Bitcoin mining has never been for the faint-hearted, but the latest data from CoinShares reveals an industry squeezed by soaring production costs, financial losses, and fierce competition. As Bitcoin’s block reward halves every four years, the race for profitability among miners grows more brutal.

CoinShares’ recent report for Q3 2024, penned by James Butterfill and Max Shannon, provides an unflinching look at how mining costs are forcing companies to innovate, restructure, or risk falling behind.

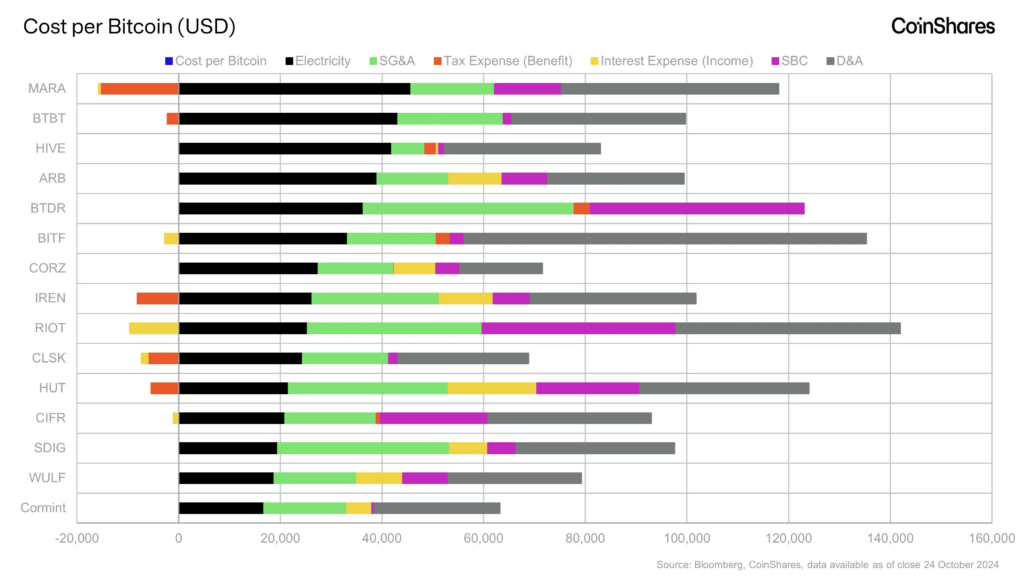

The halving event in 2024 reduced the rewards for Bitcoin miners by half, doubling the effective cost of mining each Bitcoin. For most public miners, this means operating costs have skyrocketed, leaving even the leanest producers vulnerable to Bitcoin’s price fluctuations. CoinShares estimates the average cash cost to mine one Bitcoin stands at around $49,500, but factoring in depreciation and stock-based compensation hikes that figure to a staggering $96,100 per Bitcoin.

These numbers have prompted critics, such as X user @cryptadamist, to call out the industry’s current economics as unsustainable: “It cost $96,100 to mine one bitcoin which currently sells for $68,400. Dumbest companies on the planet.”

Indeed, the data supports this sentiment; miners are investing heavily to secure future profitability, but with operating expenses outstripping Bitcoin’s market value, they may be digging themselves into a financial hole.

lol it cost $96,100 to mine one bitcoin which currently sells for $68,400. dumbest companies on the planet. @Nostre_damus @CCofNavarro https://t.co/uwhtX6VJn2

— ⚯ M Cryptadamus ⚯ | @cryptadamist@universeodon.com (@Cryptadamist) November 3, 2024

The Hidden Costs of Expansion

Mining costs aren’t only about electricity; they include expenses like depreciation, stock compensation, and facility build-outs. Many companies, including Core Scientific (NASDAQ: CORZ) and TeraWulf (NASDAQ: WULF), are pouring millions into new infrastructure.

However, expansion doesn’t come cheap. Core Scientific and TeraWulf, for example, are building facilities for AI and high-performance computing (HPC) at approximately $1.5 million per megawatt (MW). While these AI-focused expansions could offer new revenue streams, they also divert resources from mining, increasing capital expenditures without guaranteeing returns.

In contrast, companies like Cleanspark (NASDAQ: CLSK) and Bitfarms (NASDAQ: BITF) have opted for acquisitions, picking up existing, struggling sites for a fraction of the cost. Cleanspark’s recent acquisitions have cost it about $330,000 per MW—significantly less than the $881,000 per MW Riot Platforms (NASDAQ: RIOT) spent to develop its immersion-cooling site in Corsicana, Texas. This highlights a strategic divide: some miners build for future scalability, while others bargain-hunt to grow efficiently amid tight margins.

Marathon Digital (NASDAQ: MARA) and Riot Platforms show total costs per Bitcoin exceeding $100,000, driven largely by substantial SG&A and high depreciation and amortization costs. A significant portion of expenses across companies includes electricity, though SG&A, stock-based compensation, and tax expenses vary widely and further inflate production costs. Companies like Bitdeer (NASDAQ: BTDR) and Bitfarms also experience elevated costs per Bitcoin, partially due to their high stock based compensation and depreciation and amortization costs, respectively.

Hashcost

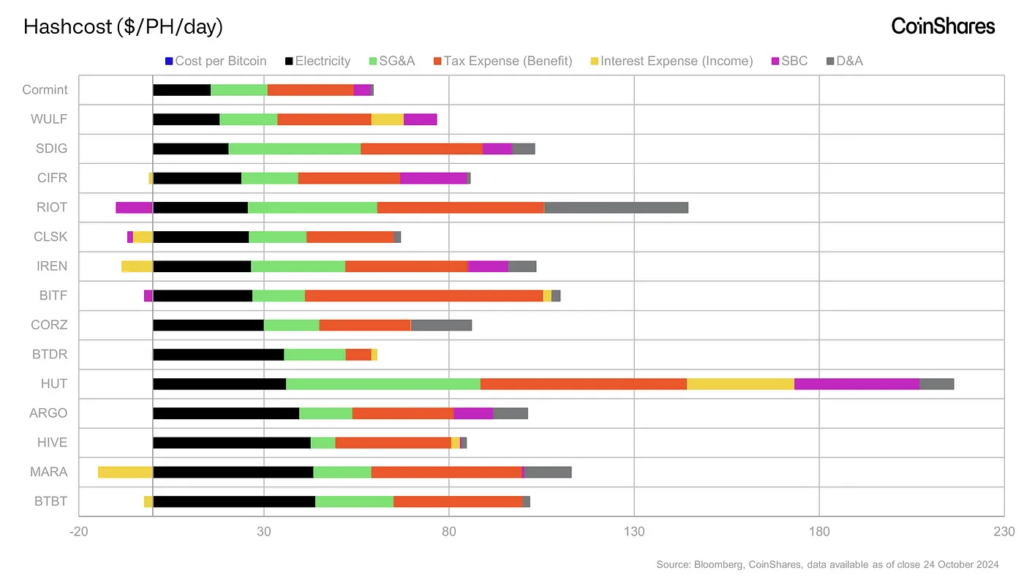

As Bitcoin’s reward system halves, “hashcost” is becoming a critical metric for assessing miners’ daily operational efficiency. Defined as the daily expense to operate each petahash per second of hash rate, hashcost highlights the impact of power management and infrastructure choices on profitability. While Bitcoin’s price movements largely dictate revenue, hashcost reflects a company’s expense control, independent of the halving cycle.

Cormint, a private mining company, currently leads the pack with the lowest hashcost, reflecting its efficient energy management strategies. At Cormint’s Texas-based site, the company’s immersion cooling and air-cooled machine combination minimizes energy expenses, allowing it to reduce hashcost by 31% since Q3 2023.

Riot Platforms, meanwhile, benefits from power curtailment credits, which amounted to $13.9 million in Q2 2024 alone, offsetting some of its high operational costs.

Hut 8 Mining (TSX: HUT) appears as one of the higher-cost producers, largely influenced by electricity, SG&A costs, tax expenses, and stock based compensation. Notably, Hut 8 has a significant chunk of its costs tied to interest expense.

Bitcoin mining economics

CoinShares’ model suggests that for many investors, buying and holding Bitcoin directly may be more profitable than mining. A 1 MW mining operation costs approximately $742,000, with a projected four-year return of around 62%, while a direct investment in Bitcoin could yield a 234% return over the same period if Bitcoin reaches $130,000 by 2026.

This sobering comparison has pushed some miners to diversify revenue streams into AI and HPC hosting, where demand is rising due to the AI boom. Core Scientific’s $725 million annual deal with CoreWeave exemplifies this trend, as miners pivot to more stable, high-margin revenue streams to compensate for Bitcoin’s volatility.

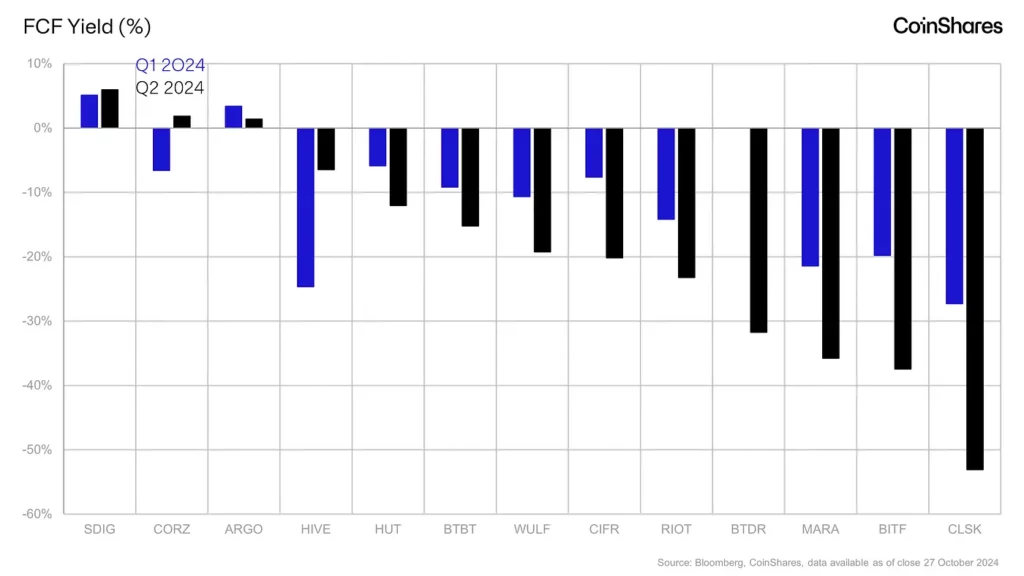

One of the most telling indicators of financial health in the mining sector is free cash flow (FCF) yield. Negative FCF plagues many miners, due to high capital expenditures and operational costs outpacing revenue.

In Q2 2024, miners such as Core Scientific and Marathon Digital reported some of the industry’s most substantial accumulated losses relative to equity raised. Shareholder dilution, driven by miners’ need to fund operations amid limited credit access, remains a sore point for investors. According to CoinShares, some miners, such as Argo Blockchain, have had to take drastic measures like selling off assets to maintain liquidity, often at the cost of long-term growth.

Conversely, Core Scientific’s diversification into AI-related infrastructure has helped it generate positive FCF yields, distinguishing it from pure-play Bitcoin miners. Dubbed “Mullet Miners” by CoinShares, these firms have one foot in the volatile Bitcoin mining world and another in the more predictable AI sector, potentially offering a blueprint for future sustainability.

As Bitcoin’s network hashrate continues to rise, energy constraints could define the limits of growth. CoinShares’ piecewise exponential model for hashrate growth estimates that by 2050, the mining network will hit an upper bound based on the energy from globally flared gas—around 150 billion cubic meters annually.

If miners fully utilize stranded gas sources, it could cut carbon emissions from flared gas by up to 63%, introducing a new dimension to the environmental debate around Bitcoin mining. While this may help address Bitcoin’s carbon footprint, accessing such energy sources on a large scale remains technically challenging and financially uncertain.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.