Today we’re going to do something different than what we normally do. We’re going to break down the earnings of a company: Cameco Corp (TSX: CCO).

So why is Cameco so important to the uranium sector as a whole? Well they make up around 15% of global production, and they’re a pretty big fish when it comes to uranium. Also, their financial statements really break down the uranium sector as a whole. So if you’re into uranium, you really should be reading Cameco’s statements.

Now Cameco is so important because when you break down the size of the uranium market, the market is quite small compared to other commodity markets like lets say copper, gold, or oil. In 2022 for example the world produced just under 140 million pounds of uranium. At today’s prices of around $100 per pound, that would make it a $14 billion market. But in 2022 the price was around half that, and of course there’s contract and spot market implications, but let’s just take half that figure of around $7 billion. Now that’s obviously peanuts compared to copper or gold, the markets for which are closer to $200 billion, or oil at close to $2 trillion.

So here we have one company that puts out earnings that make up around 10-15% of global output, and the changes in their production are really important for what that can do for price dynamics.

Okay, so on the surface, Cameco’s 2023 results were great.

Our own Smallcap Steve himself said as much in a tweet (or is it called an X now?) that he published minutes after the results came out.

Cameco sees Net Earnings up 151% on 39% revenue growth (EBITDA up 91%). $CCO.t $CCJ

— SmallCapSteve (@smallcapsteve) February 8, 2024

As a 35 year Uranium veteran told me yesterday, "there is nothing like a Uranium bull market." pic.twitter.com/MsLrmL2wiK

In terms of estimates, Cameco was a beat on revenue, but missed on earnings per share, or EPS. Analysts expected $815 million in revenue, and Cameco blew it out of the water with revenues of $844 million for the quarter, but was four pennies short on analyst expectations of a $0.25 EPS

For the full year, net earnings were up 151% on 39% revenue growth, while EBITDA jumped 91%.

But dig a little deeper, and the problems start to surface. Big problems.

Lets dive in.

Production Problems

Okay, so lets get into the juicy parts. First, Cameco has had some production problems.

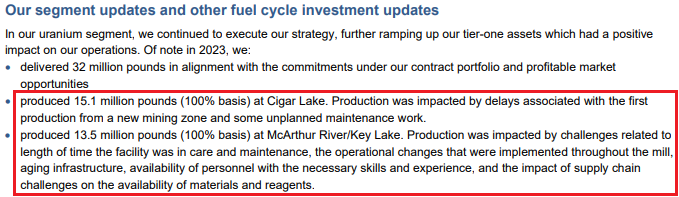

In September, after production wasn’t going as planned, Cameco was forced to cut its guidance from 20.3 million pounds of uranium produced in 2023, to 18.7 million pounds. And they still failed to hit that number, instead producing 17.6 million pounds.

Why? Aging infrastructure at McArthur River, a shortage of experienced operators, and unplanned maintenance work, among other issues.

And those production problems led to the company being forced to purchase uranium on the spot market to meet contractual obligations. In years past, a low uranium price meant this was generally fine for the company.

But a rising tide apparently doesn’t always lift all boats.

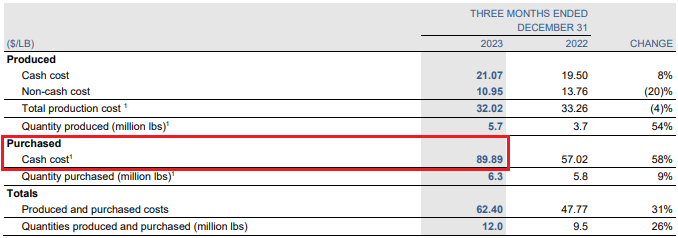

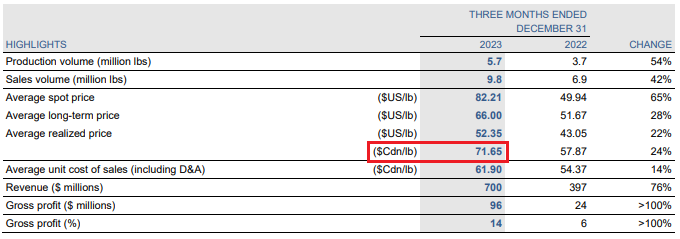

In the fourth quarter alone, the company produced 5.7 million pounds of uranium – and purchased 6.3 million pounds. The company on average purchased those pounds at C$89.89 a piece, while only generating C$71.65 in revenue.

There is some nuance here however, as the company has a joint venture with Kazatomprom, from whom they “purchase” uranium on a spot basis, but get a return via a dividend each year.

In reality, 2.8 million pounds were purchased off the spot market, at an average of C$105.74 a piece. Which is even worse.

The Guidance

And yet, things may not get much better.

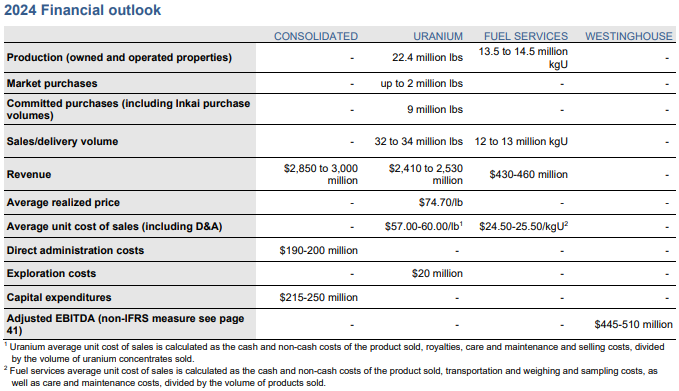

Cameco for 2024 is forecasting 22.4 million pounds of production – but their recent track record doesn’t inspire a lot of confidence in the ability to hit that number. Yet the company is slated to see sales of 32 to 34 million pounds of uranium in 2024 based on current contractual obligations. It has already committed to purchases of 9 million pounds, 4.2 million pounds of which are related to its Kazatomprom joint venture.

Cameco meanwhile expects to purchase up to 2.0 million pounds of U3O8 on the spot market – which continues to rally.

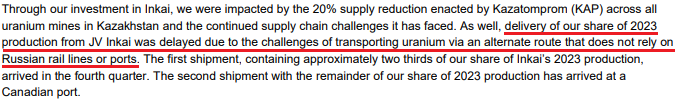

Oh, and we should probably note that that JV is unreliable in terms of actually getting their product out of Kazakhstan due to sanctions in place following Russia’s invasion of Ukraine.

And Kazatomprom is having production issues of its own, thanks in part to a shortage of sulfuric acid, leading the company to cut its production target midpoint from 65.5 million pounds to 57 million pounds for 2024 – with production also likely to have problems well into 2025.

Basically, it wouldn’t be shocking if they had to buy more product on the open market than planned. Nonetheless, Cameco is expecting to see an average realized price of $74.70 a pound – that’s Canadian dollars – while its unit cost is somewhere in the ballpark of $57 to $60.

Not exactly numbers to get you excited when uranium is above $100 a pound in US dollars.

The Price of Uranium

Lets touch on the price of uranium briefly.

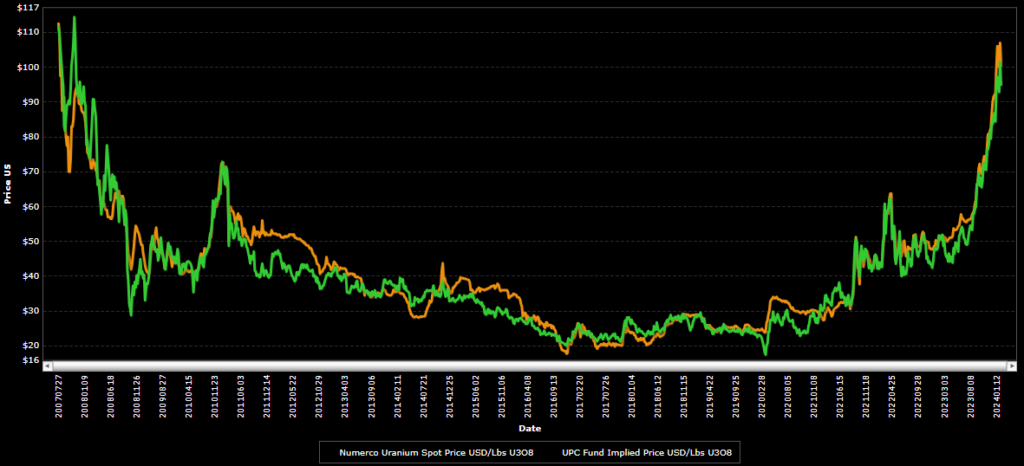

At the time of recording, its hovering just under $100 a pound after seeing a massive run that sent it as high as $107.

The price has been running following supply shortages and production shortfalls – particularly from Kazatomprom and now Cameco, along with high demand from investors who have been rabidly buying up Sprott’s physical uranium trust, which now holds in excess of 63 million pounds – or roughly 3 years worth of Cameco’s production.

Logically, investors think higher prices, higher income, which should translate to improved cash flows. Especially for the worlds second largest producer.

But that’s not the case.

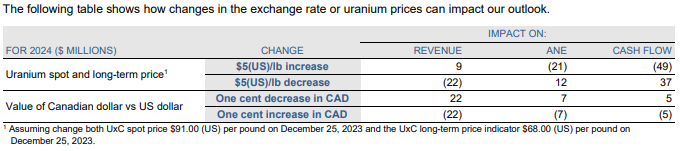

Cameco’s filings actually state that for every US$5 increase in the price of U3O8, it losses $49 million in cash flow. Yes, that’s right. The higher the price of uranium, apparently the worse it is for cash flows for Cameco. But at least revenues go up slightly.

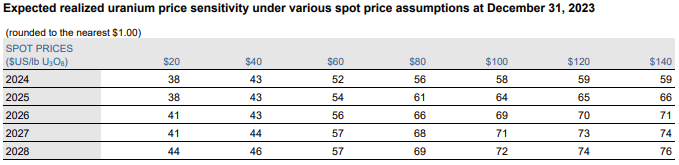

In fact, if uranium were to completely moon and go to $120 or beyond, Cameco expects to still take in about US$59 bucks a pound, thanks to its current contract portfolio.

They could always sell excess product at market prices, but their current guidance doesn’t really support that based on production and commitment levels.

Wrapping it up

Overall the quarter wasn’t that bad for Cameco. They beat revenue expectations and only had a slight miss on earnings per share. But there are some concerns that investors should be aware of.

We also have to tip our hat to Cameco, who leads the charge in the sector when it comes to writing financial statements and providing data for the industry as a whole. If you really want to understand the uranium world, Cameco’s MD&A is worth diving into.

Now look, Steve’s a degenerate small cap gambler, so he’s always looking for torque in the market. At the time of filming, the price of uranium dipped below $100 per pound – something many people in the uranium community told us would never happen. Still though, he’s a bull on uranium. Over time, Steve thinks the trade is going to pick up momentum, thanks in part to the Sprott physical uranium trust, which has jolted the price of the underlying commodity out of the range that it was stuck in for nearly a decade.

That being said, Cameco is the name to watch if you’re following the space and looking for data. How quickly they can bring product online, along with some other names like Kazatomprom, who has already reduced their guidance, are going to be key metrics to give us a glimpse into where the volatility may take us.

Fortunes were made in the last uranium run, and from what Steve can tell, we’re still in the early innings here. Many of the more “torque-y” plays still haven’t seen the types of runs one would expect given how the price of uranium has ran over the last three years, from under $30 a pound to over $100. In Steve’s view, the best bets will be the near-term producers, or the cashed up companies with great land packages that have the ability to take lots shots at lots of great targets.

But who knows. We aren’t financial analysts, and don’t claim to be.

Information for this briefing was found via Cameco, Sedar, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.