A technical valuation signal which has displayed a good predictive track record, plus constructive announcements by several large players in the Bitcoin space, augur well for a continued move higher for the world’s largest digital currency. After bottoming at just under US$30,000 in mid-July, Bitcoin has rebounded about 60% to trade at its current US$48,575 price. Based on the below valuation methodology/announcements, further near- and intermediate-term gains may be possible.

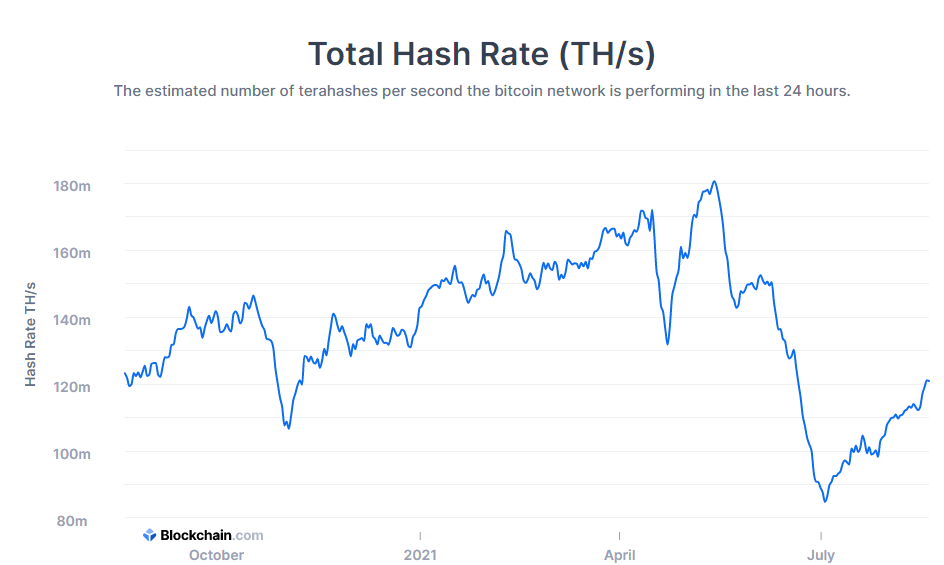

First, according to the Blockchain analytics platform Glassnode, the 30-day moving average of the Bitcoin network hash rate, or total computing power on the network, just crossed through and is now higher than the 60-day moving average. In the past, such a crossover has preceded significant Bitcoin appreciation.

The theory is that when Bitcoin miners get more bullish on Bitcoin pricing, they dedicate more computing power to their mining operations. Such an increase is reflected more heavily in the weightings of the 30-day moving average than the 60-day figure, so when the 30-day compilation crosses through the 60-day, that signals the start of what is likely to be mounting optimism.

The Bitcoin network hash rate peaked at just over 180 Exahash per second (EH/s) on May 13. It troughed at about 85 EH/s on July 2 and is currently around 131 EH/s. (Bitcoin miners solve extremely complex math problems, the answer to which is a long string of numbers, called a hash. In turn, the speed at which a miner’s suite of computers can reach such an answer is termed the hash rate. A miner with a total of 1 EH/s of computing capacity can create one million trillion hashes per second.)

Second, on August 18, David Marcus of Facebook (NASDAQ: FB) announced that after about two years of delays the company plans to be a major player in the cryptocurrency-based payment system. Novi, the name of Facebook’s digital currency wallet, has secured licenses or approvals in almost every U.S. state. Novi will offer free peer-to-peer payments, and Facebook expects to earn profits from merchant services. Given Facebook’s mammoth reach, this initiative seems very likely to speed the adoption of Bitcoin as a more conventional method of transaction.

Third, on August 19, Coinbase Global, Inc. (NASDAQ: COIN), which operates the world’s largest cryptocurrency trading platform, said it plans to buy US$500 million of cryptocurrencies and allocate 10% of its quarterly profits into a portfolio of crypto assets. Coinbase’s actions could influence investors, particularly young investors, to allocate more funds to digital currencies.

Finally, mainstream investment funds are buying substantial stakes in Bitcoin miners. As of June 30, Blackrock, the world’s largest investment manager with US$9 trillion in total assets, disclosed nearly US$400 million in investments in Marathon Digital Holdings and Riot Blockchain. Similarly, Fidelity Investments (US$4.9 trillion in assets under management), reportedly owned a stake worth about US$250 million in Marathon Digital as of June 30.

Bitcoin last traded at US$48,575.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.