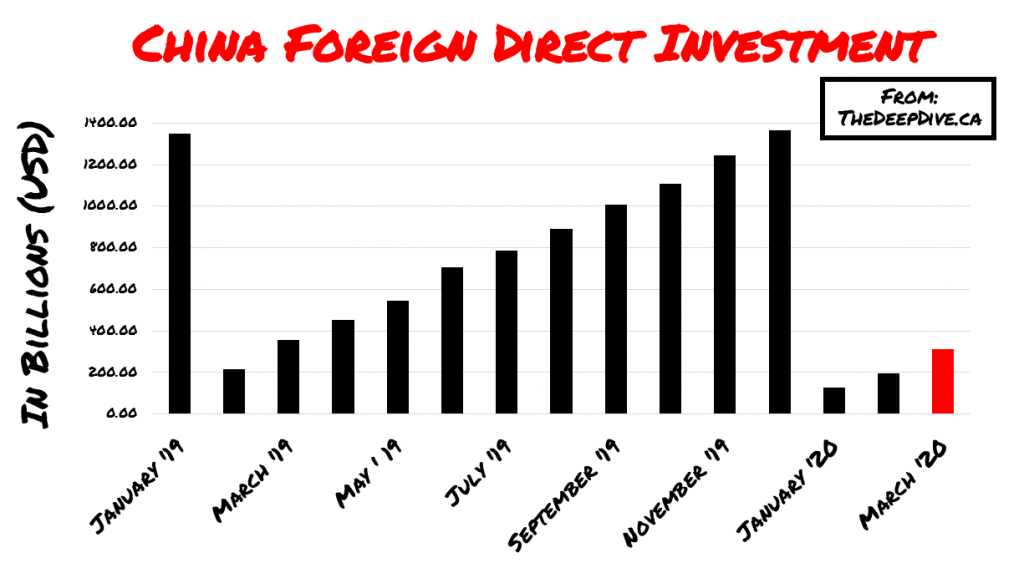

It seems that Donald Trump’s recent demand for the US federal employee retirement fund to halt Chinese equity investments has spiraled into a cascade new tensions. Although the Chinese government issued a statement regarding the US president’s request, the drama over China is far from over. Now, the National Legal and Policy Center (NPLC), which is a US right-wing not-for-profit group focused on monitoring and reporting ethics of public officials while supporting liberal causes, has demanded that Blackrock, the world’s largest investment management company, divest customer’s funds from American stock exchange listed Chinese companies.

In a letter penned to Blackrock’s CEO and Chairman Larry Fink, the NPLC is insisting that the company divests money from a total of 137 Chinese companies, stating the main reason behind the request as being China’s supposed poor human rights record and threat to world peace. A rather bold statement given that NPLC’s home turf has been slapped with that label on more than one occasion.

Nonetheless, NPLC’s letter continues, stating further reasoning as to why Blackrock should abandon its investments in Chinese companies, including China’s poor coronavirus mitigation efforts, Chinese detention camps, a organ harvesting program, and the building of a “surveillance state.” Furthermore, the non-profit group cited the increased risks to American investors if Blackrock continues to invest in Chinese companies, stating that many of those companies in question do not comply with either Dodd-Frank or Company Accounting Oversight Board audit standards.

Recently, Blackrock succumbed to anti-fossil fuel activists’ requests, and divested several thermal coal-producing companies. This move was pointed out in NPLC’s letter, bringing attention to Blackrock’s honouring of certain moral imperatives whilst ignoring others.

Information for this briefing was found via NLPC, Newswire, Trading Economics, and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.