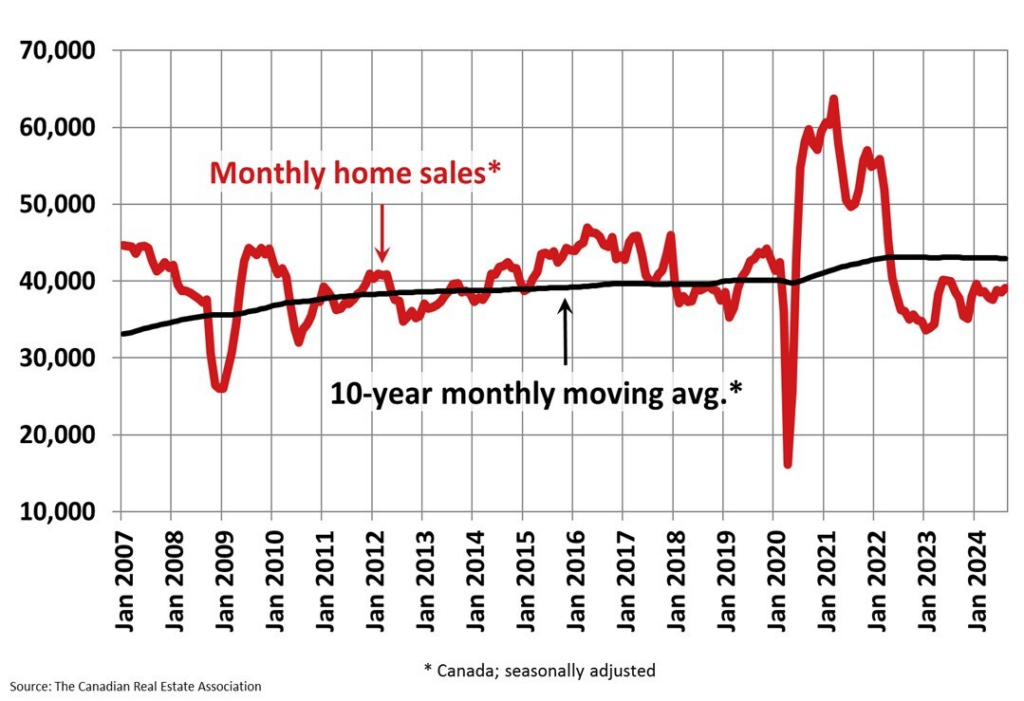

The Canadian housing market continues to show signs of stagnation, despite recent interest rate cuts by the Bank of Canada. According to the latest data from the Canadian Real Estate Association, national home sales edged up just 1.3% month-over-month in August, reaching their highest level since January but still remaining below last year’s levels.

CREA’s Senior Economist Shaun Cathcart noted that while there are “fledgling signs of life” following the start of monetary policy easing, the market largely appears stuck in the same holding pattern it has been in all year. Prospective buyers seem to be waiting for further improvements in affordability, even as prices remain stable in most of the country.

The number of newly listed properties increased by 1.1% in August, with Calgary leading the boost in new supply. However, the national sales-to-new listings ratio remained virtually unchanged at 53%, indicating balanced market conditions.

Despite the recent rate cuts, inventory levels remain tight. There were about 177,450 properties listed for sale on Canadian MLS Systems at the end of August, up 18.8% from a year earlier but still more than 10% below historical averages for this time of year.

The MLS Home Price Index was unchanged month-over-month but down 3.9% year-over-year. The national average sale price stood at $649,100 in August, virtually flat compared to the previous year.

CREA Chair James Mabey suggested that with more rate cuts expected in the coming months, conditions are set for a potential return of demand. However, the market’s response to recent rate cuts and new listings remains to be seen, leaving the Canadian housing market in a continued state of uncertainty.

Information for this briefing was found via CREA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.