South African bonds faced further declines on Tuesday, as concerns grew over the government’s ability to meet revenue targets, potentially forcing an increase in bond issuance within an already saturated market. The warning was issued by South African Revenue Service Deputy Commissioner Johnstone Makhubu, following last week’s alert from the National Treasury regarding a budget deficit and the need for government departments to cut spending.

Tax revenue for the year through August only saw a 2.6% increase compared to the budgeted 6%, largely due to power outages affecting economic output, as reported by Business Day newspaper.

Bond yields have been on the rise since February, when the government hinted at increased borrowing to support a debt-relief plan for Eskom Holding SOC Ltd., the struggling state-owned electricity company. The South African Reserve Bank has also cautioned that the domestic market is nearing its capacity to absorb more debt.

Rashaad Tayob, the Head of Fixed Income at Foord Asset Management, commented, “The consistent supply of bonds to the market is overwhelming demand. In recent years, allocations to bonds have increased materially across income and multi asset funds, pension funds and banks. Capacity to increase is now limited.”

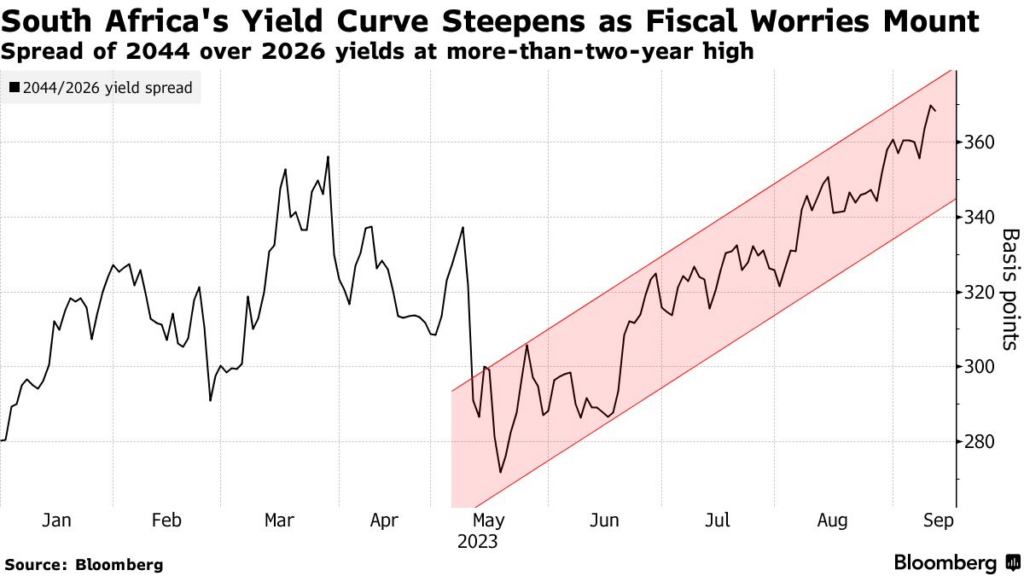

On Tuesday, yields on 2044 bonds climbed by four basis points to 12.73%, marking the highest closing level since July 2. The spread over the 2026 yield also widened this week to 370 basis points, the largest in over two years.

The medium-term budget statement scheduled for November 1 is expected to reveal ongoing weaknesses in government finances, high debt projections, and elevated deficits as a percentage of GDP, exacerbated by the country’s sluggish economic growth. Investec Chief Economist Annabel Bishop anticipates that the deficit estimate may be revised upward to “closer to 5% of GDP,” compared to the February budget estimate of 4%.

Nolan Wapenaar, Chief Investment Officer at Anchor Capital, remarked, “Questions are being asked about domestic corporate tax collection and what a believable national budget will be for 2024. At this stage, it is clear that there will be a significant revenue shortfall.”

In a letter addressed to government departments last week, the Treasury emphasized that the expenditure ceiling set in the 2023 budget would remain unchanged, with no additional resources available. Existing baseline budgets would be adjusted downward to accommodate the funding shortfall.

However, curbing spending poses a challenge for South Africa’s governing African National Congress, especially with elections looming next year and polls suggesting a potential loss of its national majority for the first time since 1994. Additional fiscal pressures include a larger-than-budgeted pay increase for government employees and demands to extend Covid-era social security grants.

According to Wapenaar, South Africa has limited room to increase debt issuance, and there are already signs of government debt crowding out other borrowers and hindering the broader economy.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.