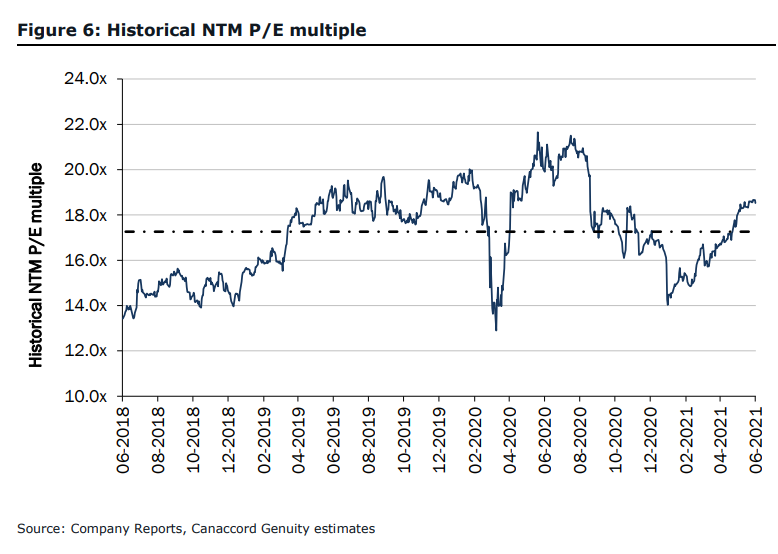

Ahead of Alimentation Couche-Tard’s (TSX: ATD.B) fiscal fourth-quarter results, Canaccord Genuity has downgraded the company from a Buy to a Hold, while reiterating their C$46 price target. Derek Dley, their analyst, says they are downgrading the name in anticipation of the next few quarters having hard year-over-year comparables. This is due to the extremely high fuel margins during COVID-19, now that oil has moved from the low teens all the way up to $72 dollars, margins have compressed.

Couche-Tard currently has 16 analysts covering the name, with a weighted 12-month price target of only C$47.49, or a 7% upside. Three analysts having a strong buy rating, seven have buy ratings and six have hold ratings. The street high sits at C$58.84, which comes from Arc Independent Research and the lowest sits at C$42.

Another reason for the downgrade is due to Couche-Tard’s M&A strategy. Dley thinks that their investor base is “nervously waiting”, and while previously investors would be willing to give a premium to Couche-Tard “for its ability to acquire and integrate larger c-store acquisitions,” the rumored Carrefour acquisition that started at the beginning of this year dropped that premium to near the all-time low around that time. Dley indicated he will remain cautious on the company’s M&A strategy until “the company addresses its long-term strategy.”

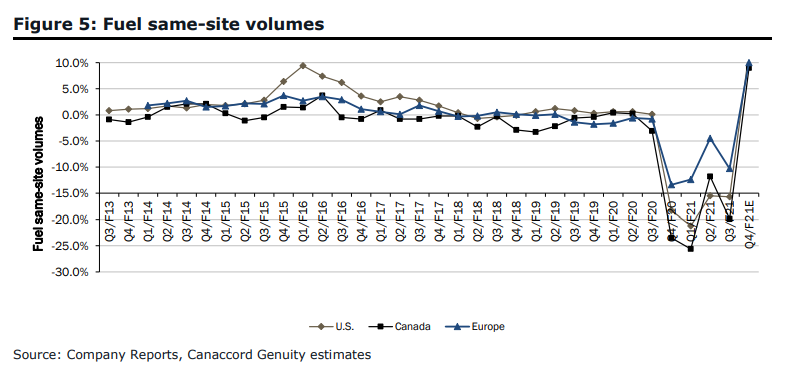

Although Canaccord believes that the company’s margins will get compressed, they believe that this quarter will show a reversal for fuel volumes as many countries are open or slowly opening and the summer months usually have higher fuel consumption. Below you can see their estimates for the full consumption per different countries.

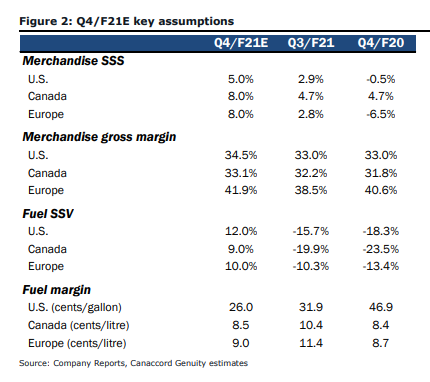

Below you can see Canaccord’s key assumptions for the fourth quarter.

Dley writes, “Given the challenging earnings backdrop Couche-Tard is facing over the next couple quarters, the cautious M&A thesis, and the fact the share price has bounced back to our target price following the sell-off earlier this year, we are comfortable moving to the sidelines.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.