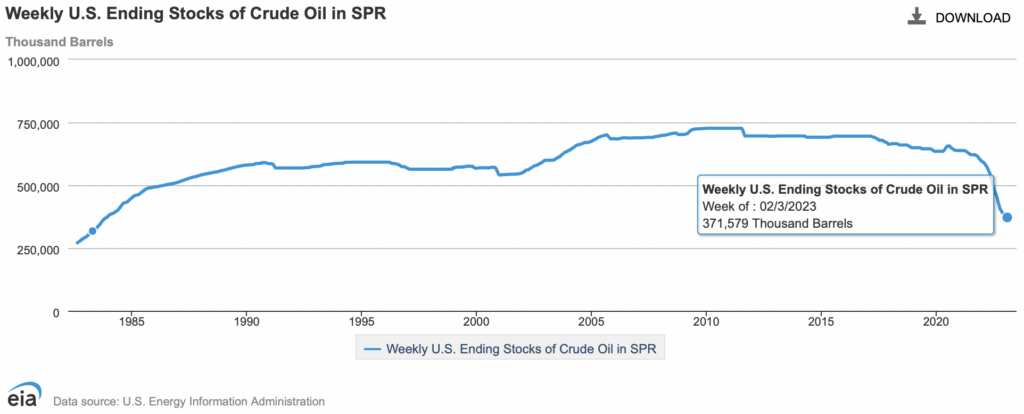

When Biden entered office in January 2021, the SPR held 638 million barrels out of a maximum capacity of 713 million barrels approved by Congress. Following a series of releases totaling more than 260 million barrels, the SPR is estimated to be about 371.6 million barrels as of February 2023, the lowest level since December 1983.

Since then, Biden officials have engaged with energy corporations about purchasing oil to replenish the SPR as oil prices reach around $70 per barrel. But the price level has reached the target price a few times, albeit sporadically.

It increasingly looks like the Biden administration missed the window to buy oil for the SPR. US officials said they wanted to see prices in the $67-$72 range.

— Javier Blas (@JavierBlas) February 13, 2023

WTI is not trading at $72 until January 2025. And the benchmark is not trading below $67 until March 2026 | #OOTT

The congressionally mandated sale comes after the Energy Department announced plans to purchase up to 3 million barrels for delivery in February. Offsetting for that, the SPR is still slated for a nearly 23 million-barrel decline, which would further dry up the reserves to a new low since August 1983.

Remember the ridiculous victory laps people took on the Biden admin buying back 3m barrels of crude after emptying 200m from the SPR?

— TheHappyHawaiian (@ThHappyHawaiian) February 13, 2023

Well now they’re selling 26m more in Q2

This thing is gonna be empty when Biden is done with it

The Energy Department has attempted to halt some of the sales mandated by 2015 legislation in order to replenish the emergency reserve. Other congressionally mandated releases — around 140 million barrels scheduled for fiscal years 2024 through 2027 — were canceled at the request of the Energy Department after legislators passed a provision in a massive budget bill in December.

The Congress-mandated sales of SPR oil were one of the worst manifestations of energy complacency under the guise of energy abundance.

— Karim Fawaz (@karim__fawaz) February 13, 2023

With the FY2024-2027 sales scrapped, these 26M barrels could (hopefully?) be the last Congress withdrawals from the SPR ATM for a while. https://t.co/MycHNOBmPy

The Republican House recently passed a pair of bills imposing conditions on future SPR sales, including a prohibition on selling SPR oil to the Chinese government or companies controlled by the Chinese government, and a bill requiring the development of a plan to make more federal lands available for oil and gas leasing prior to a non-emergency drawdown of the SPR. The former was approved by a widely bipartisan vote of 331-97, while the latter was approved by a party-line vote of 220-205.

“The Administration is focused on replenishing the SPR in a way that provides the best deal for taxpayers by aiming to repurchase crude at a lower price than it was sold for, while providing certainty to the industry in a way that helps encourage near-term production,” the Energy Department said.

Information for this briefing was found via Bloomberg, Fox News, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.