On Thursday Snap Inc (NYSE: SNAP) reported its first-quarter financial results. The firm reported revenues of $1.07 billion, an increase of 38% year over year. The company also reported gross profits of $770 million, or a 61% profit margin, double the $357 million it reported last year. Though, the company reported its 17th consecutive operating loss, which came in at -$272 million.

The company said it saw its daily active users increase 18% year over year to 332 million. Daily active users increased in every single one of their segments, being North America, Europe, and Rest of World.

Snapchat has 45 analysts covering the stock with an average 12-month price target of $49.77, down from the average at the start of the year of $74.00. The consensus estimate represents a 67% upside to the current stock price. Out of the 45 analysts, 11 have strong buy ratings, 24 have buy ratings and the other 10 have hold ratings. The street high sits at $88, which represents an almost 200% upside to the current stock price.

In Canaccord Genuity’s note on the results, they reiterate their hold rating on the stock and lower their 12-month price target on Snap from US$46 to US$40 saying that the macro environment weighted on the company’s earnings and outlook. Though they do believe that investors are taking a cautious outlook on the company while the company’s “premium” valuation keeps them at a hold rating.

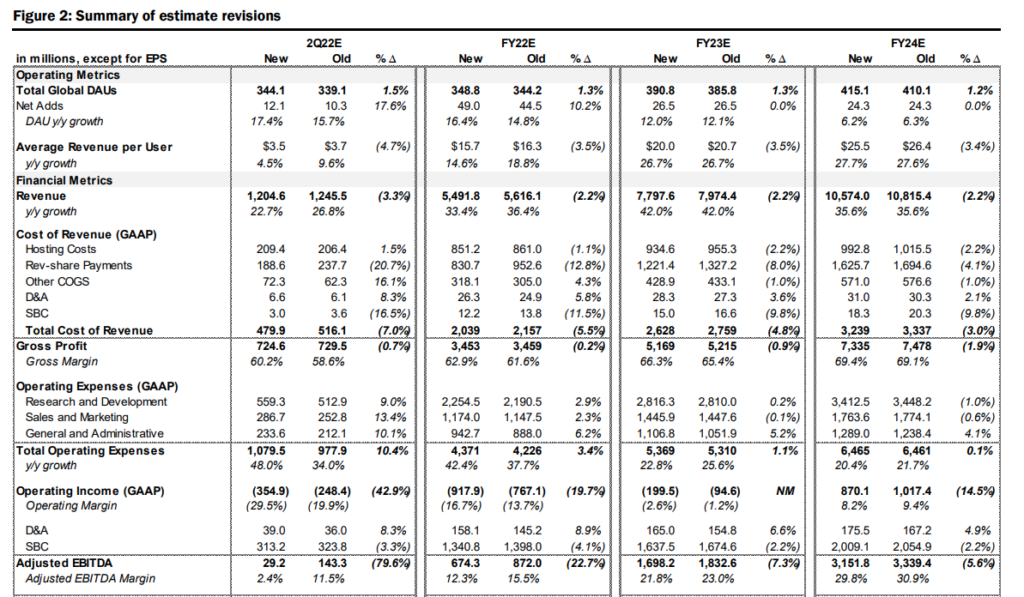

On the results, Snap slightly beat most of Canaccord’s estimates. They beat Canaccord’s total global daily active users estimate by 3.2 million, while beating revenue estimates by roughly $1 million. They add that the better than expected user growth came from ongoing momentum in the RoW region and strong content engagements.

The company continues to push advertisers to use its 1P measurement solutions though the company noted that many of its advertisers have paused campaigns following the Russia and Ukraine conflict. They say that this pause only lasted 10 days but has slightly slowed to +32% year over year.

Canaccord says that the backdrop/macro environment has put a headwind on the company’s stock as the business needs to now take into consideration a number of different items, such as supply chain disruptions, labor shortages, inflation, rising interest rates, and heightened geopolitical tensions.

As a result of these headwinds, Snapchat’s second quarter guidance was lower than expected. Snapchat now expects second quarter daily active users to come in at 343 to 345 million, with revenue of $1.18 to $1.23 billion.

Canaccord has now slightly increased their estimates on Snap, even with the lower than expected second quarter guide. They say they have raised their daily active users “slightly to reflect international momentum and strong content engagement.” Meanwhile they have slightly lowered their revenue estimates to account for the number of headwinds the company is facing.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.