On Sunday BMO Capital Markets released an in-depth report on the uranium market, saying that the recent events in Ukraine have provided a tailwind for the sector as more countries look to build nuclear power plants. BMO writes, “The role of uranium, and wider nuclear technology, in a low-carbon global economy, is becoming ever clearer and is driving significant research and development into the next generation of technologies.”

With this global tailwind, BMO expects that the uranium spot price “will ultimately have to rise to necessary levels” to meet demand, and because of this they have increased their long-term price outlook to US$58/lb from US$50.

Additionally, they say that many government strategies have the potential to increase uranium’s spot price even higher relative to their base case and note that uranium is the only commodity that they cover that is trading below its long-run equilibrium price.

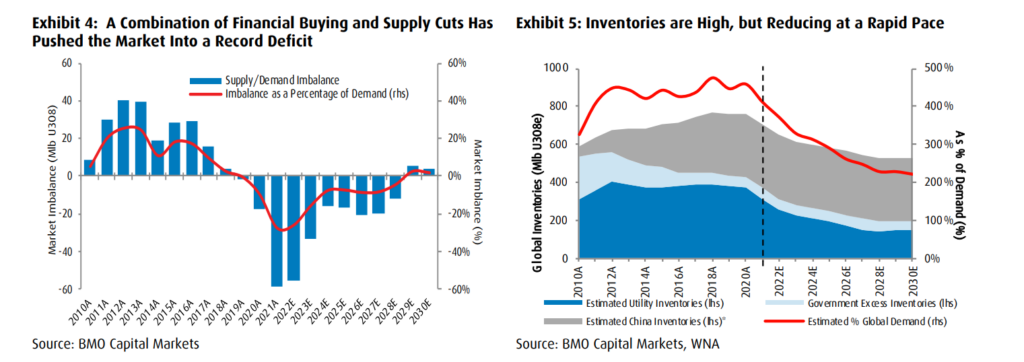

BMO believes that though demand for uranium is expected to pick up, the availability of the commodity is not scarce yet. Despite the market being in a production deficit, there was a massive amount of inventory built during the years after the GFC. They do note that inventories are finally being depleted and that they are at the lowest they’ve been since 2010.

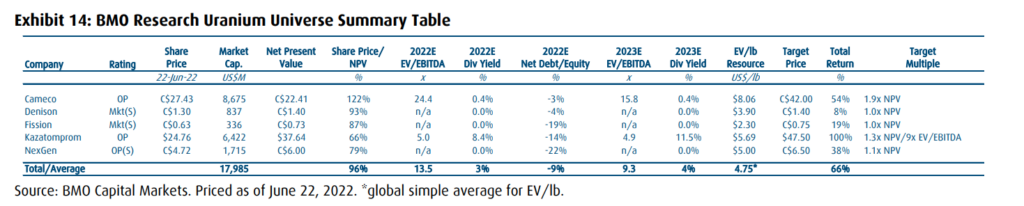

With this, BMO says that the mining equities under their coverage, which includes Cameco, Kazatomprom, NexGen, Denison Mines, and Fission Uranium, all offer a “potential for upside.” BMO also says that they prefer producers and advanced developers over any other uranium equity play.

While they are bullish on the whole sector, they reiterate Cameco (TSX: CCO) as their top near-term pick, saying that the company is, “well positioned to benefit from a focus on the security of supply by utilities given Canadian exposure, growing EBITDA base on McArthur River restart, largest and most liquid listed uranium stock.”

Long term, BMO calls Kazatomprom (LSE: KAP) their best idea for a long-term pick in the uranium market as they say that the company is “The largest and one of the lowest-cost producers in the world.” Though they do note that the stock has priced in higher risk due to its joint venture with Russian partners and its mine that’s close to Russia, making it have one of the lowest multiples in their coverage.

The last company BMO highlights in this note is NexGen Energy (TSX: NXE), which they refer to as “the best of the explorers/developers,” yet comment it trades at a large discount to its peers. They also believe that the company’s Arrow deposit could be one of the largest uranium operations globally.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.