The registration of Emerge Canada Inc., an investment business known for selling Toronto-listed versions of Cathie Wood’s popular exchange-traded funds, has been stopped by Ontario’s securities regulator.

The Ontario Securities Commission ordered the firm to wind down or find another company to take over its operations after it failed to meet its working-capital requirements.

Emerge was unable to file audited financial accounts for the most recent fiscal year after its auditor resigned. Regulators imposed trading sanctions on 11 of the investment firm’s products last month, including six Ark Investment Management-partnered funds.

The firm describes Emerge Ark ETFs as “sub-advised” by Ark, and has also moved into women-led environmental, social, and governance ETFs.

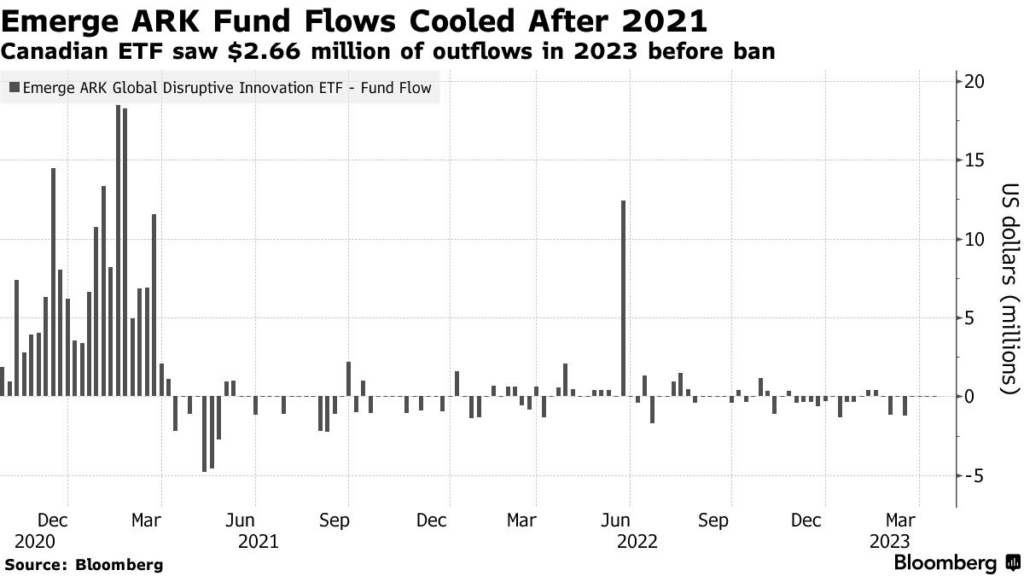

After the Federal Reserve ended its low-interest-rate policy last year, interest in risky growth-oriented investments, such as Ark’s innovation-themed funds, has waned. Emerge’s Canadian funds have seen little interest in 2023, with its largest Ark-related fund, the $75 million (US$56 million) Emerge ARK Global Disruptive Innovation ETF, registering US$2.7 million in outflows.

The restriction included EARK CN and the Emerge ARK AI & Big Data ETF (EAAI CN), as well as other of the firm’s female-led ESG products.

According to a Morningstar analysis, Emerge Canada’s problems began when the firm’s auditor, BDO Canada LLP, left in November. The Ontario Securities Commission issued cease-trade orders on April 6, stating that none of the funds had filed their year-end annual statement as required by provincial law.

Compounding the issue is the fact that Emerge Canada owes Emerge Ark ETF’s $5.5 million, which it can’t pay, at least until it receives monies owed by a US affiliate of Emerge. The affiliate is said to owe at least $3.4 million as of the end of calendar Q1.

Emerge’s lawyers said that suspending the company and mandating the liquidation of Emerge ETFs was “overly punitive and unwarranted in the circumstances.” The company in a statement to Bloomberg indicated that it is “considering its next steps.”

An ETF issuer in Canada named Emerge didn't file financial statements and so their ETFs have been halted since April. This is stain on industry. I was just in Canada, everyone annoyed by this and I don't blame them.. https://t.co/NfkBoVdXme via @markets

— Eric Balchunas (@EricBalchunas) May 11, 2023

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

What about Canadian people, those buy these funds ? How the got there money back and when ?