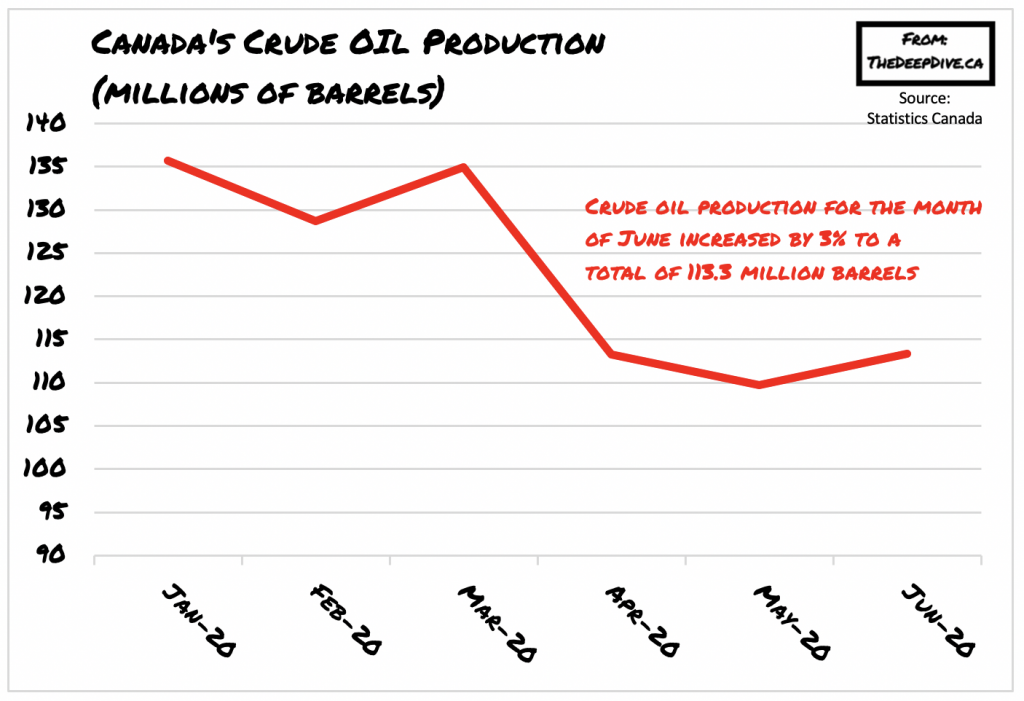

It appears that crude oil production in Canada has been on a slight rebound since May, increasing by 3% according to the latest Statistics Canada data. However, given the continued volatility in the global oil market, clear skies are not yet evident for Canada’s embattled oil industry.

Crude oil production for the month of June reached 113.3 million barrels, amounting to a 3% increase from May’s low of 109.7 million barrels. Compared to February levels however, Canada’s production still remains nearly 12% lower. In the meantime, imports of crude oil also saw an increase of over 16% since the prior month totalling to 17.9 million barrels, but are still more than 22% below February’s pre-pandemic levels. Lastly, crude exports suffered a decline of 6% in June after rebounding slightly between April and May.

Although much of Canada’s economy has been making progress in the recovery phase, the country’s oil sector appears to remain relatively stagnant. As the global demand for oil has yet to show a sign of a potential rebound, many investors have been dumping their energy assets. On Tuesday, Brent crude, which serves as the world’s benchmark slumped to under $40 per barrel, the lowest it has been since June. The sudden decline in oil prices comes as investors are becoming increasingly worried about the mounting supply of oil that has yet to find a destination.

As the summer driving season comes to an end following the Labour Day weekend, the forthcoming demand for fuel will most likely see a contraction. Likewise, the continued increase in infection rates, especially in the US, is causing the demand for air travel to be significantly below pre-pandemic levels. In fact, the evident sluggishness in the global demand for crude oil has even caused Saudi Arabia to cut back its official selling price to the US and Asia as a bid to entice buyers.

As a result of Saudi Arabia’s defacto market signal, investors have begun to ease out of previous crude oil speculative bets. According to Neuberger Berman energy analyst Jeff Wyll, investors have been flocking to sell their oil stocks, causing a cascade of sell orders to ensue. This sort of behaviour suggests that the oil market will most likely continue to suffer going into the fall season, or at least until a viable coronavirus vaccine becomes readily available.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.