Business insolvencies in Canada are on the rise, but the numbers might not be painting a full picture of the situation deemed worse.

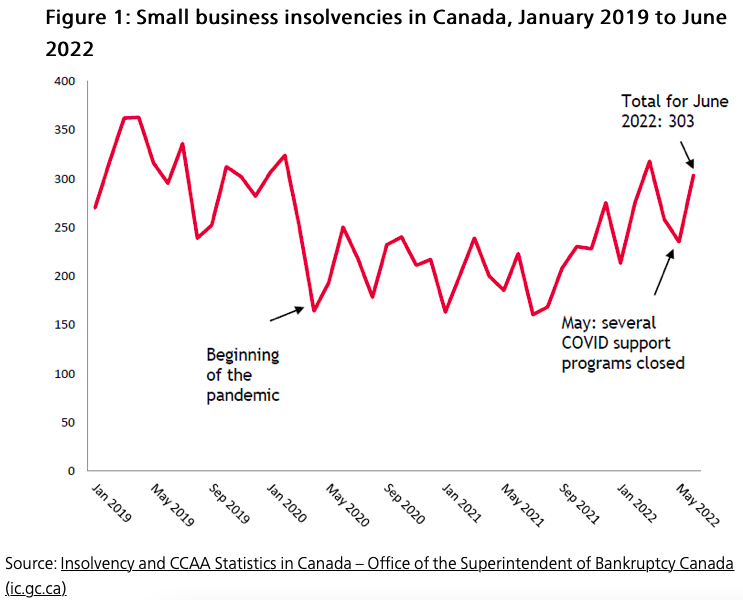

In the latest report by the Canadian Federation of Independent Business, the total number of insolvencies rose by 19.1% in July 2022 from the year-ago period. But the organization also cited the huge percentage of the enterprises who would rather stop operations abruptly than go through the bankruptcy process, obfuscating the extent of the widespread business closures.

“Bankruptcy is not the first thing business owners think about when they can no longer keep their doors open. For nearly half of small business owners who think they will have to shut down in the near future, their first choice is to just wind down without going through the bankruptcy process,” the report read.

In June 2022 when total insolvencies–both completed filings and submitted proposals for bankruptcy–rose 20.1% from the previous year and 6.4% from the previous month, it was figured that the numbers “[do] not measure the full scope of the problem.”

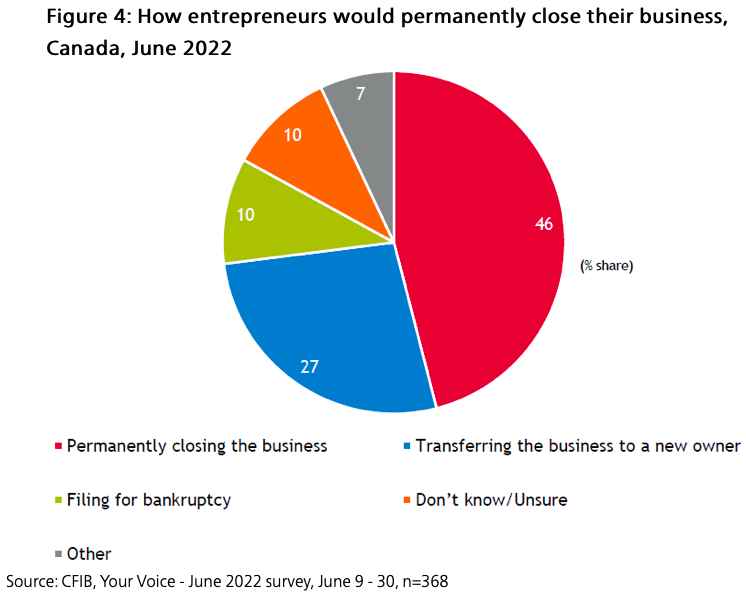

“In a recent CFIB study, only 10% of the businesses considering bankruptcy or closing would most likely do it by filing for bankruptcy,” the report cited. Some 46% would choose to permanently close straight down the business without the bankruptcy process.

In essence, with June 2022 recording 303 insolvency cases, there are around 1,393 business who could have closed down their operations without going through the bankruptcy process.

The rise in insolvencies is a compounded result of a number of factors, mainly the lasting effects of the pandemic and the wind down of several federal support programs.

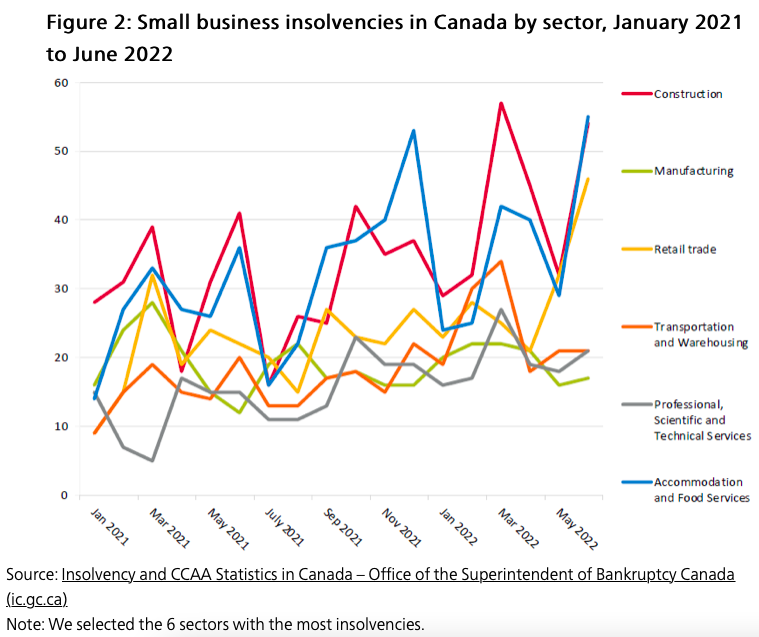

Based on the report, the most affected industries include accommodation and food services, construction, and retail trade.

Also based on the report, around 17% of Canadian businesses are actively considering bankruptcy or winding down their operations in June 2022–practically unchanged from January 2022’s 14% and January 2021’s 16%.

Some 54% are still generating revenues below the pre-pandemic level while 62% still carry unpaid pandemic debt.

The organization is making recommendations to address the rising business insolvency rate like increasing the forgivable portion of government loans, extending repayment deadlines, giving tax breaks, and eliminating credit card fees for small businesses.

“Governments need to decide whether they will make the problem worse by raising taxes or take immediate actions to keep many businesses from disappearing for good,” said CEO Dan Kelly.

Information for this briefing was found via Canadian Federation of Independent Business and the Trail Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Pay attention, kids: you never actually have to lose at capitalism if you know how to cry to the government for a handout.