On December 5th, Teck Resources (TSX: TECK.A) provided an update on the British Columbia weather affecting their business. The company said that the railway services are operating at reduced levels and continue to have service interruptions. As a result, the company has lowered a number of its guidance figures. First, they now expect fourth quarter steelmaking coal sales to be between 5.2 – 5.7 million tonnes, versus 6.4 – 6.8 million tonnes previously. The company also expects annual steelmaking coal production to be 24 – 25 million tonnes versus 25 million tonnes previously.

Additionally, the company has increased their adjusted cash costs of sales to $64 – $66 per tonne, above their previous high-end guidance of $66 per tonne. The company also expects full-year transportation costs to come in at $44 – $46 per tonne, higher than the previous guidance of $42 per tonne

Teck Resources currently has 15 analysts covering the stock with an average 12-month price target of C$40.73. Out of the 15 analysts, 3 have strong buy ratings, 8 have buy ratings and the last 4 analysts have hold ratings. The street high sits at C$53 while the lowest comes in at C$29.16.

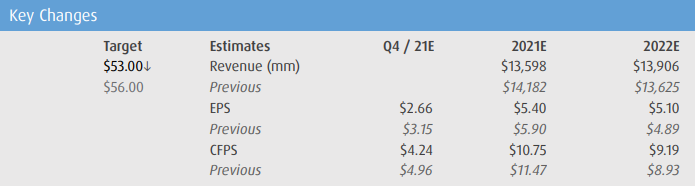

In BMO Capital Market’s note, they reiterate their outperform rating but lower their 12-month price target to C$53 from C$56, saying that the impact is more significant than they had previously expected.

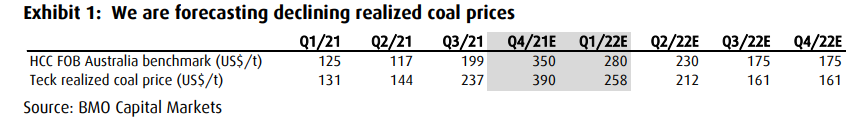

BMO expected that the company’s coal and copper mines would remain shipping, and that the shipping issues would have been wrapped up by the start of this quarter. As a result of this, BMO has elected to move their price target down based on management’s updated guidance. BMO now expects declining realized coal prices until the end of 2022.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.