Despite a rapid tightening of policy with more to come from the Bank of Canada, latest CPI figures show there is still a lot more that needs to be done before inflation falls to the 2% target range.

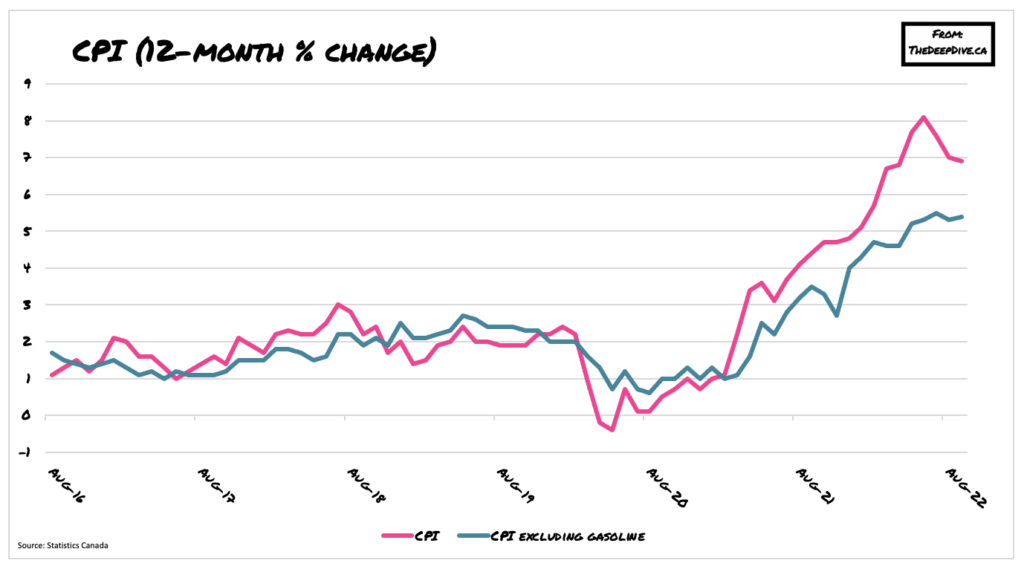

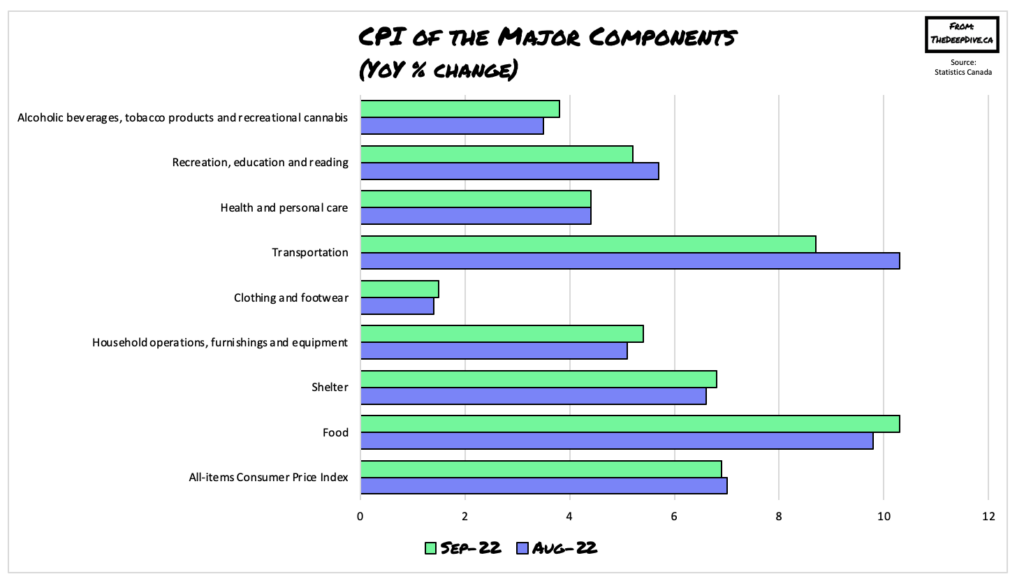

Following an August print of 7%, headline CPI decelerated to an annualized 6.9% last month, largely due to a decline in gasoline prices. On a month-over-month basis, though, inflation rose 0.1% in September, while core inflation— which does not account for gasoline prices— rose 5.4% over the past 12 months following August’s gain of 5.3%, as Canadians continued to pay substantially more for groceries.

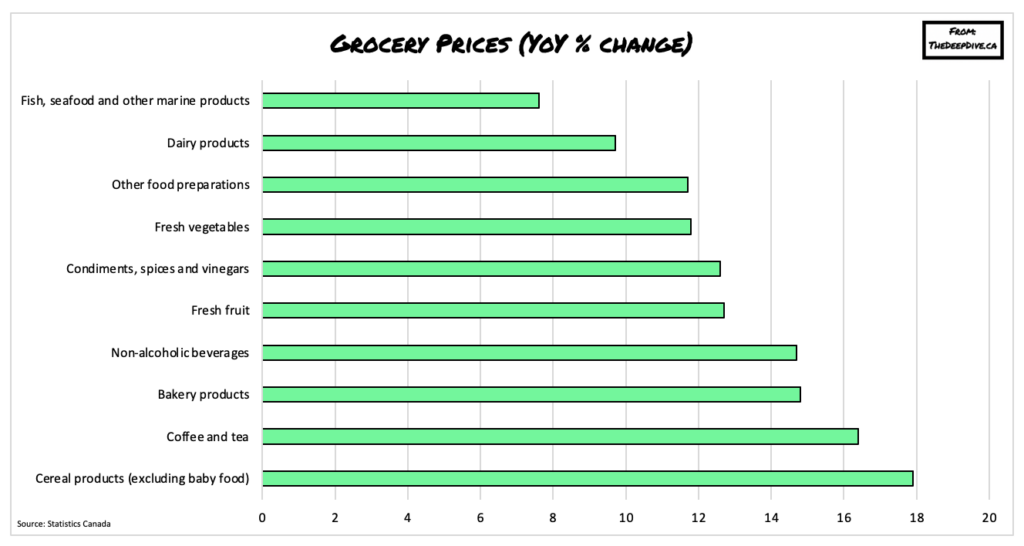

Much of September’s decline was due to a drop in gasoline prices, which fell 7.4% following a decline of 9.6% in August thanks to a boost in the global oil supply. Compared to last year, however, Canadians still paid 13.2% more at the pump. What is more alarming, though, and indicative that the Bank of Canada’s rising interest rates have yet to affect underlying price pressures, is the persistent rise in grocery costs. Last month, consumers paid 11.4% more for food purchased at stores, marking the sharpest year-over-year pace since August 1981 as the category continues to rise at a faster pace than overall CPI for 10 straight months!

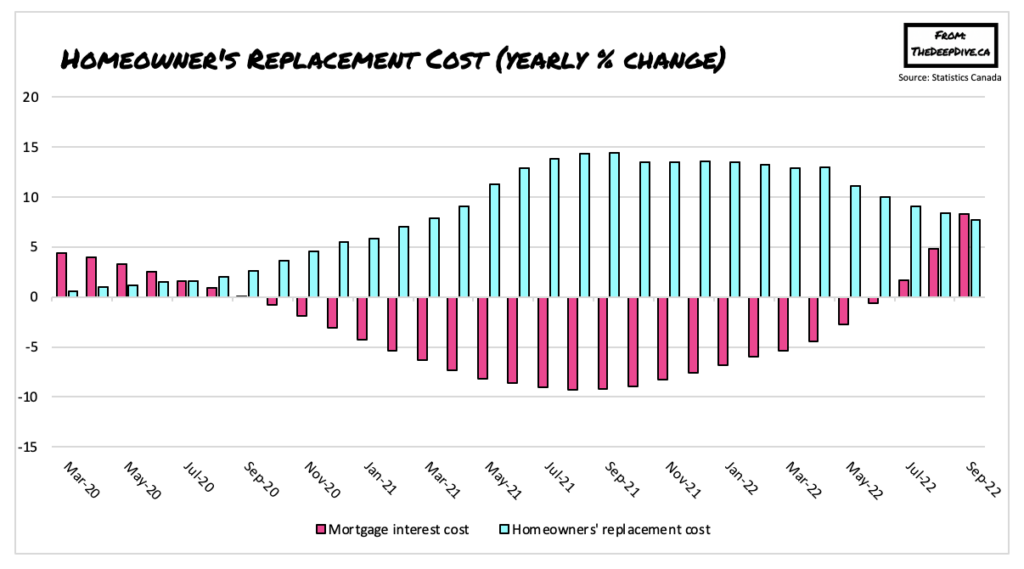

With interest rates rapidly on the rise in response to the evidently persistent inflation, the Mortgage Interest Cost Index also exacerbated significant upward pressure on CPI, rising 8.3% year-over-year. The homeowners’ replacement cost index, which is linked to the price of new homes, decelerated in September to 7.7% following an increase of 8.4% in August, suggesting that Canada’s housing market is cooling off.

Meanwhile, average hourly earnings increased 5.2% from September, showing that on average, the rapid and persistent rise in prices continues to outstrip Canadians’ pocketbooks. Get back to work Bank of Canada!

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.