FULL DISCLOSURE: This is sponsored content for Carlyle Commodities.

Phase two drilling has begun at Carlyle Commodities’ (CSE: CCC) flagship Newton Gold project in British Columbia.

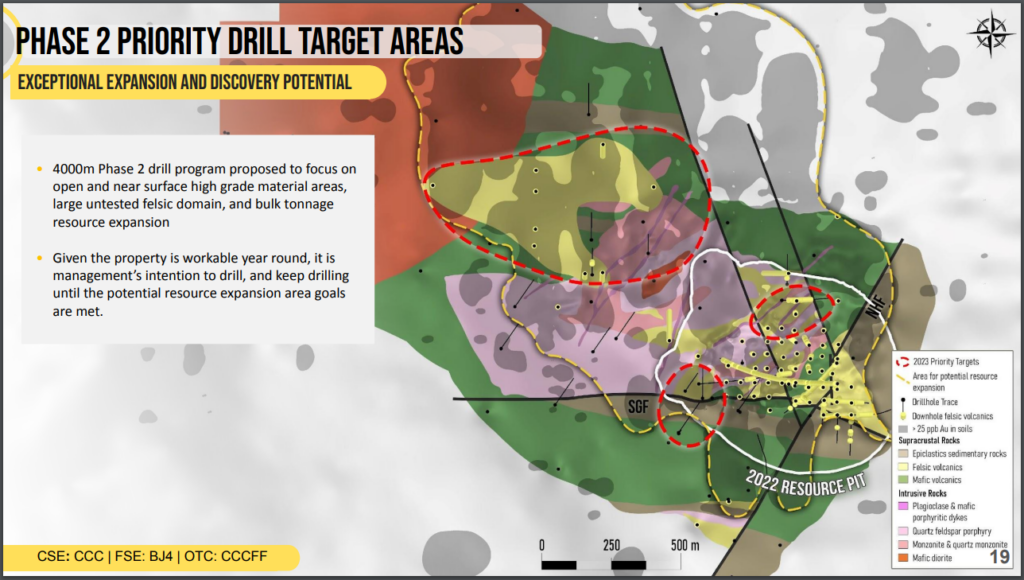

The program aims to expand the current inferred mineral resource for the Newton Project, which currently sits at 861,400 ounces of gold and 4.68 million ounces of silver at 0.63 g/t gold. Near surface targets are the priority for drilling, with those targets including geochemical anomalies, open mineralization, and mineralized volcanic and intrusive rocks.

The bulk tonnage low sulphide epithermal system identified at Newton has been to date drill tested across an 800 metre by 400 metre footprint, and is defined to a depth of 500 metres, although most holes haven’t exceeded 300 metres. The resource has been defined by nearly 35,000 metres of drilling, and it sits atop a large IP anomaly that measures 4,000 metres by 2,000 metres, meaning the resource covers just 7% of the anomaly.

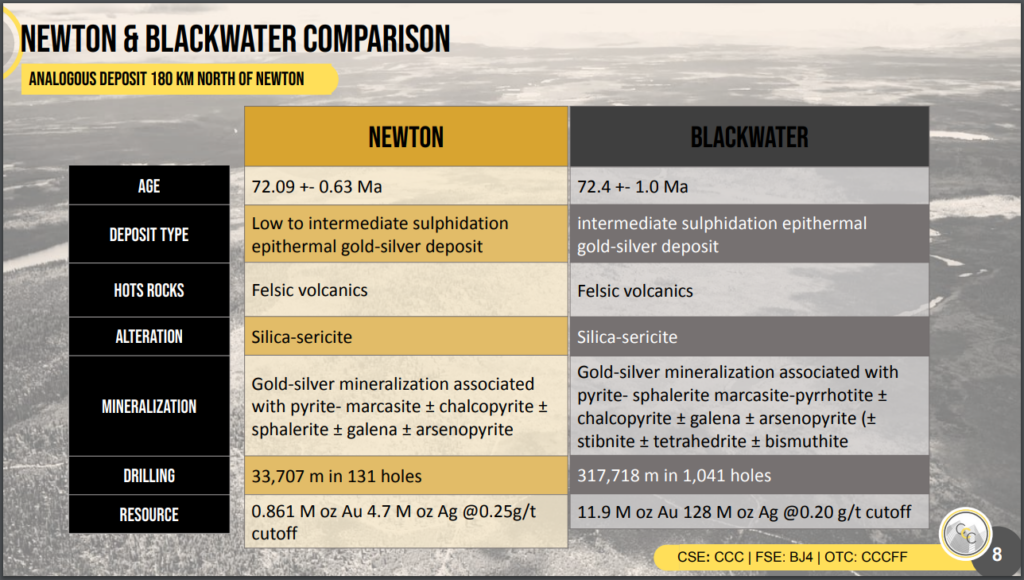

Mineralization found at Newton is said to be similar to the nearby Blackwater Gold project being developed by Artemis Gold, which contains a resource estimate of 11.7 million ounces of gold and 122 million ounces of silver.

READ: Carlyle Commodities Releases Drill Strategy For Phase Two Program

“The Company is feeling optimistic with its phase 2 drill strategy considering the various high priority targets we have available to test. A potential new discovery zone northwest of the current inferred NI 43-101 mineral resource calculation boundary is of keen interest, and timing of the current overall macro environment for gold only increases our enthusiasm for this program,” commented CEO Morgan Good.

The company has previously indicated that the program will consist of up to 1,500 metres of drilling, which is set to occur across seven holes at depths of up to 200 metres each. The company intends to expand the program once work is underway.

Carlyle Commodities last traded at $0.13 on the CSE.

FULL DISCLOSURE: Carlyle Commodities is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Carlyle Commodities on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.