Bitcoin (BTC) yesterday saw a sudden surge to $138,000 on Binance.US — almost 400% higher than spot prices in other exchanges — during early trading on June 21. The surge, called a “flash pump,” only lasted a few seconds before the price returned to its normal level.

BREAKING: Bitcoin hits $138,000 due to hyperinflation of the US dollar as predicted! 🚀🚀🚀

— Bitfinex’ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) June 21, 2023

Oh no, hang on a second, it’s on Binance US which has been sued by the CFTC and SEC, with allegations that Binance is knowingly laundering money for terrorists organizations and CZ has… pic.twitter.com/COQpsTWCo9

The event was limited to Binance.US’s BTC/USDT trading pair, while other assets continued trading as normal.

And maxis wonder why we refuse to participate. They actually believe the price on their screen represents “dollars.” https://t.co/pCFtEcCBSk

— Doomberg (@DoombergT) June 22, 2023

In its report, crypto news site Blockworks pointed out that 62.22 BTC traded at the time, or about $1.8 million at current prices. “The dramatic upwards spike suggests someone market bought that amount in bitcoin with USDT,” they wrote.

“If that’s the case, poor liquidity meant all available sale orders were immediately filled at realistic prices. With only sky-high ‘joke bids’ waiting, the price of bitcoin shot to fresh all-time highs.”

Lololololol- Bitcoin hit $138,070 on Binance US a little bit ago.

— DIRTY BUBBLE MEDIA: GOOD LUCK, GOOD BYE. (@MikeBurgersburg) June 21, 2023

Everything ok over there, CZ? https://t.co/qPTpwt2aFL pic.twitter.com/9kM7k2Et3X

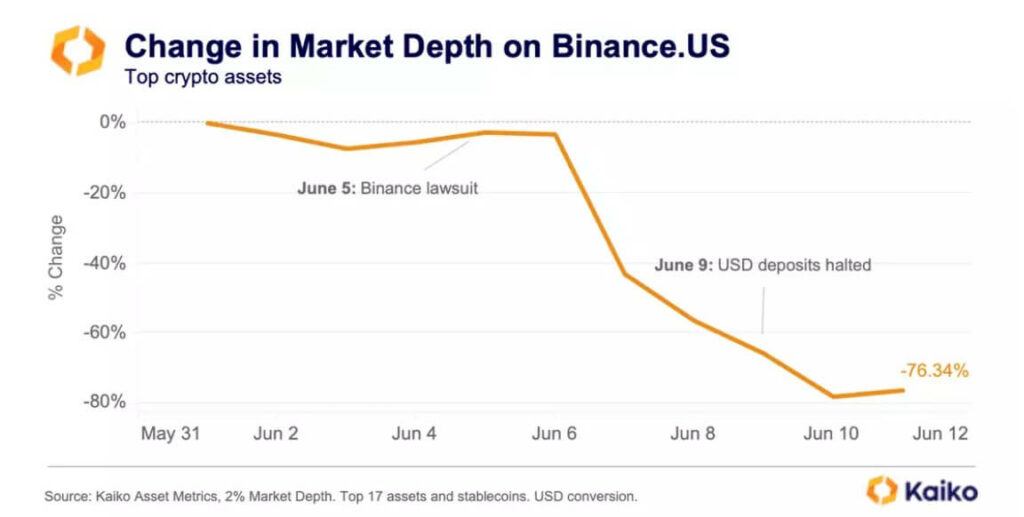

The market depth on Binance.US has significantly declined since the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against the exchange on June 5. Traders have been leaving the platform to avoid potential asset freezes.

The blockchain analytics firm Kaiko reported that the exchange’s market depth dropped by nearly 80% as of June 12, with the market depth for 17 tokens plummeting from $34 million on June 4 to just $7 million.

Moreover, Binance.US has been facing liquidity issues due to its banking partners’ decision to suspend USD payment channels.

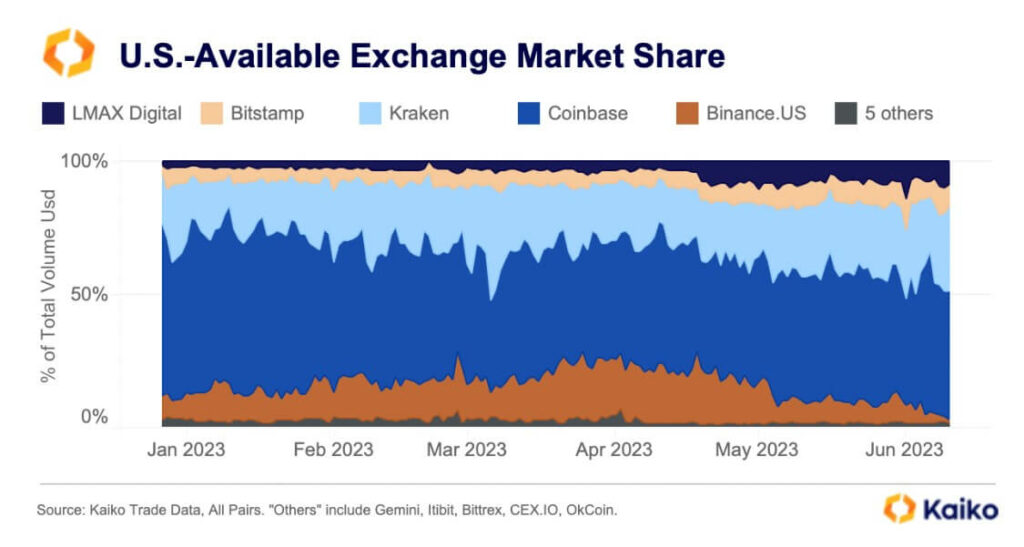

Kaiko data reveals that Binance.US’s market share in the US-based crypto exchange market has plummeted to 1%, a significant decline from its previous all-time high of 27%.

Information for this story was found via Blockworks, Kaiko, Twitter, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.