Today we go back to 2015 when Yale University first collected interest from an almost 400-year-old bond written in goatskin. The tale was invoked recently by the Financial Times in its story on bonds and how the bond market will shape the next financial crisis.

Yale University collected an interest payment on a 375 year-old bond, originally issued to Dutch dike-builders in 1648. https://t.co/PnGX9pb1oU pic.twitter.com/SuzFy3FKDg

— Wessie du Toit (@wessiedutoit) August 3, 2023

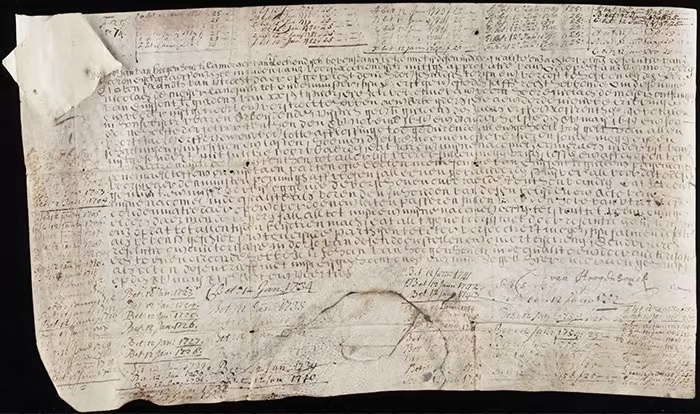

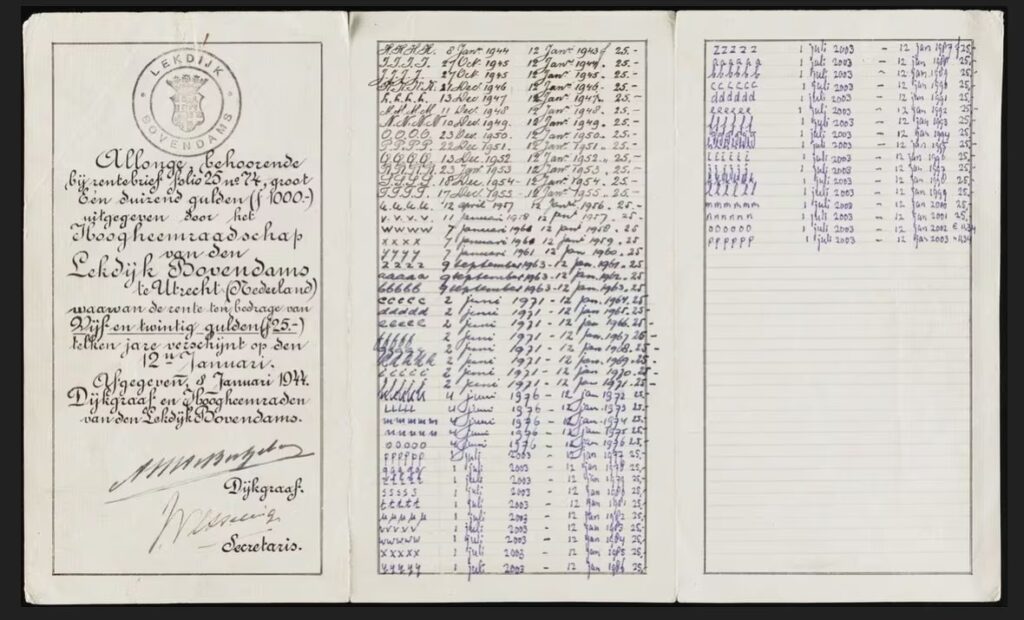

The story goes that in 1648, the Netherlands embarked on civic projects, including pier reconstruction, financed by a 1,000 guilder bond issued by the Dutch Water Authority, valued around $500 back then, inscribed on goatskin.

Beyond its historical value, the bond is transferable with perpetual interest. Yale University acquired the bond in 2003.

Timothy Young, Beinecke Rare Book and Manuscript Library’s curator at Yale, notes the bond’s enduring relevance. Various owners have benefited from the interest over centuries. Young’s research traced the Dutch Water Authority de Stichtse Rijnlanden as the contemporary successor to the original issuer. Upon contacting them, they confirmed their commitment to honoring the bond.

With the modest €11.34 yearly payout, Young humorously acknowledged its limited financial impact but emphasized the bond’s educational significance. He referred to it as an “archival paradox,” defying typical archival practices due to its continued relevance. Cataloging the bond posed a unique challenge, as it straddles the line between archival and active documents.

In Young’s view, the bond remains a valuable teaching tool, showcasing a financial instrument that retains viability even after almost four centuries.

Ray Dalio, founder of Bridgewater, the world’s biggest hedge fund, believes as much. “The bond market is the most important market in the world,” he said. “It is the backbone of all other markets.”

Information for this story was found via The Financial Times, CBC news, Twitter/X, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.