Yesterday, Canaccord initiated coverage on PLBY Group (NASDAQ: PLBY) with a U$28 12-month price target and a buy rating. Austin Moldow, Canaccord’s analyst, believes this is the perfect time to “hope on an undervalued global brand,” and that Playboy is, “one of the most recognized yet undervalued brands in the world.” He adds that the company has transitioned from a solely media-focused company to now a consumer E-commerce and DTC company evidenced by the many licensing agreements signed over the last two years.

PLBY Group currently has four analysts covering the company with a weighted 12-month price target of $27.75. Two analysts have a strong buy rating and the other two analysts have buy ratings. The street low comes from Craig Hallum with a $25 price target.

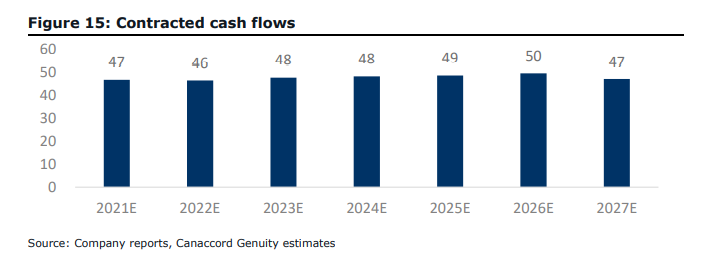

The first highlights Moldow makes is that PLBY Group has a “solid baseline” of future cash flows from its licensing agreements, which total $375 million, but expects that they ultimately exceed that number for a few reasons. The first one being that PLBY will see a healthy flow of contract renewals, and the second being that this $375 million number is the minimum, so any outperformance will generate a higher cash flow. The third and fourth reasoning go hand and hand, Moldow believes that the company will capture more market share of the total retail spend by expanding new SKU’s.

Moldow expects the direct-to-consumer revenue/segment to be the main driver of growth, with the DTC segment expected to grow 21% compounded annually through 2025. He notes that all revenue generated through this segment means direct revenue in the company as there are no license fees. This allows the company to capture a much better portion of the economics and have a higher revenue per unit sale otherwise. Moldow writes, “We believe the company will do this in a targeted and thoughtful way, to maximize revenue in categories where it has expertise but maintain the reach and benefits it gets through its partner licensing agreements elsewhere.”

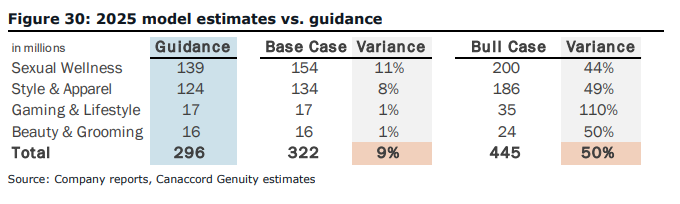

Below you can see Canaccord 2020 to 2025 revenue estimates broken down in two different ways. They are forecasting that the company grows revenues at ~17% compounded annually. Modlow calls the companies’ top-line estimates conservative.

You may notice that Canaccord has higher 2025 estimates than the guidance that PLBY has given recently. Even their base case beats guidance by 9%. This bullishness from Canaccord comes from them expecting an outperformance in Chinese apparel and an improved Yandy forecast.

Moldow says that the bull case, which has revenue in 2025 pegged at $445 million or 50% above guidance, is not unreasonable. He writes, “While we expect the company to steadily deliver singles and doubles over time, it would not be unreasonable if more opportunities came to fruition or the company achieved a few step-change type deals.”

They believe the Direct-To-Consumer revenue will contribute the majority of the growth over the years.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.