OceanaGold Corp (TSX: OGC) provided a corporate update to their investors on August 27. Included within the update they indicated that the Haile operation had roughly 220 workers go into self-isolation, which slowed down operations materially. Since June, the company has had 18 confirmed positive COVID cases and three presumptive cases. For those reasons they have revised their full year 2020 guidance lower. Now the production at Hailie’s will come in around 135,000 to 175,000 ounces of gold, and they now see full-year production between 295,000 and 345,000 ounces of gold at an all-in sustaining cost between $1,150 to $1,250 per ounce.

OceanaGold also announced that they are receiving a $77 million pre-payment for the delivery of 40,000 ounces of gold in the second quarter of 2021, which equates to $1,925 an ounce. These proceeds will go towards getting production ready at the Martha Underground mine for the second quarter of 2021.

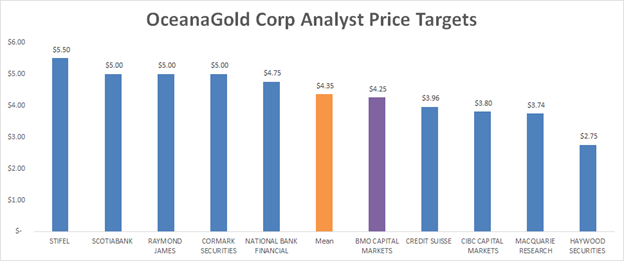

In BMO’s note to investors on Friday, Brian Quast reiterated his firm’s outperform rating and $4.25 price target, which is a 31% upside, and commented that “even after factoring in the lower near term production from Haile, the company trades at 0.7x NPV and 7.2x estimated NTM CFPS. This compares to other medium-sized producers, which trade at 1.6x NPV and 7.9x 2021E CFPS.”

With the news, Quast updated his full-year 2020 revenue and earnings per share estimates downwards to incorporate Hailie’s lower production. Quast now estimates that revenue and earnings per share will come in at $593 million and $(0.05) versus $667 million and $0.03 prior.

Sixteen analysts cover OceanaGold. Three analysts have strong buy ratings, while ten analysts have buy ratings, and the last three have hold ratings. The mean price target is C$4.35, while the highest comes from Ian Parkinson from Stifel Canada, and the lowest comes from Mark Geordie from Haywood Securities with a C$2.75 price target.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.