Jericho Energy Ventures (TSXV: JEV) is set to split its operations in two, with the firm this morning announcing a plan to spin out its hydrogen assets into a new company, referred to as Hydrogen Technologies Corporation.

The spinout will result in the division of its oil assets and its hydrogen assets into two separate entities, enabling the businesses to operate with two distinct strategies and investment plans. Shareholders of Jericho are expected to receive shares of the Hydrogen spinout at an as-of-yet undetermined ratio, with further details to be released via a management information circular.

“By separating our hydrogen platform, we can create two agile, focused companies. This will allow each to pursue its strategic objectives independently and position them for long-term growth and success. We believe JEV shareholders will benefit from the distinct growth opportunities in both the hydrogen and oil & gas sectors, with each company committed to maximizing value within its industry,” commented Brian Williamson, CEO of Jericho.

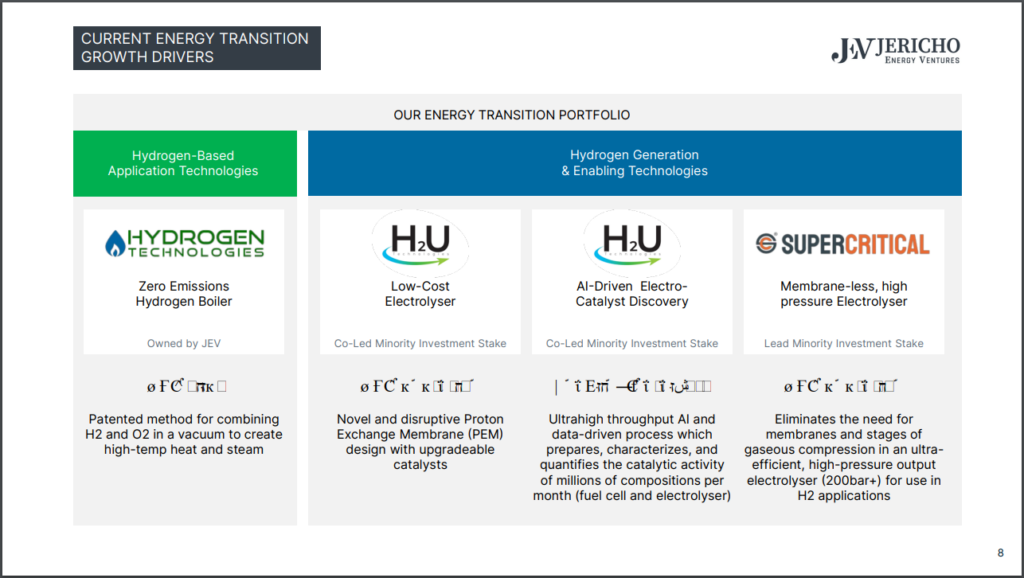

Jericho’s hydrogen assets currently include the subsidiary Hydrogen Technologies, which includes tech for a zero emissions hydrogen boiler, as well as minority investments in H2U, which has developed a low-cost electrolyser and an AI-driven electro-catalyst for use in fuel cells, as well as in Supercritical, which has developed a membrane-less high pressure electrolyser.

It’s oil and gas assets meanwhile consist of 61 active wells, which produce on average 305 BOPD and 1,959 MCFD in Oklahoma. The company currently holds claim to 41,000 acres in the region, and boasts proven reserves of 1,630 Mbo, 2,533 MMCF, and 325 Mbbls NGL.

Jericho Energy last traded at $0.135 on the TSX Venture.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.