Excitement within the lithium exploration space appears to be reaching a crescendo, with Brunswick Exploration (TSXV: BRW) announcing this morning a large financing despite little exploration conducted to date.

Brunswick is set to raise a total of $7.0 million, of which $5.0 million will be raised via a bought deal through Red Cloud Securities, and $2.0 million is to be raised via a non-brokered private placement. Both raises will see funds raised at $0.85 per unit, with each unit containing one common share and one half of a common share purchase warrant. Warrants are valid for a period of 3 years, and contain an exercise price of $1.25 per share.

An over-allotment option also exists, which could see up to $1.5 million in additional funds raised.

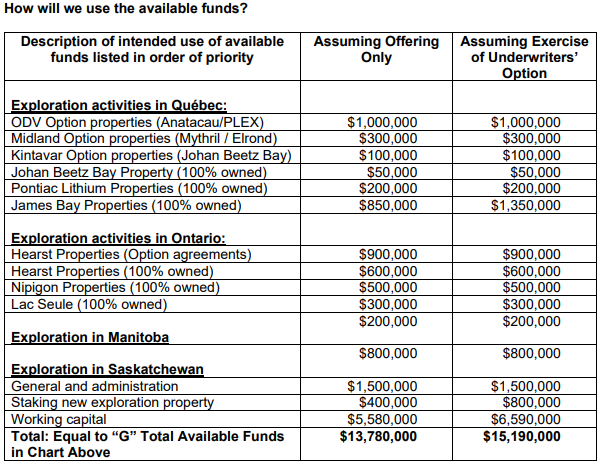

Proceeds from the financing are slated to be used for exploration in Quebec, Ontario, Saskatchewan and Manitoba, as well as for working capital and corporate purposes.

The financing values the firm at a pre-money valuation of roughly $147.3 million, despite its status as a grassroots explorer. The funding follows a $5.5 million financing conducted by the firm in December.

Unfocused property strategy

To say that Brunswick has an un-focused strategy in terms of property acquisition would be an understatement. The self-described grassroots explorer has a smattering of properties across Canada, with the company last year conducting some level of exploration on properties in Ontario, Quebec, Nova Scotia, New Brunswick and Newfoundland.

In January alone, the company added five separate properties across the country to its portfolio, including the following:

- January 17

- The company staked 36 claims 36 claims in Saskatchewan, referring to the 79,892 hectare property as the Trans-Hudson project. The property contains 124 mapped pegmatites that are said to be between 0.5 and 14.5 kilometres in strike length.

- The firm also staked the Lake Athabasca project, which consists of one claim covering 1,386 hectares with two mapped pegmatites near to Uranium City.

- Also staked was the Lynn Lake project, which covers 27,163 hectares via three mineral exploration licenses over land with 9 mapped pegmatites between 500 and 8,500 metres in length.

- January 24

- The company optioned from Globex Mining (TSX: GMX) the Mirage project, consisting o 198 claims covering 8,884 hectares in the James Bay region of Quebec. The property is said to host several pegmatitic glacial boulders, with lithium anomalies of over 100 ppm lithium found in altered basalts. To acquire the property, the firm is to pay $500,000 in cash over three years, while conducting exploration of $1.0 million in aggregate over the term. The company concurrently staked adjacent claims.

- January 30

- Brunswick entered into a letter of intent to option the Hanson Lake project, found 55 kilometres west of Creighton, Saskatchewan. The property is said to host four spodumene-bearing pegmatites, and 57 mapped pegmatites between 0.5 and 2.2 kilometres in strike length. The Hanson Lake project consists of 12 claims covering 16,103 hectares, and is regional to the Trans-Hudson project staked earlier in January. The firm is to pay $700,000 over a period of four years for the project, and spend $1.0 million in exploration expenses to acquire a 100% interest in the property.

In terms of specific exploration, funds from the current program (in conjunction with sources of other funding) appear slated to be spent on small programs across a smattering of properties, based on offering documents prepared by the company and filed on Sedar.

Brunswick Exploration last traded at $0.89 on the TSX Venture.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.