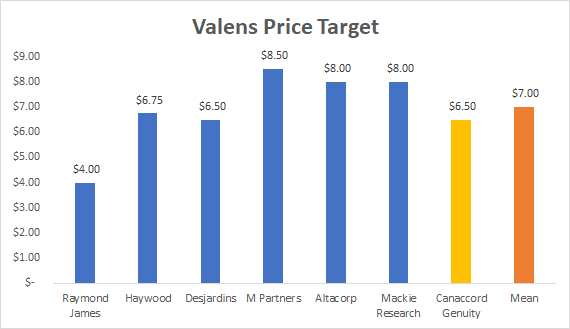

This morning Canaccord Genuity resumed coverage on The Valens Company (TSX: VLNS) with a C$6.50 price target and Speculative Buy rating, which is below the analyst estimate mean of C$7. However, the analyst is one of only two to have a strong buy rating on the company.

Canaccord sings high praise for Valens, stating the firm, “has amassed the most diverse manufacturing capabilities within the Canadian cannabis arena,” which Canaccord believes can be used and leveraged into a position of substantial market share in cannabis 2.0, a segment that Canaccord believes to have high medium to long term growth.

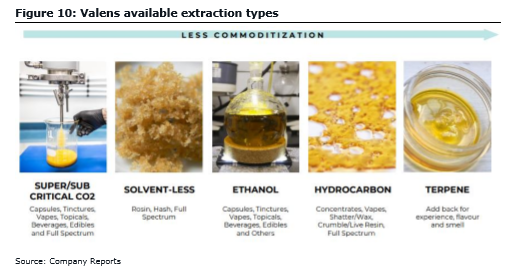

To support this argument, the analyst went as far as showcasing the array of extraction methods that Valens currently offers for third-party manufacturing. Currently, Valens has five different extraction types, which are 2-3 more than its competitors. Canaccord says that this diversity, alongside the ability to develop a full brand of products, sets Valens apart from its peers.

The firm then goes on to state that the international markets alongside many exciting developments make Valens a “Catalyst Rich” company. On the international development side, Canaccord says that with C$100m in cash plus the recent hires to find and identify asset purchases, Valens can make a big splash in the international markets. The other catalysts that Canaccord says could happen in the next 12 months include:

- White-label contracts

- EU-GMP Certification

- Accelerated growth in international markets

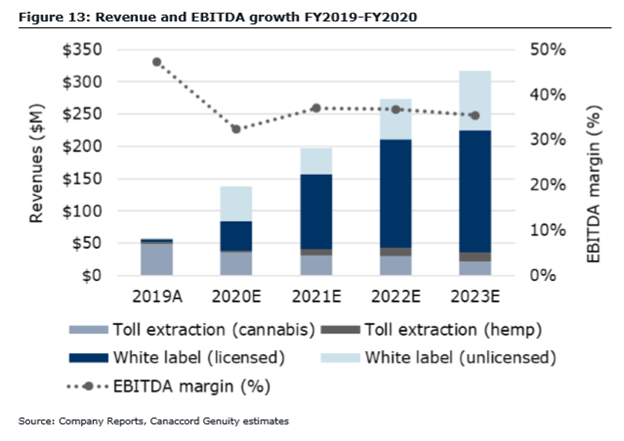

Canaccord predicts that Valens will more than double their FY2019 revenue, going from C$58.1m to C$139.9m, and will become net income positive at the end of FY2020 with net income coming in around C$5.9m. The firm then sees Valens increasing their revenue by 40% to C$200.5m in FY2021, becoming free cash flow positive which will continue into FY2022 with a further revenue increase of ~38% to C$276.5m, which from FY2019 is an almost 400% increase.

Information for this briefing was found via Sedar and The Valens Company. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.