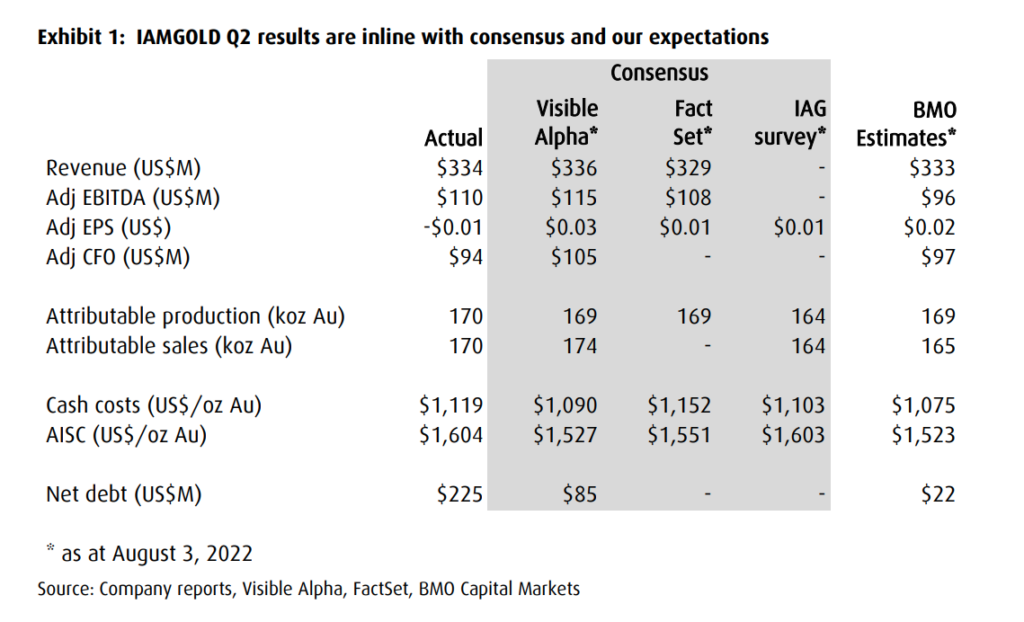

Last week, IAMGOLD Corporation (TSX: IMG) reported its second-quarter results. The company said it produced 170,000 gold attributed ounces, down 4,000 ounces or 2% from the last quarter. The firm said it realized an average gold price of $1,799, slightly down from the $1,813 during the previous quarter, while the company’s cost of sales per ounce sold was $1,130, up from $1,035 during the previous quarter. While the cash costs remained a majority of the total costs, coming in at $1,119 per ounce, and the all-in sustaining costs jumped from $1,490 during the previous quarter to $1,604 this quarter.

Revenues came in at $334 million, down from $356.6 million last quarter, and gross profits saw the same dollar decrease, going to $49.4 million for the second quarter. Adjusted EBITDA came in at $110 million, and the company saw its cash flow from operations come in at $81.9 million, almost half of what the company reported for the first quarter.

The company ended the quarter with $452.9 million in cash on hand and $612 million in long-term debt, with $348.7 million available for use in their credit facility.

IAMGOLD currently has ten analysts covering the stock with an average 12-month price target of C$2.54, or an upside of 23%. Out of the ten analysts, one analyst has a buy rating, four have hold ratings, another four have sell ratings, and there is one analyst who has a strong sell rating on the stock. The street high price target sits at C$4 and represents an upside of almost 95%.

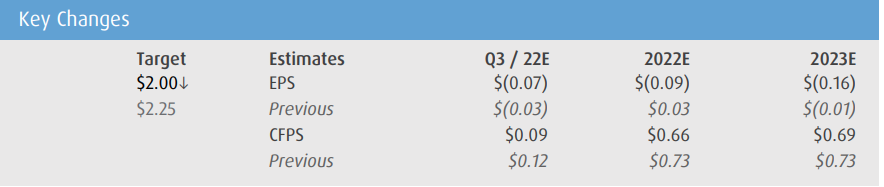

In BMO Capital Markets’ note on the results, they reiterate their market perform rating but lower their 12-month price target from $2.25 to $2.00, asking the question about how the company will ultimately fund the Côté mine.

On the results, BMO says most of the results generally came in line with their estimates, except that both cash and all-in sustaining costs came in above their estimates of $1,075 and $1,523, respectively. Net debt also came in above their $22 million estimate.

BMO adds that the company’s CAPEX and OPEX spend is higher on a per tonnes milled basis than their estimates. On the Côté estimate, they assume that the total spending is $2.815 billion on a 100% basis.

Though they say that not everything is negative in the company’s results, commenting that they believe that IAMGOLD is now assuming “a more realistic” US$185 million contingency and US$80 million escalation allowance.

Lastly, BMO writes that the company’s financing “continues to be a major overhang” as the company needs more money to fund the completion of the project. BMO is currently estimating that the company borrows the remaining on a credit facility to fill in the gap but warns that if the company cannot access a credit facility, the company will be forced to go and issue equity which would be dilutive to shareholders.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.