CanAlaska Uranium (TSXV: CVV) is the hot ticket in the market today, with the equity currently up 43% on 9.84 million shares trading following some preliminary results that were released for its West McArthur Property, which is found in the Athabasca Basin of Saskatchewan.

The company this morning released what is referred to as radiometric equivalent uranium grades for drill hole WMA082-4, which means the results were derived from a calibrated gamma downhole probe. The tool effectively enables a company to release preliminary data, before the official data is back from the assay lab.

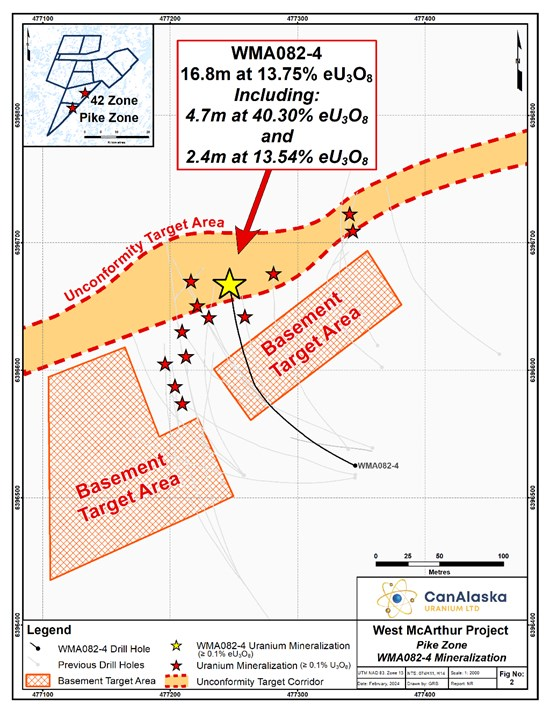

WMA082-4 managed to intersect 13.75% eU3O8 over 16.8 metres at a depth of 796.6 metres downhole, including a 4.7 metre long section that encountered 40.30% eU3O8, and what the company refers to as several low grade intersections. Mineralization is said to have occurred at the contact between the Athabasca sandstone and the underlying basement rocks.

“It is extremely rare to intersect uranium mineralization of this grade and width anywhere in the world, including the Athabasca Basin. This is a significant outcome for the West McArthur JV and CanAlaska shareholders. Since initial discovery in 2022, the CanAlaska team has believed Pike Zone had the potential for Cigar- and McArthur River-like uranium grades and thickness based on prior drilling results,” commented Cory Belyk, CEO of CanAlaska.

The drill hole was conducted at the Pike Zone under an ongoing drill program that is focused on the expansion of the Pike Zone discovery. That discovery, which occurred in WMA082-2, including 1.03% U3O8 over 6.3 metres, and a sub interval of 2.82% U3O8 over 1.9 metres.

Full assays remain pending for the hole.

“The geologists have been laser focused on determining the geological controls in a clear and methodical approach and the results of this fantastic work are now achieving outcomes for our shareholders. Tier 1 uranium deposits always occur as ‘pearls on a string’ and we have now found a pearl,” continued Belyk.

The West McArthur property is a joint venture between CanAlaska and Cameco. With 83.35% ownership, CanAlaska is the primary operator, and has sole funded the 2024 exploration program. CanAlaska originally staked the project two decades ago, and after a brief option out to Mitsubishi Development, entered into an option deal with Cameco in 2016, which ultimately translated into the current arrangement.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.