As we wrap up this crazy year and head into a highly uncertain 2023, BMO Capital Markets tries to provide some guidance for real estate investors with their 2023 Canadian real estate outlook.

They start off the note by reassuring investors that the Canadian economy is likely entering a recession in 2023, saying that the Bank of Canada’s efforts in trying to get inflation back down to 2% will drive the slowdown. Their market economic research group calls for “two consecutive quarters of real GDP contraction in the first half of 2023.”

They believe that investors’ expectations should be more tempered for 2023 as they believe there are many reasons for property valuations to be “tilted to the downside.” They point to the turbulent yield curves as playing the biggest role in the uncertainty that lies within a lot of sectors, specifically real estate. Noting that Canada and the U.S. came into 2022 with “ultra-low rates” for both short and long term, now exiting 2022 with above average rates, wreaking havoc on the bond market.

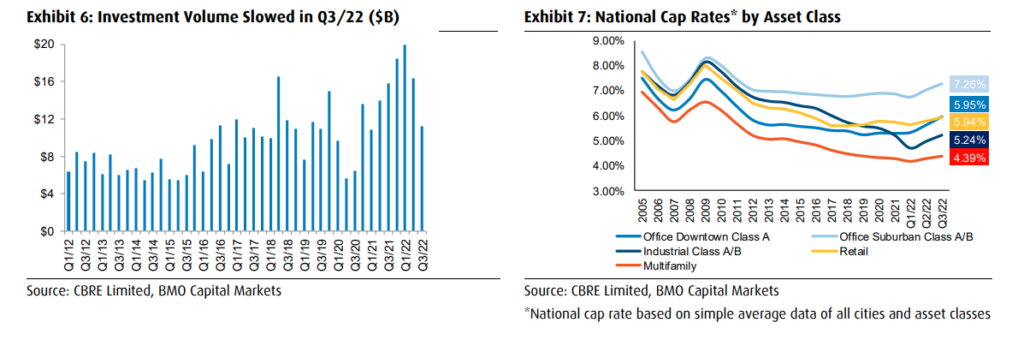

As a result of this outsized move in interest rates by the central banks, investment activity in the private markets has dropped like a rock. According to CBRE, the total volume has seen two consecutive declines, with the total volume being down 44% peak to trough to $11.3 billion in the third quarter of 2022.

Demand destruction is not the only thing higher interest rates have impacted for real estate buyers. More expensive debt due to the rate hikes is also affecting demand. According to CBRE, the national average cap rates have increased by 20bps at the low end and 60bps at the high end from the first quarter to the third quarter of this year. While BMO believes that rates will continue to be pushed higher as the interest rate hikes flow through the system and stay high for a longer period of time.

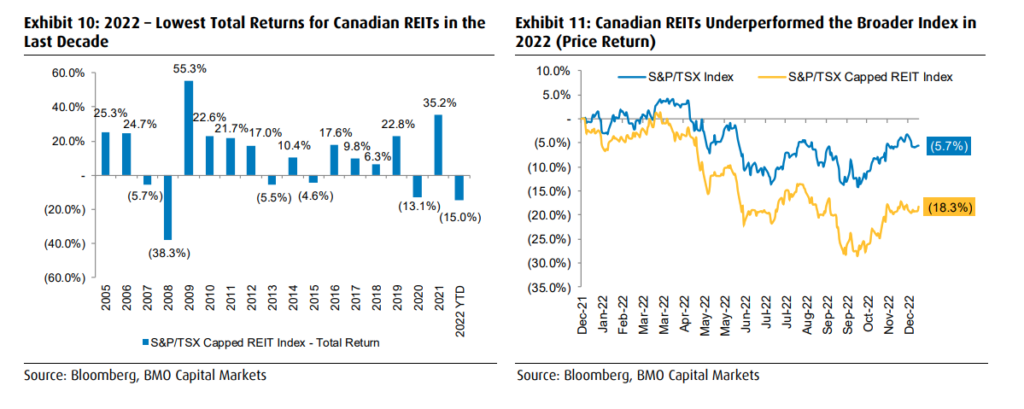

2022 is shaping up to be the worst year for real estate investment trusts since 2008 BMO says. The year-to-date return for the S&P/TSX Capped REIT Index was down 15%, while the index was down 13.1% in 2020. BMO says while the sector is arguably due for a bounce,” they believe that even if one were to happen, it would be a very weak bounce.

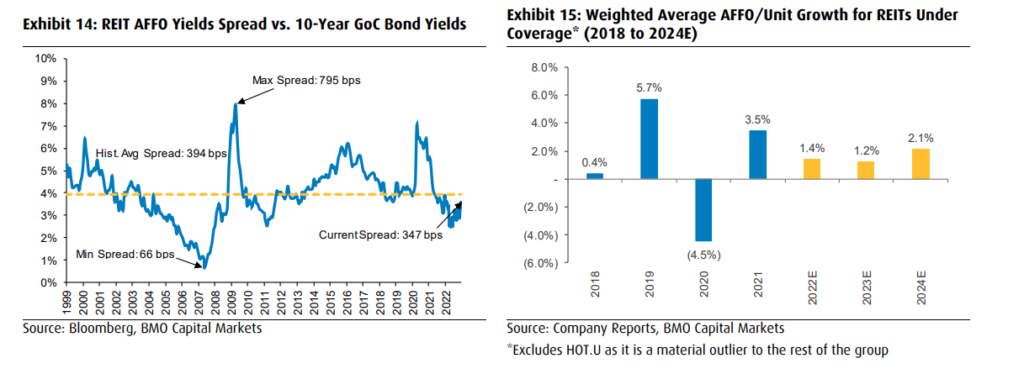

For the reasons discussed above, BMO believes that the historically high weighted average discount to NAV of -11.4% will continue to grow as companies continue to make revisions to it. They also add that the AFFO yield spread (Adjusted Funds from Operations Yield), which is equal to 6.3% for BMO’s coverage, is only 3.47% higher than the 10-year government bond. The spread between the two usually is much higher anytime the sector has traded at a “material discount to NAV.”

On a more bullish note, BMO points to immigration. The national population growth has exceeded the pre-pandemic peak, with the latest numbers saying that Canada’s population has increased by 285,980 in the second quarter of 2022. With the number of residents added for the 12-month endings July 1st, 2022 was 703,400.

They say that the most significant increases have been in six specific provinces, New Brunswick, Nova Scotia, Newfoundland, Prince Edward Island, Alberta, and British Columbia. They write, “In these regions, strong international immigration has been augmented by accelerating net inflows due to relocations from other areas of Canada.”

Lastly, BMO says that regulatory concerns should be at the top of their minds for multi-family investors. Pointing to Prime Minister Justin Trudeau’s letters, which told the Minister of Finance, Chrystia Freeland and the Minister of Housing and Diversity and Inclusion, Ahmed Hussen, to do many things.

It includes changes to the Income Tax Act requiring landlords to disclose pre- and post-renovation rent received in their tax filings and to pay a surtax if the rent increase “is deemed excessive” and to review and consider possible reforms to the current tax treatment of REITs. BMO points to the ever-increasing scrutiny of the financialization of housing.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.