New home prices across Canada aren’t showing signs of increasing, in the latest indication that the Bank of Canada’s aggressive tightening cycle is cooling housing markets across the nation.

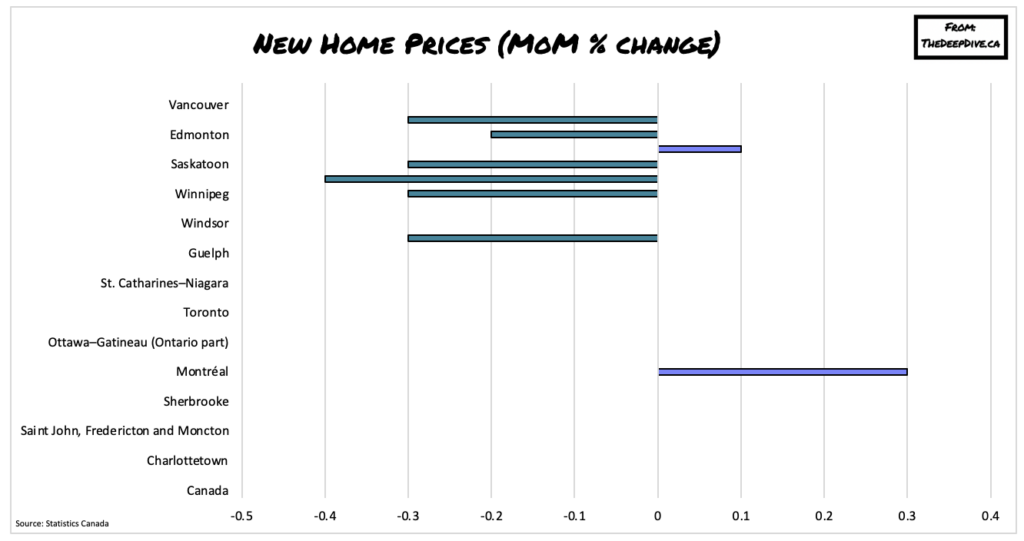

Latest Statistics Canada data shows that the price of a new home across 19 of the 27 census metropolitan areas remained unchanged between November and December, following three consecutive months of declines. Prices fell the most in Regina, alongside declines in Winnipeg, Kelowna, and Edmonton, as builders reported weakening housing market sentiment. Conversely, new home prices rose in Montreal and Calgary by 0.3% and 0.1%, respectively, last month, as increased demand and higher building costs offset rising mortgage rates.

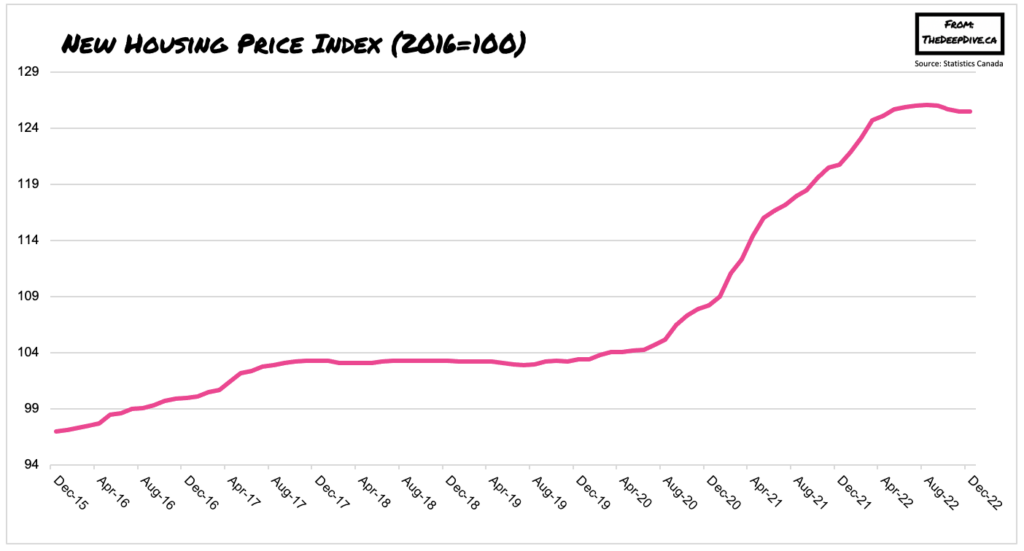

Nationally, the price of a new home rose 7.7% from December 2021, marking a deceleration from the 10.3% annual increase noted the year before. New home prices accelerated rapidly in the beginning of 2022, rising 2.5% in the first quarter thanks to ultra-low interest rates. Prices continued increasing into the second quarter as homebuilding costs rose, before eventually subsiding in response to rising interest rates.

With the central bank’s overnight rate now sitting at 4.25% compared with 0.25% at the beginning of 2022, the pandemic-fuelled demand for housing subsided, causing new home prices to fall 0.4% between July and December across the country. However, some CMA’s were more robust in the face of tightening monetary policy, including Calgary, where the price of a new home rose 16.3% in the first half of 2022, compared to a 9% increase during the same period one year prior.

Going forward, Statistics Canada noted that it expects new housing prices will continue to cool during the first half of 2023 at least, mostly due to elevated borrowing costs and declining lumber prices. However, come the second half of the year, housing prices could pick up momentum as mortgage rates stabilize and increased immigration drives the demand for housing upwards.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.