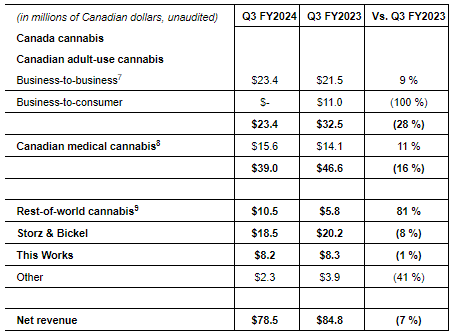

Canopy Growth Corp (TSX: WEED) this morning reported falling revenues on a year over year basis, primarily the result of the sale of its retail operations. Revenues fell by 7% in the third quarter, down from $84.8 million to $78.5 million for the period ended December 31, 2023.

Excluding the impact of the retail exit, revenues improved by 6% during the quarter, and were an improvement over the $69.6 million reported in Q2 2023. The cannabis segment overall accounted for $39.0 million in revenue, while rest of world cannabis amounted to $10.5 million.

Gross margins improved slightly to 36%, or $28.2 million, however the company has failed to achieve any left of profitability, with total operating expenses amounting to $88.5 million. Expenses included selling, general, and administrative expenses of $54.4 million, along with $30.4 million in impairments.

After other expenses of $171.0 million, Canopy reported a net loss of $216.8 million, an improvement over the $264.4 million loss recorded in the year ago period. Adjusted EBITDA meanwhile came in at a loss of $9.0 million, while free cash flow was negative $34 million.

Cash and short term investments meanwhile stood at $186 million at the end of the quarter.

READ: Canopy Growth Records Another Huge Loss With Sale Of This Works

“This is the dawn of a new era at Canopy Growth. We’re singularly focused on cannabis and demonstrating growth across all of our business units. With our Canopy USA strategy now moving forward, we expect to be the first and only U.S. listed company offering shareholders a unique opportunity to gain exposure to the fastest growing cannabis market in the world,” commented CEO David Klein on the results.

Canopy Growth last traded at $5.56 on the TSX.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.