Canopy Growth Corp. (TSX: WEED) reported its fiscal Q4 and full-year 2023 financials last night, topbilled by a quarterly net revenue of $87.5 million, down from Q4 2022’s $101.8 million as restated.

For the full year results, annual net revenue came down to $402.9 million, also a decline from last year’s $510.3 million as restated.

CEO David Klein put a positive spin on the results, saying that 2023 “was a transformational year for Canopy Growth.”

“[In 2023], we began to implement a comprehensive strategy to accelerate our path to profitability, and position our business to realize the tremendous opportunities ahead. Our actions are already yielding results and we expect to realize significant benefits from our cost reduction program in Fiscal 2024,” he said in a statement.

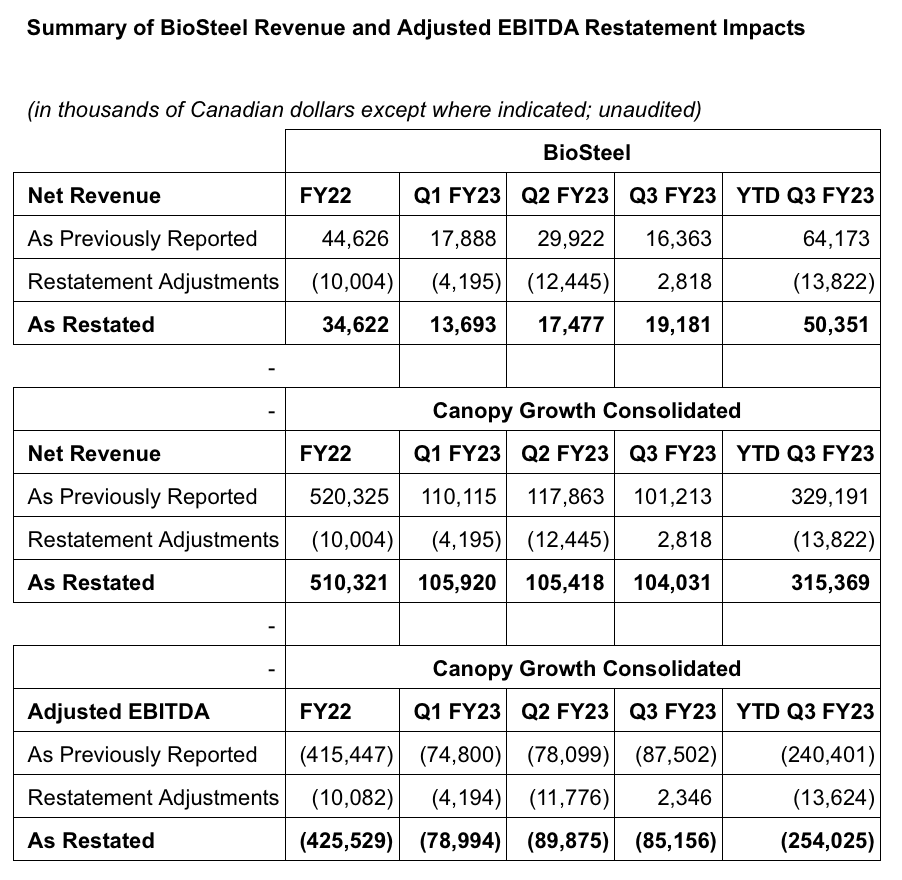

The 2022 financials were forced to be restated as the company reportedly “identified certain trends in the BioSteel Sports Nutrition” business unit, which identified that there were “material misstatements” resulting in “a decrease of approximately $10 million in net revenue for FY2022.”

“As a result of the review, we are continuing to implement several remedial actions, including management changes and appropriate personnel actions. The Company is also considering all legal options that may be available in connection with the associated overpayment made in FY2023 to the minority shareholders of BioSteel as a result of the overstatement of revenues,” the company said.

The misstatement led the company to be a subject of an investigation by the Securities and Exchange Commission and an informal inquiry by the Ontario Securities Commission.

After cooking the books on BioSteel revenue by $25M for the last 2 years, Canopy is now under SEC investigation!

— SmallCapSteve (@smallcapsteve) June 22, 2023

A once darling 24 billion dollar Canadian capital market story, now a penny stock.

And we wonder why no one wants to invest in Canadian stocks anymore? $CGC $WEED pic.twitter.com/78mSj5zG8p

Gross margin in the fourth quarter came in at a loss after the firm recorded a higher cost of goods sold over its revenue, with Q4 yielding a gross loss of $90.5 million. For the year, gross loss is at $104.1 million.

Total operating expenses are also higher than the revenue, recording $514.2 million in Q4 and $2.74 billion in 2023. Selling, general and administrative expenses alone have exceeded the topline figure, notching $104.3 million in Q4 and $456.2 million in 2023.

The huge jump in expenses, however, was driven by asset impairment and restructuring costs–$405.1 million in Q4 and $2.26 billion for the fiscal year.

Earlier in February, the company announced it is undergoing a “Canadian business transformation plan,” which entailed closing its 1 Hershey Drive facility and job losses for roughly 60% of the corporation.

The increase in expenses led the firm to end the quarter once again with a net loss of $640.1 million, a decline from last year’s $582.5 million. This translates to $1.28 loss per share.

For the fiscal year of 2023, total net losses came in at $3.28 billion, a huge decline from 2022’s $310.0 million net loss.

In Q4 2023, the adjusted EBITDA loss landed at $95.6 million, compared to Q4 2022’s $131.9 million. The full-year 2023 adjusted EBITDA loss improved to $349.7 million from last year’s $425.5 million, which the firm attributes to higher gross margins, reduced operating expenses, and a $64 million decrease in COVID-19 relief payments.

It really can't be understated just how awful the $CGC $WEED earnings are.

— The Deep Dive (@TheDeepDive_ca) June 23, 2023

-Cost of goods sold higher than revenue

-SG&A higher than revenue

-Impairments of $2.3 BILLION for the year

-Net loss of $3.3 billion for the year

Yet somehow the CEO was compensated $6.5 mil in 2023. pic.twitter.com/0kBS2GzZwN

For fiscal 2024, the company expects to achieve breakeven to positive adjusted EBITDA in all of its businesses, with the exception of BioSteel.

The declines in financial performance are in contrast to the reported compensation for the firm’s chief. Klein reportedly earned nearly $6.5 million for fiscal year 2023, up from last year’s $4.5 million.

Total Compensation of David Klein, CEO of $CGC:

— WeedStreet420 (@WeedStreet420) June 22, 2023

2023: $6,459,521 💰

2022: $4,541,890 💰

2021: $2,793,688 💰

Net Losses:

2023: -$3.3 billion 📉

2022: -$320 million 📉

2021: -$1.7 billion 📉

Stock Performance:

-98.6% since 2021 📉 pic.twitter.com/KnaZ5fg5M4

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.