Last week, Netflix (Nasdaq: NFLX) reported its second quarter financial results. The company announced that revenues grew 9% to $7.97 billion, and noted that the growth would have been 13%, but they were impacted by a $339 million foreign exchange hit. They add that the growth was driven by a 6% and 2% increase in average paid memberships and average revenue per member.

The company reported an operating income of $1.78 billion or a margin of 19.8%, both metrics being down sequentially. While net income and diluted EPS also saw a sequential decline, coming in at $1.44 billion and $3.20, respectively.

The company reported another quarterly subscriber loss, though better than the forecasted loss of 2 million. The company did announce that there was a net loss of 1 million subscribers for the quarter, bringing the total paid members to 220.67 million, which equates to year-over-year growth of 5.5%.

Netflix also provided third-quarter guidance in which they expect revenues to grow to $7.84 billion, which equates to 4.7% year-over-year growth. Netflix anticipates that they will see 1 million new subscribers during the third quarter and expects net income to drop to $961 million, or earnings per share of $2.14.

Netflix currently has 46 analysts covering the stock with an average 12-month price target of $270, which represents an upside of 23%. Out of the 46 analysts, eight analysts have strong buy ratings, 4 have buy ratings, 28 have holds, five analysts have sell ratings, and one analyst has a strong sell rating on the stock. The street high sits at $735, or an upside of 233%.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and $365 12-month price target, saying that the growth at a reasonable price is now “fully engaged” as it seems like the results have turned the corner with the third quarter guidance.

BMO writes, “This quarter management delivered a much better explanation of its new points of focus, including advertising and password sharing/add a home.”

On the results, the paid subscribers came in better than Netflix’s own guidance of -2 million. With EMEA beating BMO’s estimates while UCAN, LATAM, and APAC subscribers came in line with their estimates. BMO was expecting losses of 1.6 million for EMEA.

Revenue and average revenue per member all came in line with BMO’s estimates, not only for the second quarter results but also for the third quarter. While operating margin came in below BMO’s estimate of 21.5%.

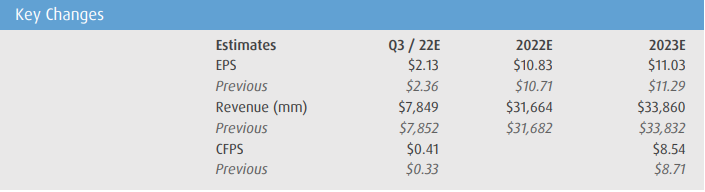

Lastly, the company revised its estimates for the third quarter, the full year 2022, and 2023 to factor in the results and fresh guidance. In the updated estimates, they are factoring in that Netflix maintains its subscriber estimates but realizes a slightly lower average revenue per member. They also are reducing their buyback expectations as the company elected to not buy back shares during the second quarter.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.