Canada’s banks have a problem. Despite being nearly two years into the interest rate hike cycle – the first 25 basis point hike under the current cycle occurred in March 2022 – the banks have been unable to get their lending books under control when it comes to home mortgages.

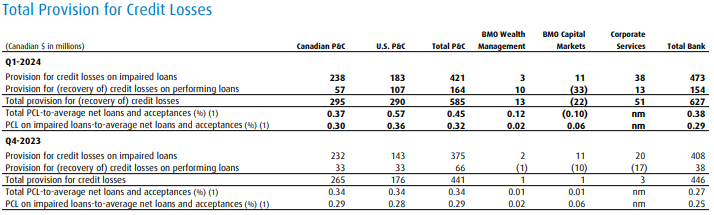

The most recent example of this is the Bank of Montreal (TSX: BMO), whom this morning filed its financial results for the period ended January 31, 2024. Among the highlights are increased provisions for credit losses, which climbed from $446 million in the fourth quarter of 2023, to $627 million in the current quarter.

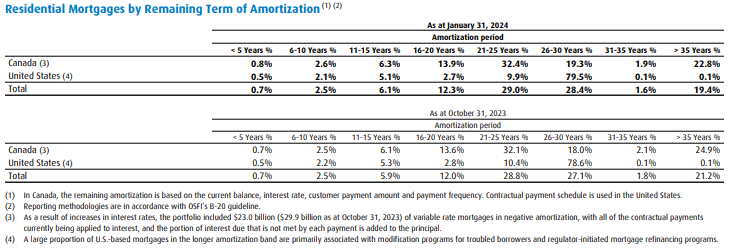

But the real story here is the number of residential mortgages that remain in negative amortization. Nearly a quarter of BMO’s residential mortgage book remains in this category, with 22.8% of mortgages outstanding currently being variable rate mortgages, with all of the contractual payments currently being applied to interest. The remaining portion of interest due not being paid each month is instead being added to the principal amount.

The bank has managed to reduce this figure from 24.9% to 22.8% over the last quarter, however substantial improvement is still clearly in need here.

BMO’s residential mortgage book amounts to $42,908 million in Canada, and a further $58 million in the United States. This implies that approximately $9,783 million in outstanding mortgages are under negative amortization, based on dollar value.

Outside its disaster of a residential mortgage book, Bank of Montreal reported adjusted net income of $1,893 million, down from $2,158 million a year ago. Adjusted earnings per share came in at $2.56, versus $3.06 in the comparable period.

BMO last traded at $120.90 on the TSX, down 4.9% on the day.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.