Cannabis stocks are having a major red day on the markets, following the results of yesterdays election in the United States. The strong decline is believed to be related to a mix of recreational amendments failing along with the failure of the Democrats, who are traditionally more open to legalization, to secure any major wins in the race.

Most impacted by the results is Trulieve Cannabis (CSE: TRUL), who is the largest loser on the Canadian markets today. The company, who spent nearly $145 million on attempting to get Amendment 3 passed in Florida, has declined by 37% on the day, following the amendments failure to secure the required 60% approval to pass.

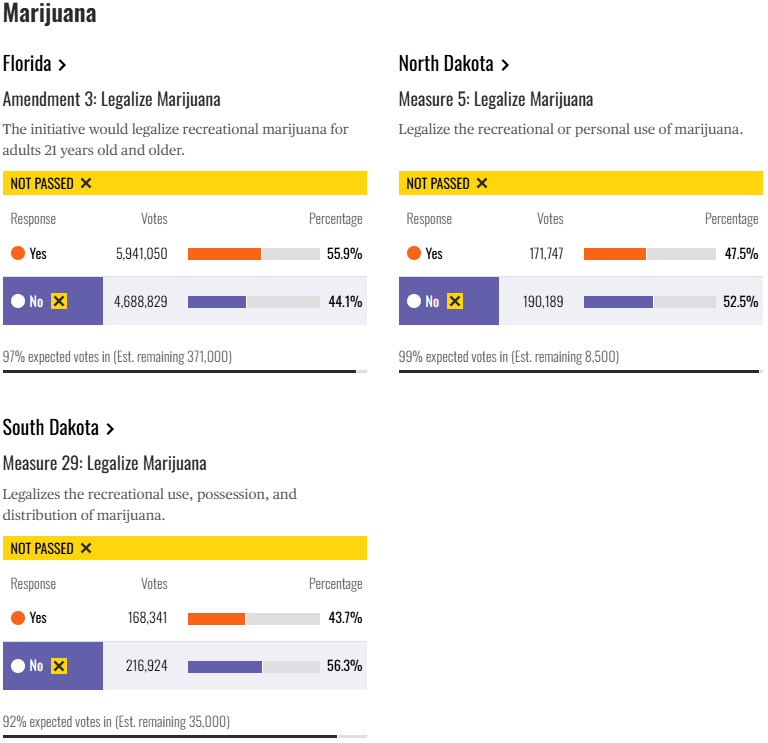

The amendment, while supported by a majority of voters at 55.9%, failed to hit the required threshold for passing. Had it passed, it would have enabled recreational legalization to occur in the state of Florida.

This failure in Florida is believed to be the driving force behind the decline in the AdvisorShares Pure Cannabis ETF (NYSE: MSOS), which is currently down 27% on the day.

Viewed as a bellwether for the entire cannabis sector, the decline in the ETF is blamed for the massive declines seen across the board.

The performance of other equities involved in the cannabis space include:

- The Cannabist Company (NEO: CBST): -25%

- Curaleaf Holdings (TSX: CURA): -24.6%

- TerrAscend Corp (TSX: TSND): -20.7%

- Ascend Wellness (CSE: AAWH-U): -20.2%

- Cresco Labs (CSE: CL): -19.6%

- Verano Holdings (NEO: VRNO): -19.5%

- Planet 13 Holdings (CSE: PLTH): -19.0%

- Green Thumb Industries (CSE: GTII): -18.4%

The losses also extend to Canadian cannabis operators, with Canopy Growth (TSX: WEED) presently down 21.5%, and Aurora Cannabis (TSX: ACB), whom reported earnings this morning, down 18.1%. The trouble for cannabis equities moving forward, is the lack of a positive catalyst on the horizon, with the potential rescheduling of cannabis to a Schedule 3 drug having no definitive date at this time.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.